Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

The problem is employees sometimes buy stuff for the business, for which they need to be reimbursed. I need to log these as expenses in the system - but there is no way to assign them to Liability account in Expenses form. What is QBO best practice for assigning expenses that were paid for by someone else that need to re-imbursed to them sometime later.

A work around my accountant said was to create a "fake" Credit Card account in Chart of Accounts and assign the expenses to that, but it doesn't seem like a good solution as on the Balance Sheet these are all classified under Credit Card which doesn't seem right and might confuse an auditor?

I appreciate the detailed information you've shared, @dtl.

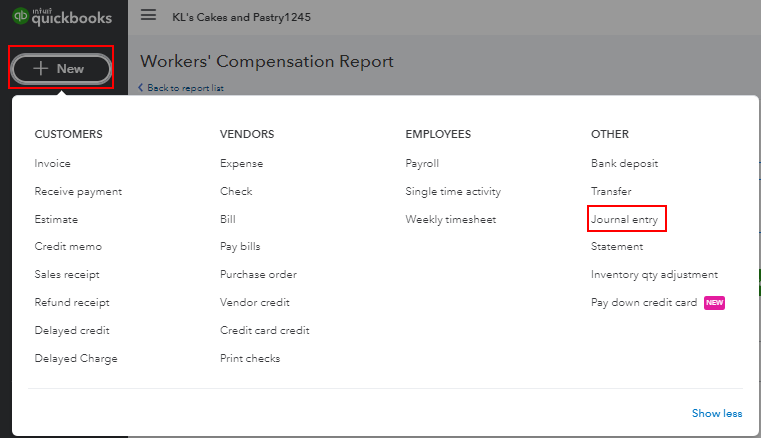

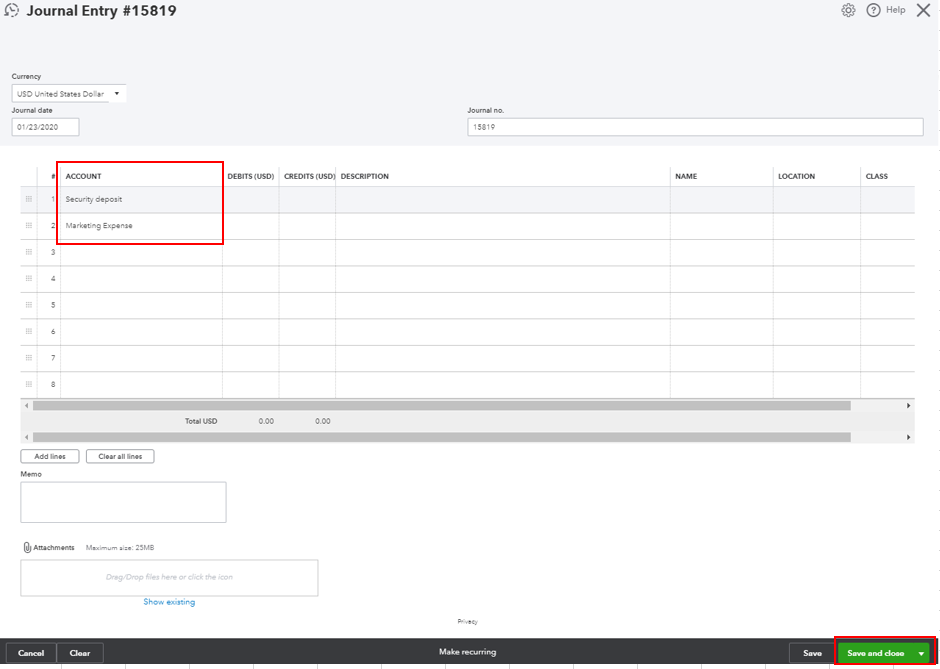

Since we're unable to assign a liability account for expense transactions, you can consider creating a journal entry. This way, you can assign a liability account along with the expense account for your employee's reimbursement. Let me guide you through the steps.

Here's an article you can read on for more details: Create journal entries.

Once done, you can now create an expense or check transactions to reimburse your employee. For your reference, feel free to check out this article for more guidance: Reimburse an employee.

But most importantly, I still recommend seeking help from your accountant. He/she may add suggestions based on what's more suitable for your business and to your books.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one.

Please join me in posting the following feedback to QuickBooks Support:

Click on the gear icon, then Feedback.

Here, Intuit explains how to repay employees for company expenses paid for by the employee:

What this article fails to address is how to do this via payroll. Note: It does suggest using a liability account as the clearing account which is correct.

The issue with attempting to reimburse employees via payroll is that QuickBooks Payroll only allows a reimbursement to be linked to an expense account, not a liability account.

Categorizing an employee reimbursement as an expense is NOT the best practice accounting method. When a business files their taxes, they must be able to categorize all of their expenses. Simply saying that "I repaid an employee for business expenses" isn't satisfactory. Instead, the expense incurred by the employee for gasoline in a company truck should be entered as an EXPENSE for gasoline with the PAYMENT ACCOUNT being Employee Reimbursements (a liability account). When it is time to repay that employee, the payroll reimbursement should be mapped to the same Employee Reimbursement liability account to clear it out.

At the time Employee A swipes their personal card for company fuel at a Shell station, the company has incurred an expense from Shell Oil and a has incurred a liability to Employee A. At the time the employee is repaid through payroll, the company is repaying that liability and closing it out.

Issue #1: QuickBooks does not allow a liability account as a payment account. It only allows banks, credit card, and asset accounts - unless adding an expense from the receipts screen in which case, it works fine.

Issue #2: QuickBooks Payroll. does not allow the mapping of Employee Reimbursements to a liability account. It only allows it to an expense account. From an accounting standpoint, this is incorrect.

Here are a few dozen others who agree with me:

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here