I'm here to help you record a check as a refund, fv0515.

You can use the Check entry to record the partial refund. It reduces the bank's balance and offsets the customer's payment.

Here are the steps you can follow.

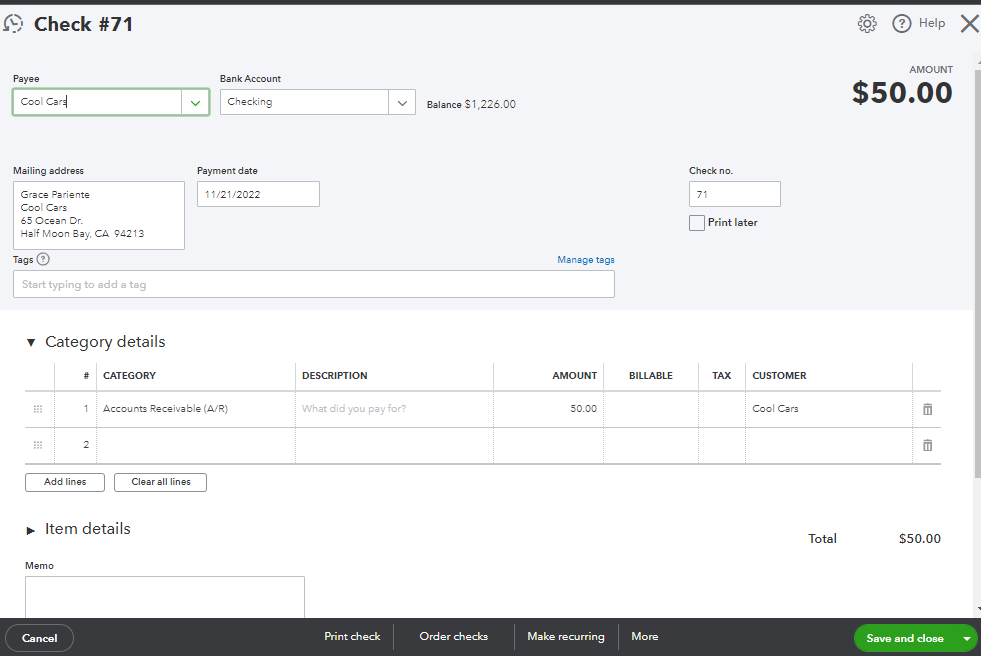

Step 1: Record the check as a refund.

- Click + New, then choose Check.

- Select the customer you want to refund from the Payee ▼ drop-down.

- From the Payment account ▼ drop-down, enter the bank account where you deposited the payment.

- On the first line of the Category column, choose Accounts Receivable.

- Enter how much you want to refund in the Amount field.

- Fill out the other fields as you see fit, then click Save and close.

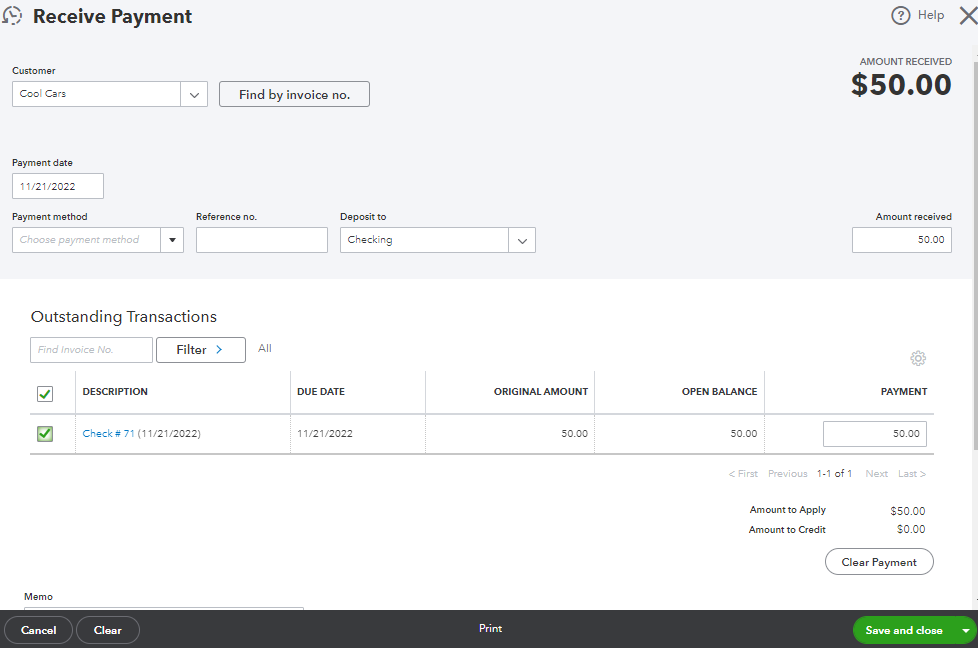

Step 2: Link the check to the customer's payment.

- Click + New, then choose Receive payment.

- Select the same customer you used for the check.

- Fill in other fields.

- Under the Outstanding Transaction section, mark the Check you've created.

- If you have automation to apply bill payments turned on, this step is done for you.

- Click Save and close.

Processing a refund depends on various scenarios. Check out this article to learn how to record them in QuickBooks: Record a customer refund in QuickBooks Online.

In addition to this, it's important to review your transactions in QuickBooks to make sure they match with what's your bank statements. That being said, I recommend reconciling bank accounts every month. Please browse this complete reconciliation guide through this link: Learn the reconciliation workflow in QuickBooks.

Click the Reply button below and tag me if you have additional questions about recording a refund. It's always my pleasure to help you.