Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi!

I need to record expenses in April, March & June that I will be paying later. Is there a way to record this expenses to be shown as short term liabilities?

Thank you.

Hi there, @Marco Sagnelli.

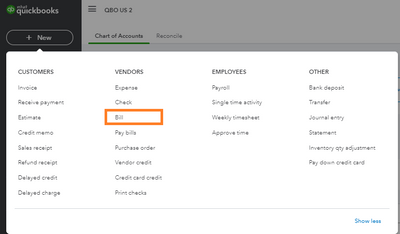

You can enter a bill to record the expenses that you'll be paying later. When entering a bill, it goes directly to your Accounts Payable account.

Here's how to enter a bill:

Once you're ready to pay your bill, you can either record it using Pay bill or Check.

Additionally, if you need to record the expenses under a specific accrued liabilities account, you can enter a journal entry.

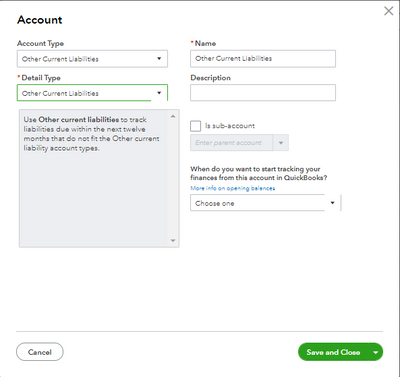

First, follow these steps to set up a liability account:

Then, enter a journal entry to record the accrued expense.

The above steps will create the following journal entry:

Expense A/c............................. Dr.

Liability A/c...............................Cr.

You can check out this article to learn the complete list of standard accounts: Chart of Accounts.

Visit us again should you need further assistance with navigating QuickBooks tools. We're always here to help you.

Hi @Marco Sagnelli ,

Hope you’re doing great. I wanted to see how everything is going about recording expenses. Was it successful? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

Yes! this is very helpful.

Thank you!

Hi,

I accrued for payroll using JE in QBO, how do I match it to the expense that show in my bank feed to zero it out? Any assistance is much appreciated.

I'll help you ensure your accrued payroll expenses via journal entry (JE) are properly accounted for, smj3.

If you use QuickBooks to manage payroll, you'll have to match the bank transactions to the paychecks rather than the journal entry. There's isn't a way to matched the expenses displayed on the bank feeds page to the JE transaction.

As a workaround, you can Exclude those expenses showing on bank feeds to clear it out. I'll show you how.

Once everything looks good, feel free to read this article for guidance on reconciling your account to ensure your bank statement balance and QuickBooks balance match: Reconcile an account in QuickBooks Online.

You can always post again if you have other questions or concerns in QuickBooks. The Community is available to help you 24/7.

Thank you for your response. I apologize, I use ADP for payroll. We accrue and I am trying to make sure after I enter my journal entries, I allocate the expense that appears in the bank feed (Debit) to zero out the accrual. Any suggestions on how to do that?

Once the payroll debits happen, I want to allocate those accruals per the debits i.e. Accrued Payroll, Accrued Payroll Taxes, Payroll Tax Payable, Payroll Tax Expense, Garnishments, etc.

Hi there, @smj3.

Thanks for getting back to us and letting us know that you're using ADP for payroll.

Since you are using ADP, I wanted to mention using a 3rd party software that's available. The 3rd party software will transfer your ADP Payroll to QuickBooks. You can see the link I've included below for more information about this software if you're interested in going that route.

However, if you choose to stick with journal entries, you'll need to consult with your accounting professional for the best accounting advice based on your business needs. If you don't have an accountant, don't sweat it. You can find one here in our Resource Center.

Please don't hesitate to let me know if you have any questions or concerns. Take care!

If we already selected the expense account in the bill posting window, then why are we posting another journal entry for an accrual?

I appreciate you for chiming in on this thread, Jawad.

As provided by my colleagues above, choosing to enter a Journal Entry records expenses under an accrued liabilities account.

You don't have to use a bill when recording manual payroll. You'll want to stick to this JE method to ensure your payroll expenses are accrued properly.

However, it would be best to seek professional advice from your accountant to ensure the accuracy of your accounts. If you're not affiliated with one, you can utilize our Find an Accountant tool to look for one in your area.

Keep me posted if you still have questions or concerns about payroll or QBO-related tasks. I'll be around for you. Have a great day!

The general entry for any accrual expense is:

First Entry:

Debit: Expense

Credit: Accrued Liability Account

Payment against accrued liability next month

Second Entry

debit: the account for accrued liabilities

Credit: Bank A/C

How do we make this entry in QBO.

I also need to know how to record in QBO. Hopefully someone responds soon.

@Jawad Kayani @trcautomotive1 @coluhen

Enter the accrued expenses with a journal entry (debit expense, credit accrued liability), then reverse the entry (debit accrued liability, credit expense) the following month when you create the actual payroll entry.

Would the steps be the same if I want to accrue Employee Bonuses?

I appreciate you for joining the thread, @Tgodfrey73.

Yes, the steps would be the same if you want to accrue employee bonuses. Since we don't have the feature to accrue employee bonuses directly as a workaround, we can enter the accrued expenses with a journal entry (debit expense, credit accrued liability.

Also, I recommend that you contact your accountant to ensure an accurate account.

I also recommend visiting our website for tips and other resources you can use in the future: Self-help articles.

Feel free to reach us back if you need further help. Have a good one!

I am an accountant. I know I can handle this thing through journal entries, but I want to avoid doing it this way. I was looking for a more automated route. Anyway Thanks

I appreciate you for coming back to the thread and adding extra details about your concern. With this, I'll ensure you can send feedback so our product developers can consider adding the feature you need in the next updates.

Journal entries are the last resort for entering transactions that force your books to balance in specific ways. This is one of the best steps to make sure your accrued expense transactions stay accurate. Other than this, performing another step to achieve your goal is currently unavailable.

For now, I suggest going to the Gear icon in QBO and choose Feedback from there. Then, submit a request about having another option to manage accrued expenses in QuickBooks. Any recommendations are sent to our engineers for consideration in future updates.

Lastly, you may refer to this article to see steps on how you can run different payroll reports that you can use to view useful information about your business and employees: Run payroll reports in QuickBooks Online Payroll.

Keep me posted if you need further assistance with handling transactions in QBO. I’ll jump right back in help and make sure this is taken care of for you. Enjoy the rest of the day, Jawad Kayani. Have a great day!

How can I show as a recurring amount each month? Not memorized. I need for QB desktop

Can I set up an expense to show monthly one I accrue it in QB desktop?

Hello there, @Tgodfrey73

Let me help clear things out. At the moment, the ability to show recurring expenses with different amounts based on accrual is unavailable in QuickBooks Desktop.

While this option is not yet available in QBO. I encourage you to send this as a suggestion to our Product Development Team through your feedback feature and I'll do the same thing from my side.

We'll want to have new features based on the value they'll add to the most users possible. Your suggestions will be kept in mind for future development plans.

To send feedback, here's how:

Check out the guides here if you need help with creating, editing, or deleting memorized transactions.

Stay tuned for now. If there's anything else I can do to help, just let me know by leaving a comment below.

Edit - the posted solution does not work. See revised post below.

I have a similar question to @Jawad Kayani 's, but NOT for payroll. Instead it's for the question in the OP.

The posted solution doubles the expense in the P&L, as it is debited twice if we both create a bill and add the j/e for the accrual:

Bill:

debit XYZ Expense

credit Accounts Payable

j/e:

debit XYZ Expense

credit Accrued Liability Payable

My client wants the expense to show up when we pull up the vendor screen (thus the bill, since j/e don't show up under the vendor even if the vendor is added in the Name field) and P&L but also wants to show the accrued liability on the balance sheet. Is this possible without doubling the expense?

If it's relevant, we are not paying these expenses in the next month. The expense is accruing indefinitely. Thanks.

1. Wait for the vendor bill and when you receive the bill like if the vendor bill was for March 2023 but you received the bill on April 5 2023 simply open vendors in QBO post the bill and select the expense but select the bill posting date of March 31 2023. You can record actual month-end expenses in this manner.

2. The second way is if you want to create accrued liability then open a journal entry

Debit: Expense

Credit: Accounts Payable, and in the name section, select the vendor name. This entry will show up in both the accounts payable and vendor account as well.

and when you want to pay the vendor, then open a new window and select Check out Select Vendor and when you select the vendor a journal entry will pop up then select it and enter the details and post.

3. Post the journal entry for accrued liability then when you receive the vendor bill post the reversal entry for accrued liability and then post the actual bill using the vendor account.

But what I am doing If the vendor bill is fixed then I post the bill in the vendor account without an invoice number and when I receive the bill I update the vendor bill by adding invoice information etc. but if the vendor bill is not fixed then I post the average amount of monthly bills and wait for the actual bill. When I get the actual bill I reopen the vendor bill and update the bill with the actual amount but I always post bills on the last day of each month to show the bills in the actual month.

Note: Customer accounts and vendor accounts are sub-ledgers of accounts receivable and payable. Any activate with Vendors or Customers Accounts will also update AP & AR main Accounts.

Regards

When entering using the JE method, how would you later pay the bill with a check if the amount changed? For example, we created a JE for an invoice that was budgeted for but not received. When the invoice was received the amount was for less than the JE. We need to cut a check for the correct amount to the vendor. Thank you!

We can create a bill for the vendor if these expenses can be adjusted in the future and paid later, Mgwiozdowski. Since you mentioned journal entries as your way of tracking your vendor expenses, there are scenarios that we need to consider. I'll lay those out for you.

When using Journal Entry to track vendor expenses, there are three scenarios we need to take a look at. From there, we can provide the correct process on how to deal with them:

If you enter your journal entry as shown in scenarios 1 or 3, it will generate a credit that can be applied to a bill. As a result, we're unable to create a check for the vendor as a form of payment directly. Instead, we will need to delete the journal entry. After that, we can proceed with one of the following options:

If scenario 2 is followed, a payable will be created for the vendor. We can easily pay the bills and print them.

Those scenarios are based on things I've replicated. It is still best to reach out to professionals/accountants before taking any of those actions.

Moving forward, you can utilize the Bills, Bill payments, and Expense when managing your vendor transactions in QuickBooks Online.

Additionally, it's important to understand the distinctions between bills, checks, and expenses. Here’s an article: Learn the difference between bills, checks, and expenses in QuickBooks Online.

Additionally, I suggest considering our QuickBooks Live Expert Assisted service to enhance your QBO experience. Our knowledgeable team of experts stands ready to provide immediate support tailored to your business's unique needs. They will assist you in navigating your plan's features, accounts, customers, and vendors.

I'm here to assist you further if you have more questions or issues concerning your bills and payments. Please feel free to add any additional concerns or queries in the comment section below, and I’ll be glad to provide you with the necessary information and support.

Disclaimer: Please be aware that I have made modifications to a previous answer. The details posted above is the update one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here