Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDear Fellows

I bought from a vendor USD 10.000, he shipped 10.000 and I paid 10.000.

When product arrived was off specs and generate USD 1000 expense to be in good order (re bag damaged bags).

I presented a claim for Vendor and wer agreed to settle this ammount on the next purchase.

How do I issue a debit note against this vendor for this ammount? Or express this im my accounting system?

Thxs in advance for any help

Solved! Go to Solution.

Thanks for reaching out to the Community, @Leonn.

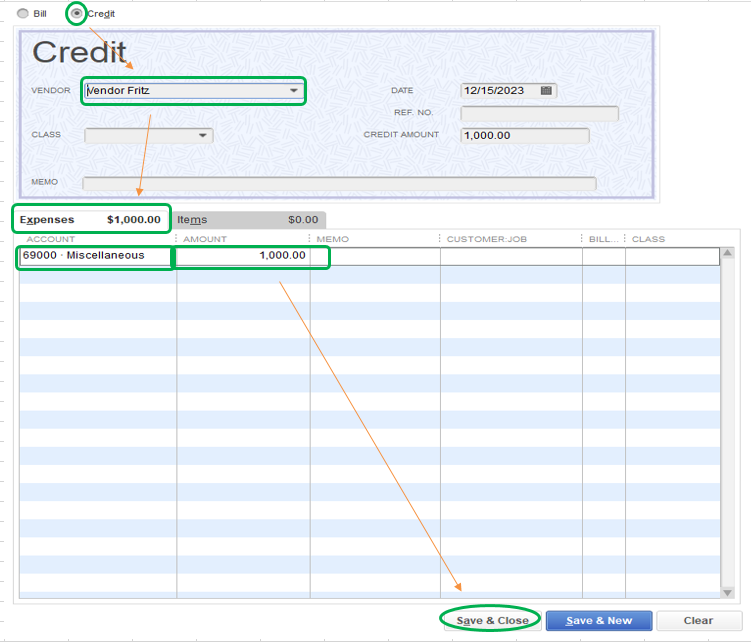

Based on the information provided, you can create a debit memo (vendor or bill credit) to record the expense, and apply it to the next bill payment. This way, the expense you incur from the previous transaction will be deducted on the future one.

Here's how:

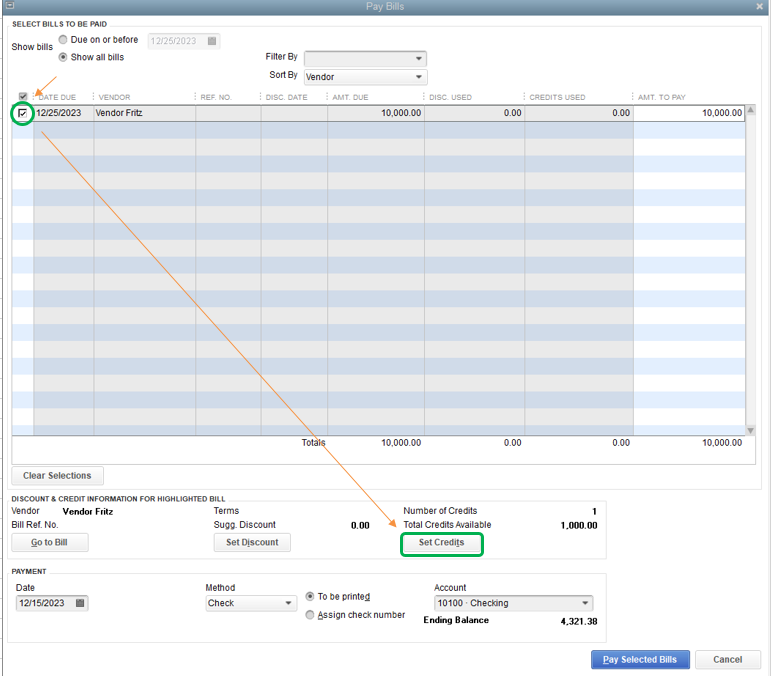

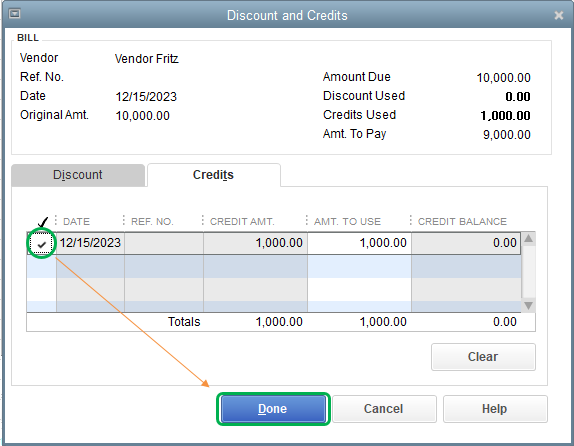

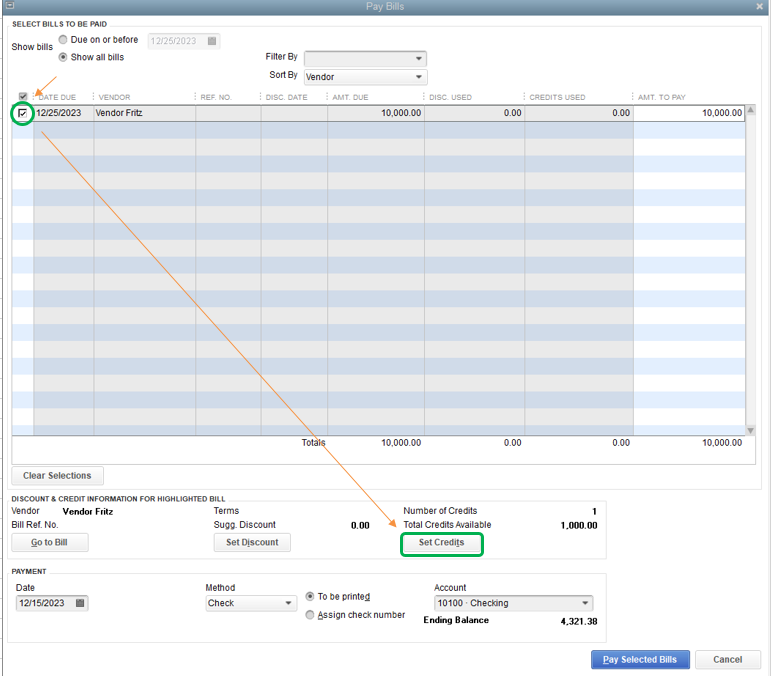

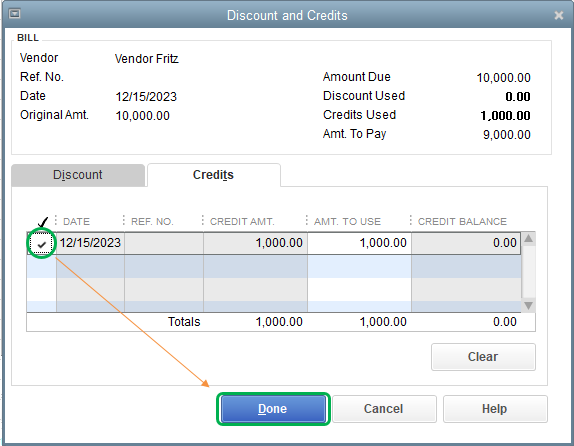

After that, apply the credit by the time you pay the next bill. Here's how:

Just in case, I'll be adding this article for future reference: Record a vendor refund in QuickBooks Desktop.

Please let me know if you have any other issues, and I'll get back to you right away. I'm more than happy to assist. Have a great weekend!

Thanks for reaching out to the Community, @Leonn.

Based on the information provided, you can create a debit memo (vendor or bill credit) to record the expense, and apply it to the next bill payment. This way, the expense you incur from the previous transaction will be deducted on the future one.

Here's how:

After that, apply the credit by the time you pay the next bill. Here's how:

Just in case, I'll be adding this article for future reference: Record a vendor refund in QuickBooks Desktop.

Please let me know if you have any other issues, and I'll get back to you right away. I'm more than happy to assist. Have a great weekend!

Dear FritzF

Many thanks for your prompt reply.

It worked well!

This lead me to another question in the same topic since I have a vendor that is also somtimes my customer for otther products, I had to creat a vendor and a customer that each one has the transactions but I cannot use my sale to him as payment to some purchase aI made from them...

Any suggestion?

Best regards

Leonn

Thanks for your swift response, @Leonn. To do this, you can use a clearing account to move money from one account to another. This is also called a barter or wash account. Here's how to set it up:

4. Select Continue.

5. Enter Clearing Account, Barter Account or Wash Account in the Account Name field.

6. Leave the opening balance blank.

7. Click Save & Close.

To use a clearing account, you can create a journal to move money between accounts, then link the Journal Entries together as you enter bills or receive payments. for more information, check out this help article: Set up a clearing account.

To make sure your books are accurate, I'd suggest you refer to your accountant for the proper posting of your transactions.

Feel free to message us again if you have more questions. We're always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here