Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am a sole proprietor and I have a regular client that pays for my meals and mileage when I work for them. This can sometimes be fairly substantial, a month or more at a time. I provide the client with all the original receipts and a client provided form, then I am reimbursed. Initially I was recording the meals and mileage as "expenses" incurred by me, creating a "reimbursable expenses group" and using this to account for the money in. The expenses would still show up as being incurred by me, which seems wrong as they were fully reimbursed, x dollars out = x dollars in. Is there another way to account for the money? If it isn't an expense, and it isn't an income, what is it? Am I over thinking, or under thinking this? Thanks in advance.

Easy way to think about business, is what you pay is an expense (or an asset purchase) and what you are paid is income

book your expenses, book the amount received, then on the P&L income is reduced by expense

so if they are the same they cancel each other

Does anyone have a clear answer on this?

I work for a lawfirm and we are converting the entire firm to Quickbooks.

We prepay massive amounts of medical bills for client and they are paid at end of the case.

Need clear answer please

Hi there, @lynnhomer.

Thank you for joining this thread. I've got the detailed steps you'll need to track these reimbursable expenses in QuickBooks Desktop.

You'll have to record these medical expenses you incur on your client's behalf as billable. This allows you to link them to an invoice so your customer can reimburse them when they receive it.

Here's how:

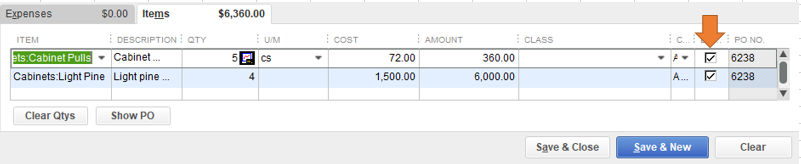

To reimburse the cost, add it to an invoice using these steps:

Once you receive the payment, you can record it right away.

Please let us know how these steps work out. The Community is always here should you need additional assistance. Have a pleasant day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here