Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello all,

I am running into some issues on QuickBooks Enterprise specifically pertaining to the Fixed Asset Manager Module. Our issue is the allocation of Depreciation Expense when posting the entry by job and by class.

The entry itself will post to QuickBooks but not to a specific job or class. We have tried investigating multiple called QuickBooks customer service and referred to the FAM manual, and still haven’t found anything to resolve this issue.

Is there a way to instruct the FAM to allocate the Depreciation expense to the appropriate Job/and or Class?

Thanks for the help in advance!

Hello there, Andrew909

I've got a way on how you can allocate the Depreciation expense to the appropriate Job or Class.

You'll need to make sure that the transaction is billable to the job and assign it to the appropriate class. In order to use the billable feature, you'll need to set it up first in your QuickBooks preferences. Let me show you how:

You can then enter bills as billable expenses. In the Customer:Job field, choose the customer billable for this expense. It will automatically mark this expense as Billable. Also, make sure to include the class you need to associate with this transaction. Then, Save & Close.

To learn about the Class feature, please read through this article for further insights: Find out how to track account balances using different classes in QuickBooks Desktop.

I've added a few resources below for additional information about the Fixed Asset Manager (FAM):

Please let me know if you need additional assistance or have any concerns related to QuickBooks. Take care and stay safe always.

Hi Andrew909,

Hope you’re doing great. I wanted to see how everything is going about the allocation of Depreciation Expense by job/class. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

Andrew,

Did you find a solution for this? I am running into the same problem: I need to assign Depreciation Expense to a "Job" and I don't see how to do this in FAM.

Any insight will be appreciated!

Thanks

Thanks for joining the thread, @garnettj.

The concern above was already by my colleague Sarahann.

If you haven't performed the following steps yet, I'd recommend doing so. This way, you can allocate the Depreciation expense to the correct Job or Class.

In case you're still unable to assign the Depreciation Expense, I'd recommend reaching out to our customer support. This way, they can walk you through the process in accomplishing your tank in QuickBooks. Simply follow these steps to connect with them:

You can also check out our support hours to ensure that we address your concerns on time.

The Community always has your back, so please let me know if you have any other questions. I'll be more than happy to help. Keep safe.

Hi SarahannC,

Unfortunately no, its still not working for me. I followed your instructions exactly and when I run the Fixed asset list, I'm still seeing nothing in the class/job column.

Does inputting the asset as an item instead of expense change anything?

Please provide further assistance, if possible.

Thank you,

-Andrew

I appreciate you for getting back, Andrew.

I'm here to help you run your fixed asset manager or depreciation expenses with their corresponding jobs and classes.

The Fixed Asset List displays the fixed asset items you've created. It won't show you the transactions or expenses with their corresponding classes or jobs. Instead, you can only see the following columns: Item Name, FAM Number, Purchase Date, Purchase Description, Account, Cost, and Attach.

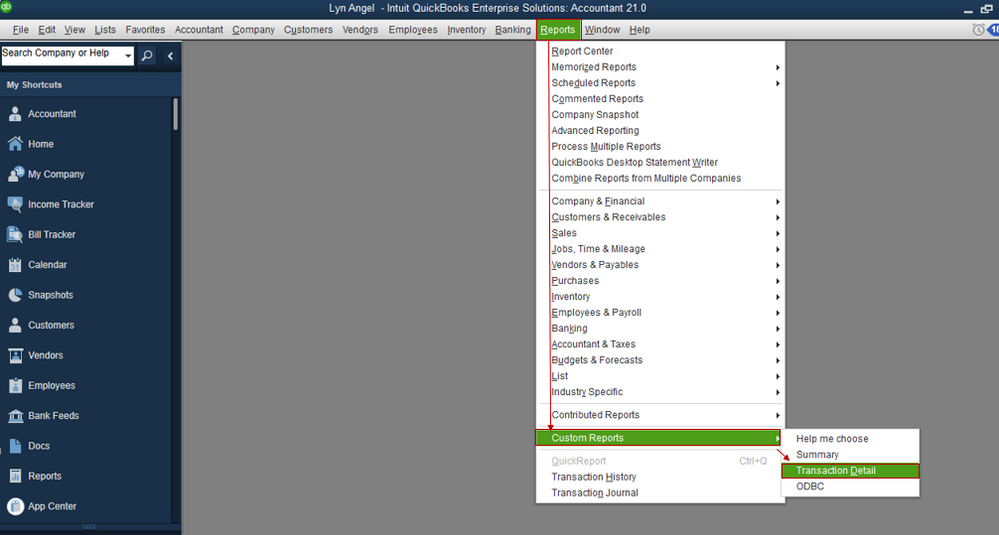

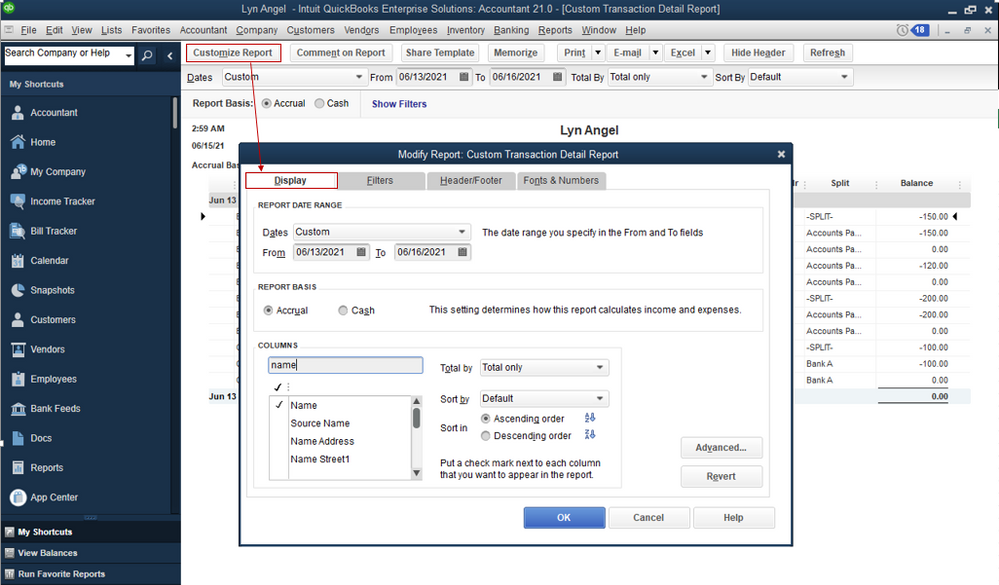

To get the information you need, I recommend running a custom report. Then, add the Name and Class column. I'll guide you on how.

From there, you'll see the fixed asset expenses with the class and job details.

If you want to customize the details of your report, you can export it to Excel. This way, you can remove or add the details you need. I'm adding these links to learn more about the process:

Aside from your reports, you can also open the topics from these articles to keep track of your customer and vendor transactions in QuickBooks Desktop:

If you have other questions about the fixed asset manager, please feel free to click the Reply button and add a comment below. I'll be right here to provide additional assistance. Keep safe!

I really need to understand the Class issue. We have over 10 departments and use Class in all transactions. Will I need to make all invoices "billable"? When I create the journal that will post to the GL for montly depreciation, will class be included?

Yes, you're right, @Lonnie5.

General Ledger includes small company business accounts and all transactions that affect these accounts. Business transactions posted to the general ledger are recorded through journal entries. These entries record increases and decrease to the business's assets, liabilities, and owner's equity accounts.

Journal entries posted to the general ledger can also record transactions that reclassify amounts from one account to another, correct accounting errors, and close temporary accounts at the end of a fiscal year.

However, I'd suggest consulting an accountant to help and guide on which account to debit and credit. Your accountant can provide more expert ways of dealing with this situation.

You can get more information about journal entry: https://quickbooks.intuit.com/community/Help-Articles/Record-a-journal-entry/td-p/203691.

Also, you may find these articles helpful:

• Manage fixed assets using Fixed Asset Manager (FAM)

• Set up Fixed Asset Manager (FAM)

• Use Fixed Asset Manager in QuickBooks Desktop

You can always get back to us if you have more questions about tracking depreciation. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here