Hello there, rosebud2.

Thanks for reaching out to the Community about your concern. Getting the VAT to calculate your expenses is my number one priority.

To accomplish this task, let’s check the Tax settings and make sure its VAT is turned on. Then, apply the correct rate or VAT code to the expenses.

Here’s how:

- Go to the Taxes tab on the left panel to select VAT.

- If you see the Set up VAT menu, click on it to activate the tax.

- This will take you to the Set up VAT page.

- From there, tell us how you handle VAT and click Next.

- Follow the on-screen instructions to finish the activation process.

Now that we’ve turned on VAT, let’s start creating the expenses.

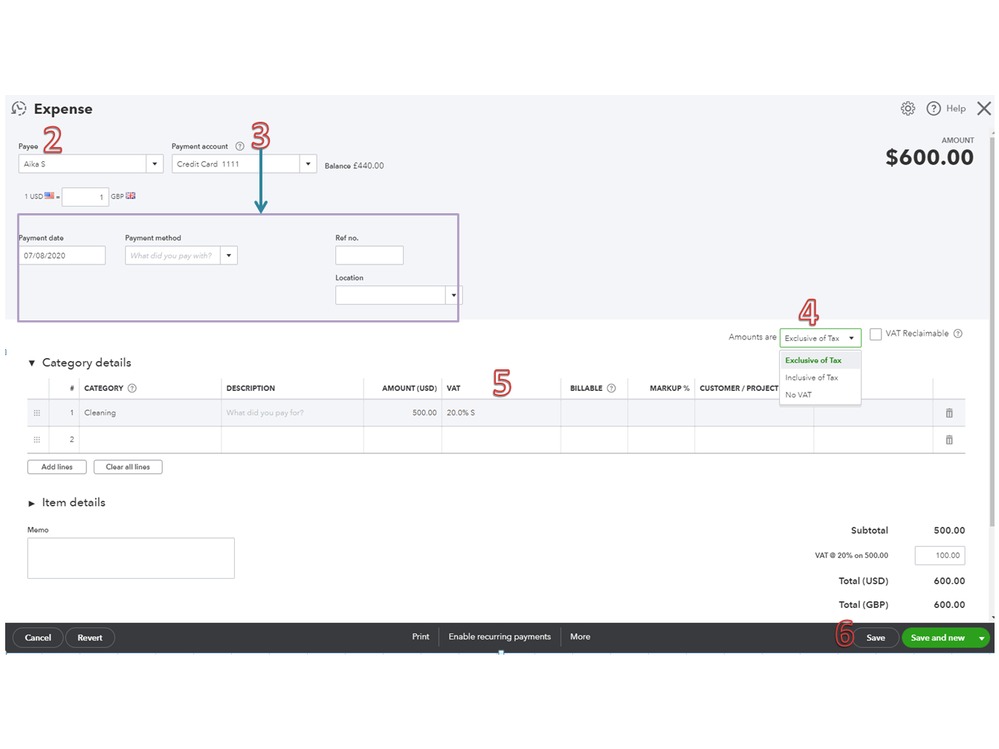

- Click the New menu at the top and choose Expense under Suppliers.

- Key in the supplier’s name in the Payee drop-down.

- Fill in the remaining field boxes.

- In the Amounts are drop-down, choose the correct tax tracking: Exclusive of Tax or Inclusive of Tax.

- Navigate to the Category or Item details section, select the appropriate tax rate from the VAT drop-down.

- Click Save to keep the transaction.

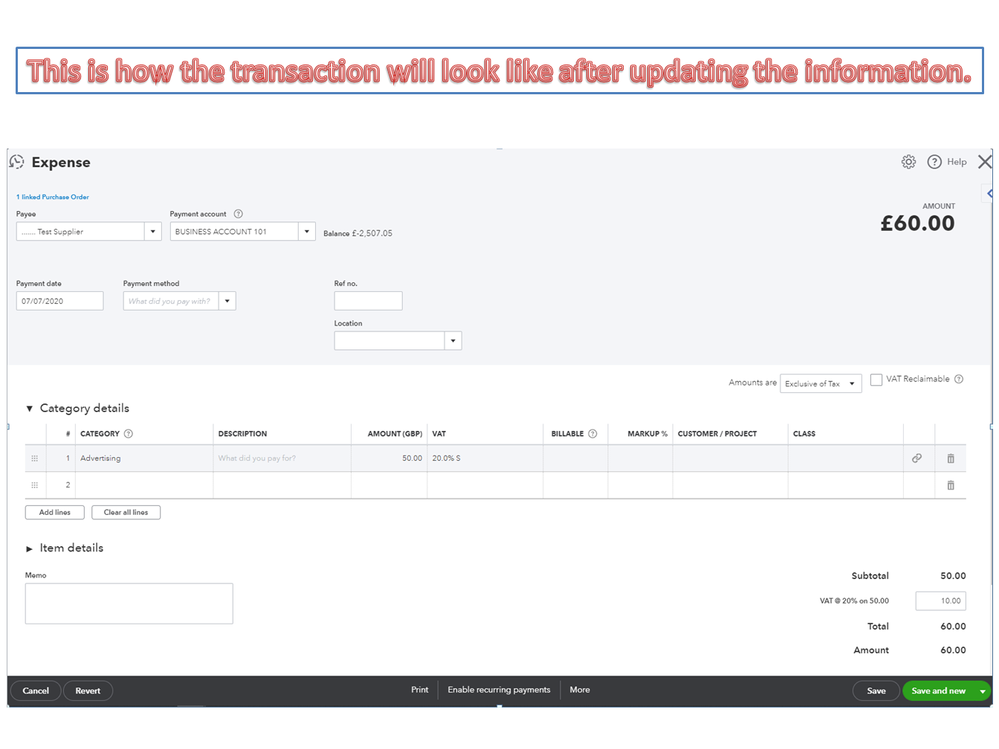

However, if the company is configured to calculate VAT, open the expenses, and select the appropriate tax tracking (Exclusive of Tax or Inclusive of Tax). Then, make sure the tax code chosen is not Exempt or No VAT.

Check out the following guides for additional resources. You’ll find detailed instructions about turning on VAT, adding or editing the codes, rates, etc. Also, links to help get started using the tax.

Keep me posted if you need further assistance performing any of these steps. I’ll get back to help and make sure this is taken care of for you.