Hey there, Scott.

You can create a credit memo to record a refund for an advance payment. Here’s how:

- Click + Create and then select Credit Memo.

- From the Customer dropdown, choose the client you are refunding.

- Select the original Product/Service that was not completed.

- Enter the amount you are refunding.

- Click Save and close.

The next step is to record the refund:

- Click + Create and then select Expense.

- From the Payee dropdown, select your client.

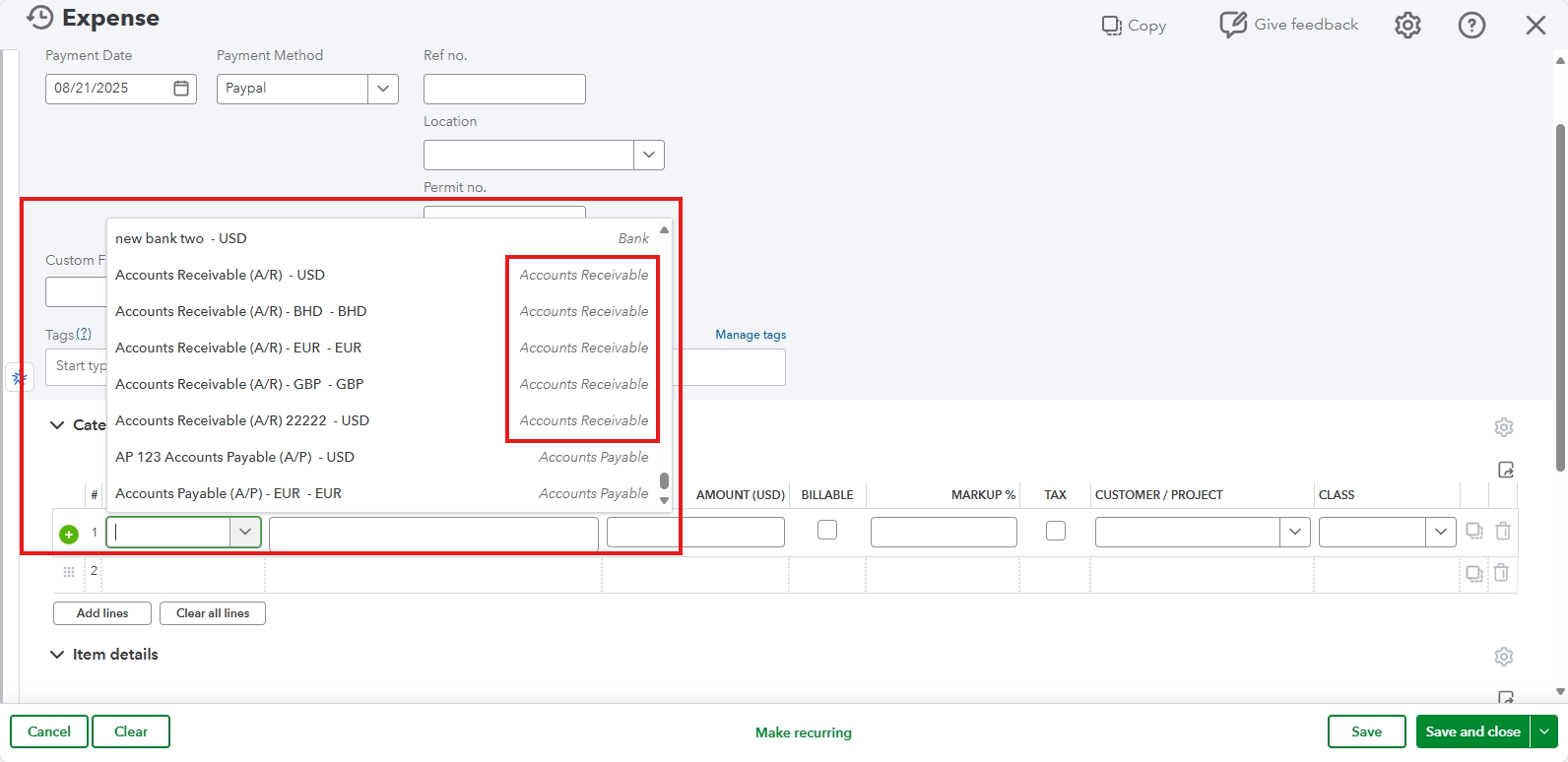

- Choose the Payment account (the bank account the refund came from).

- In the Category field, select the Debtors account (Accounts receivable).

- Enter the refund amount as a positive number.

- If you collect tax, select the appropriate Tax in the Tax field.

- Click Save and close.

The last step is to link the credit memo and refund, as this clears the open balance on the customer's account:

- Click + Create and select Receive Payment.

- Select your client's name from the Customer dropdown.

- You will see the Credit Memo you created and the Payment you just recorded. Check the box next to both of these transactions.

- Make sure the amount in the Payment field at the top is $0.00.

- Click Save and close.

- If you have Online Banking, go to Accounting, then Bank transactions.

- Match the record you find.

For more information, you can refer to the following articles:

I also recommend consulting your accountant for further assistance on accurate recordkeeping. If you don't have one, you can find a professional through the QuickBooks ProAdvisor page.

Feel free to let us know if you have additional questions. The Community space is available 24/7.