Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI set up lodging for my clients and pay for the charges of this lodging. I then invoice the client for this lodging, at the cost I paid for it, on their invoice which also contains the fare we charge for our services (a boat trip). Right now I have a product and service item set up and named "packages" to refer to what I package into their fare and it is an income account. I select this on their invoice to add the charge for lodging that I paid for them. When they pay the invoice it gets applied to that income account. I don't want this to account as income for my business but am not sure how to do it differently.

I'm here to ensure you can receive your customer's payment successfully and get applied to the correct account.

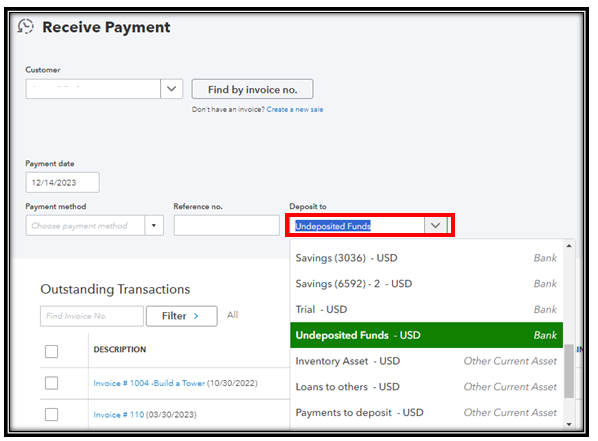

Before doing so, can you verify if you're referring to the deposit to section where the invoice payments get deposited? If so, you have the option to select what account you want the payment it be deposited to. Here's how:

However, if you mean anything else, please add additional details below so we can provide accurate information to address your query.

Moreover, you can run dozens of reports that tell you about different aspects of your business. Some focus on sales, others focus on your spending, and some look at parts of each.

I'm just around the corner if you need additional help in QuickBooks.

Thanks. When I receive payment, I select my bank account for it to be deposited to. Right now the payments look like income but they aren't income. They just pass through me. I am looking to avoid having it categorized under an income acct.

"When I receive payment, I select my bank account for it to be deposited to. Right now the payments look like income but they aren't income. They just pass through me."

It is income to you, just not taxable income. The lodging expenses you pay will offset the gross income (revenue) and you will have $0 net/taxable income. If you record the lodging expenses and no income, you will have a loss, which you don't have in this case. So, yes, you want to record it as income in QB.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here