We can create a Journal Entry to transfer Work in Progress (WIP) from the balance sheet to the Profit & Loss (P&L) in QuickBooks Desktop (QBDT), @AHC_1962. I can guide you through the process.

Before doing so, I recommend consulting an accountant as they can provide expert guidance on what specific account you need to credit and debit. If you're not affiliated with one, you can visit this link: Find an Accountant.

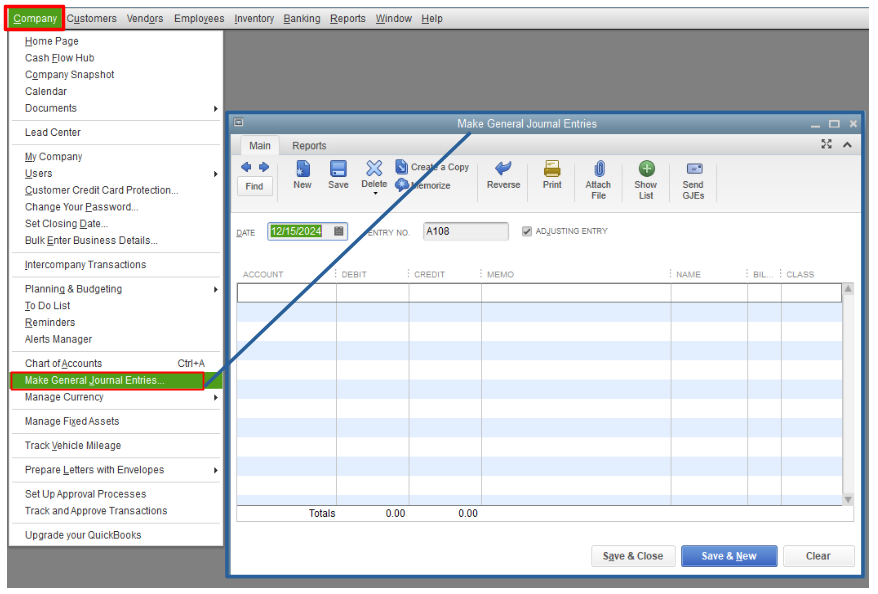

To create a journal entry, follow these steps:

- Open your QBDT company.

- Go to the Company menu and select Make General Journal Entries.

- Fill out the fields to create your journal entry. Make sure your debits equal your credits.

- When you're done, click Save or Save & Close.

Regarding the credit for closing costs, the settlement fees/closing costs should be included in the property's basis. I still suggest consulting with your accountant about this one. They can provide advice on the best course of action you should take in this situation.

Moreover, you can run financial reports in QuickBooks to view different aspects of your business

Please let us know if you have additional QuickBooks-related concerns. We'll be more than willing to assist.