If you're looking for a way to specify a 50% deposit requirement directly on an invoice in QuickBooks Online (QBO), please note that this feature isn't currently available.

As an alternative, you may need to manually communicate the deposit terms to your customer or include the details in the invoice's Note to customer or Description section.

On the other hand, if you're trying to receive a 50% deposit due, we can account it to Accounts Receivable and apply to the invoice. Here's how:

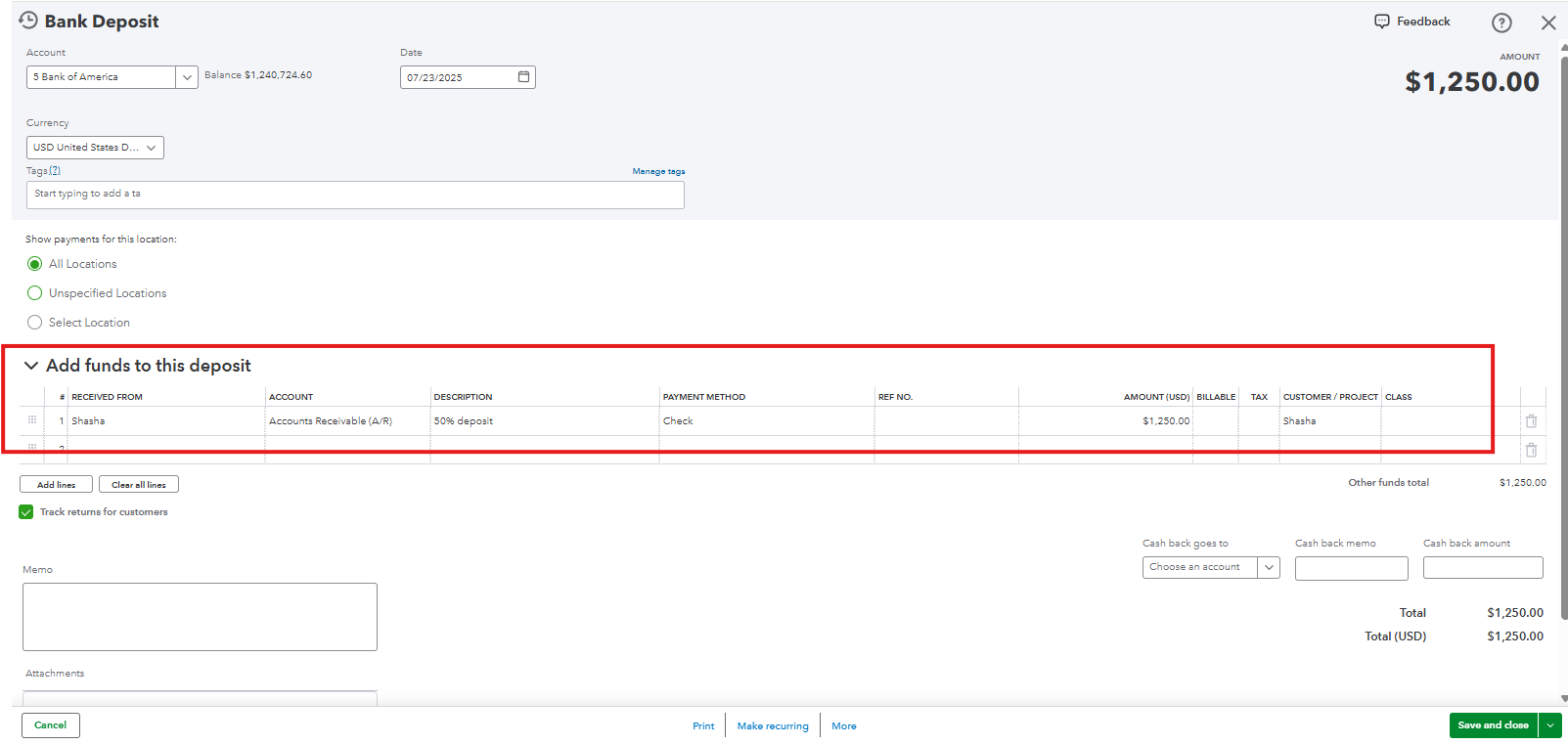

- In the left menu, click the + New button and choose Bank deposit.

- From the Account ▼ dropdown, choose the account you want to put the money into.

- Go to the Add funds to this deposit section.

- In the Received From column, enter in the name of the customer

- Select Accounts Receivable from the Account ▼ dropdown.

- Enter the Description, Payment method, Amount, and other necessary information.

- Select Save and close.

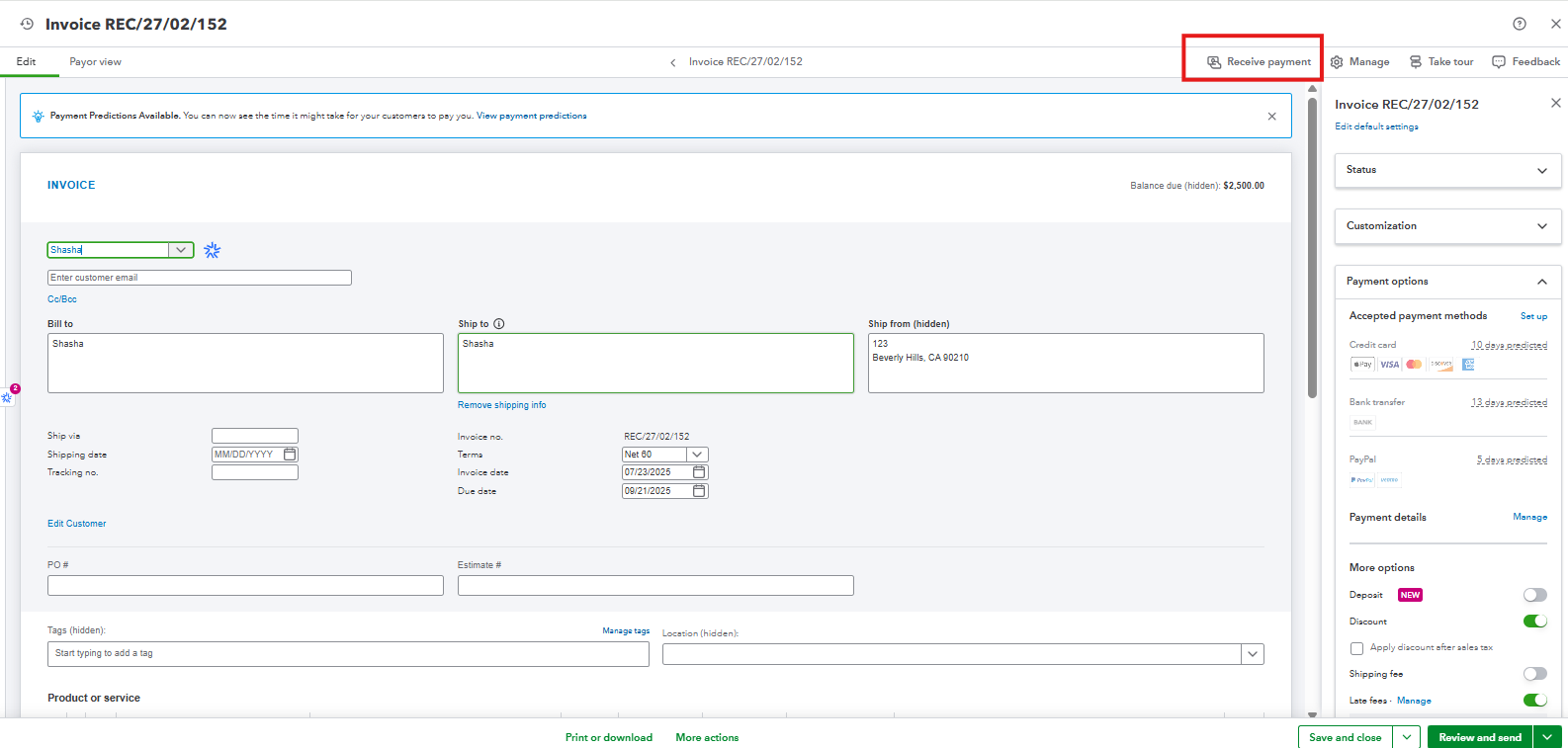

Once done, apply the deposit to the invoice by following these steps:

- Open the invoice, and click the Receive payment button on the upper right hand.

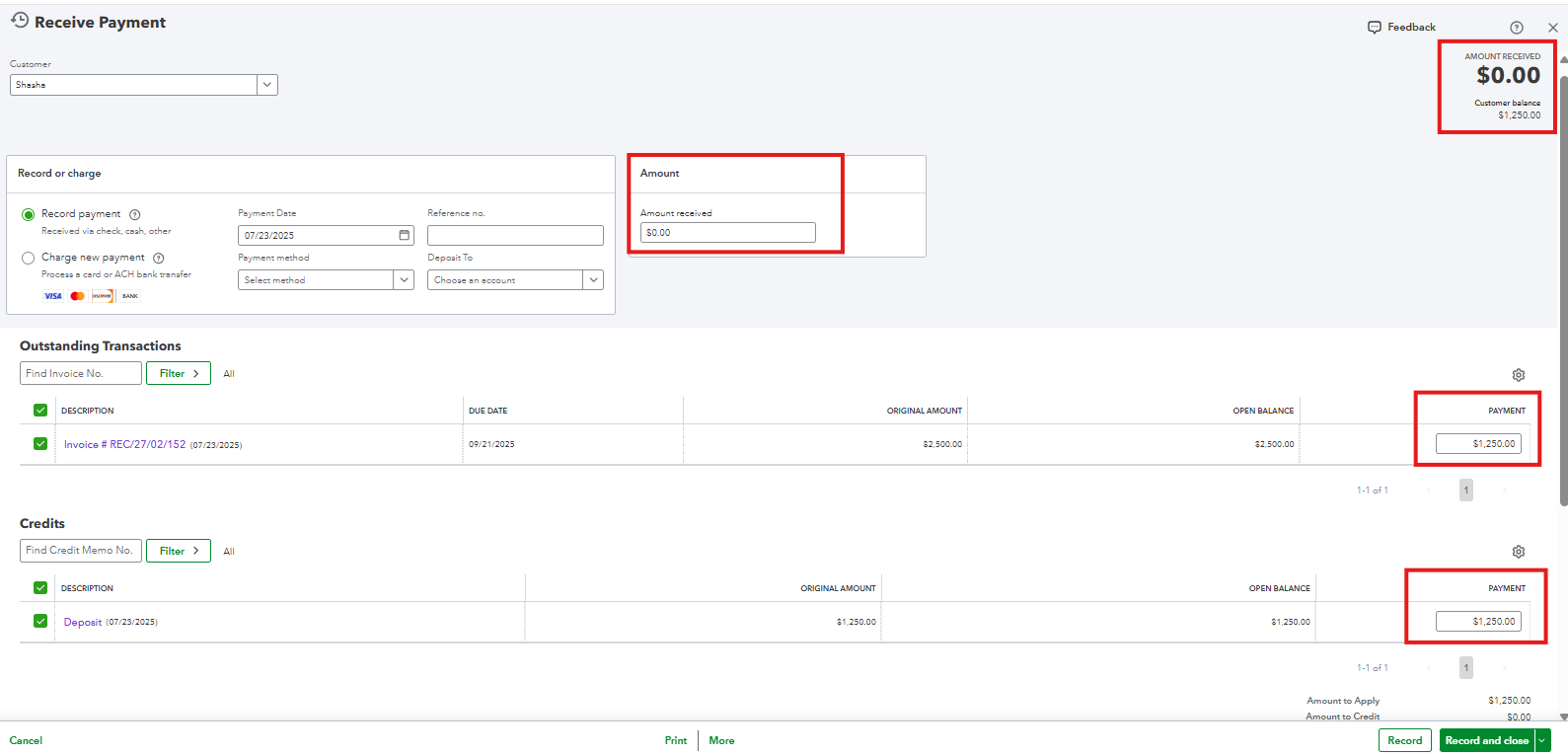

- Enter $0.00 in the Amount section.

- In the Outstanding Transactions, select the invoice and enter the 50% amount in the Payment field, then choose the deposit from the Credits section.

- Choose Record and close.

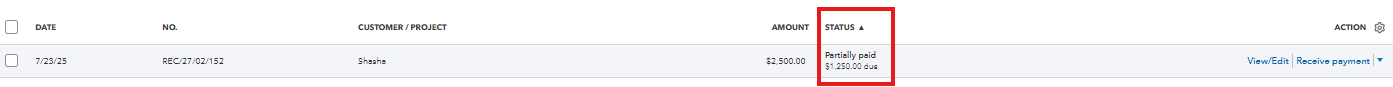

After that, the invoice status will now show as Partially paid.

You can explore our QuickBooks Live Expert Assisted to get personalized support in managing your accounting tasks. They will help automate bookkeeping processes, making it easier to handle tasks such as invoicing, expense tracking, and sales tax management.

If you have further questions, let us know.