Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am fairly new to quickbooks. I am needing to learn how to account for owner draws. I am a LLC single member. 1st how to I record cash that I withdraw from day earnings before deposit is made? 2nd how do I record cash that I withdraw from register to buy a last minute/out of stock item? As much detail as can provide is appreciated.

Solved! Go to Solution.

Hi there, @Hogwild3. With the help of this information, you'll be a QuickBooks master in no time.

When you write a check to yourself, that is an owner's draw. It is when a business owner takes funds out of their business for personal use. You may use a draw for compensation versus paying yourself a salary. They're usually taken from your Owner's Drawing account.

You can write a check to withdraw cash from your day earnings before depositing them. When you take this for yourself, you'll need some sort of name for the payee. You can enter yours as a vendor.

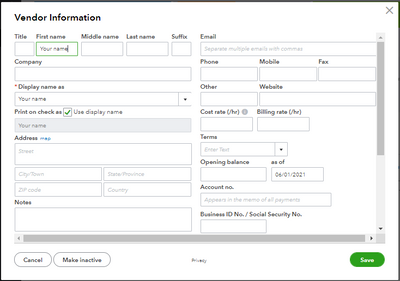

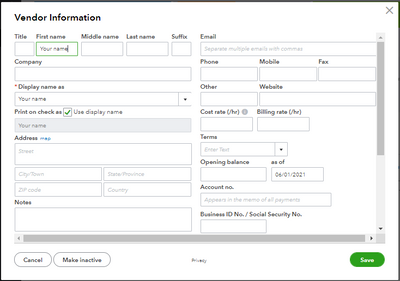

To enter a new vendor:

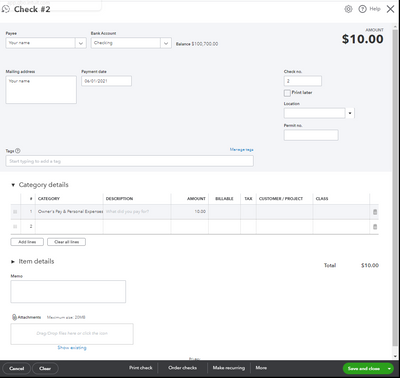

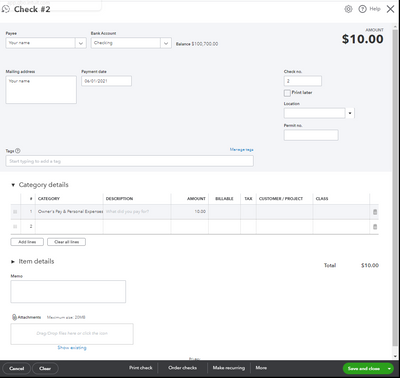

To write a check:

Refer to this article on how to put your money into your bank account: Record bank deposits.

You can also write a check or expense to record your purchases. Make sure to activate the Item details table on the expense and purchase forms.

To enter expense:

You can check out this article that tackles the complete list of standard accounts: Chart of Accounts.

Additionally, you can visit our Community Help website that shares helpful articles to read on topics like account management, banking, reports, and more. Just select a subject from the Topics drop-down menu.

Visit us again should you need further assistance with navigating QuickBooks tools. We're always here to help you.

Hi there, @Hogwild3. With the help of this information, you'll be a QuickBooks master in no time.

When you write a check to yourself, that is an owner's draw. It is when a business owner takes funds out of their business for personal use. You may use a draw for compensation versus paying yourself a salary. They're usually taken from your Owner's Drawing account.

You can write a check to withdraw cash from your day earnings before depositing them. When you take this for yourself, you'll need some sort of name for the payee. You can enter yours as a vendor.

To enter a new vendor:

To write a check:

Refer to this article on how to put your money into your bank account: Record bank deposits.

You can also write a check or expense to record your purchases. Make sure to activate the Item details table on the expense and purchase forms.

To enter expense:

You can check out this article that tackles the complete list of standard accounts: Chart of Accounts.

Additionally, you can visit our Community Help website that shares helpful articles to read on topics like account management, banking, reports, and more. Just select a subject from the Topics drop-down menu.

Visit us again should you need further assistance with navigating QuickBooks tools. We're always here to help you.

One last question to clear up maybe past mistakes in categorizing. If they were bank transfers to I categorize them under expense owners equity or the quickbooks suggestion transfer to owner equity?

When the owner takes a draw, it is categorized as "owners draw" (income). Right?

But when I look in the bank register, it has it categorized as "owners draw" (expense) in the "ref type" column.

Hi Linda. Let me share with you some information about the Owner's draw.

The owner's draw is an equity account used by QuickBooks Online (QBO) to track withdrawals of the company's assets to pay an owner. If a transaction is categorized under expense, you need to modify the category through the Banking page. I'll guide you on how.

I'm adding this article to learn more about this account: Set up and pay an owner's draw.

On the other hand, you can get more tips about categorizing your banking transactions through this link: Categorize and match online bank transactions in QuickBooks Online.

Once everything is corrected, you're now ready to reconcile your statement to match your bank and credit card balances.

Let me know if you have any other questions about owner's withdrawal. I'm always here to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here