Hi there, Marco.

In QuickBooks Self-Employed (QBSE), please note that a Social Security Number (SSN) is required to process your application when setting up your account or applying for payments.

If you're interested, I recommend applying for an SSN online or at a Social Security Administration (SSA) office.

Once you've obtained your SSN and are ready to set up payments, here’s how you can do it:

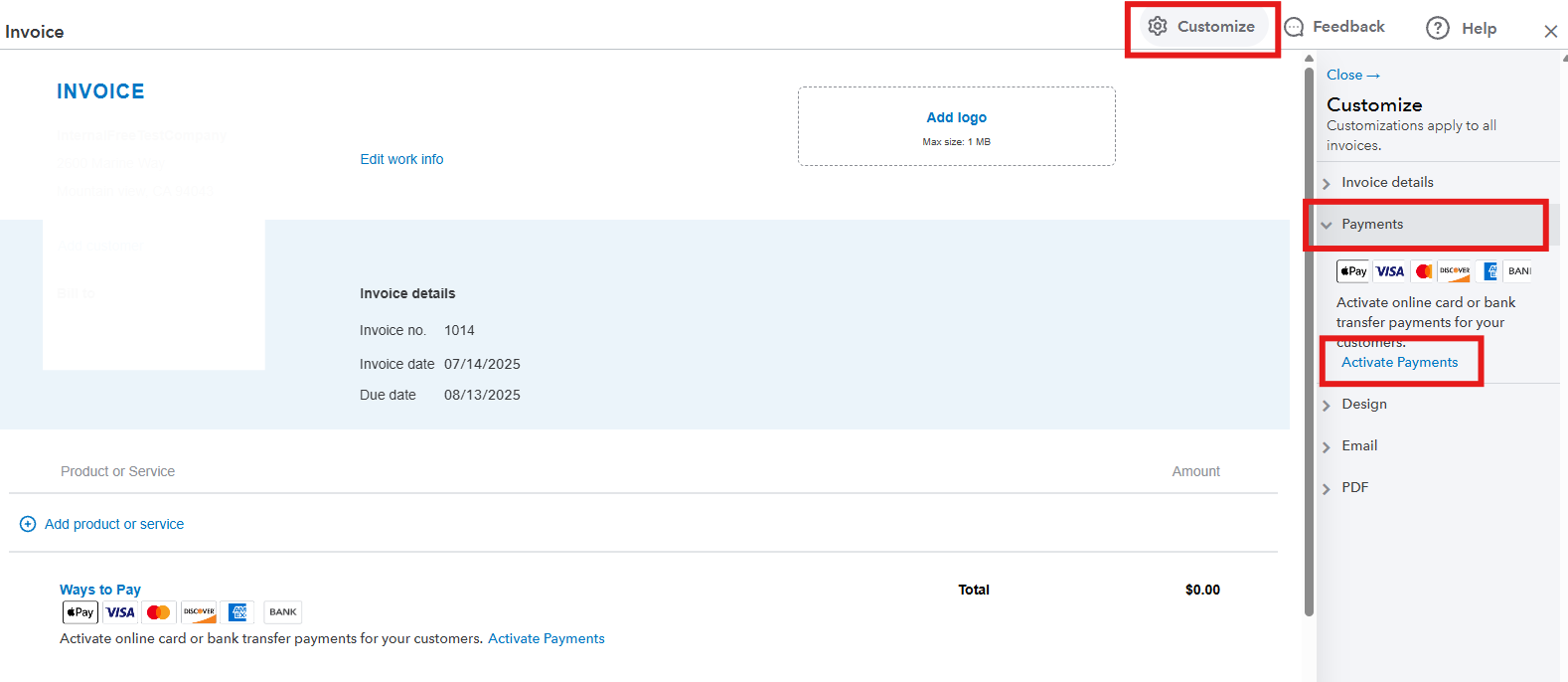

- Go to the Invoices menu and select Create Invoice.

- Click the Customize option and choose Payments.

- Select Activate Payments and follow the onscreen instructions.

We'll be around to help you if you have any other concerns about SSN.