Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Let me help you record a transfer to your personal bank account, emdec.

If you're trying to record the transaction from your Business Account to your Personal Account, we can create it as a Transfer. Then, record the transfer and the check number using the Check window if you used a physical check to transfer funds. Here's how:

Once the transaction is recorded in the personal account, you can categorize it as Owner's Equity. You can read through this article for more detailed information: Set up and pay an owner's draw. Also, I'd recommend consulting with your accountant so that your books are reflecting the owners' payments in a way that works best for you and your business accounting structure. They can also provide you with detailed information if the transfer should be recorded as a transaction, expense, or check.

On the other hand, QuickBooks tracks all of your opening balances for all of your accounts in an Opening Balance Equity account. This helps us to go back and look at what you entered later on. If you connect your bank and credit card accounts, the program automatically downloads your historical transactions up to a certain date. Then, it totals them up and enters the opening balance and date for you. If you don't connect your account, just manually enter the opening balance. Here’s how:

You can now start tracking new transactions in QuickBooks that come after the opening balance date. If you skipped opening an opening balance and have already been tracking transactions, here’s an article you can refer to for more details about entering an opening balance later on.

Lastly, I've added these articles to learn more about managing your bank transactions:

Get back to us here if you have other questions about managing your Transfer transactions. I'm always here to help. Have a great day ahead.

Hello there, @emdec.

I'm here to make sure you can properly pay yourself as self-employed in QuickBooks Online (QBO). This way, you can keep your financial data accurate and monitor your business's growth accordingly.

Paying yourself as a business owner depends upon the business structure and payment method. The owners of a sole proprietorship, partners, and LLCs are considered self-employed. With this, you must be paid with an owner's draw instead of a paycheck through payroll.

However, before performing the steps below, I would encourage you to consult with your accountant. They can further provide expert advice and direction tailored to your business needs.

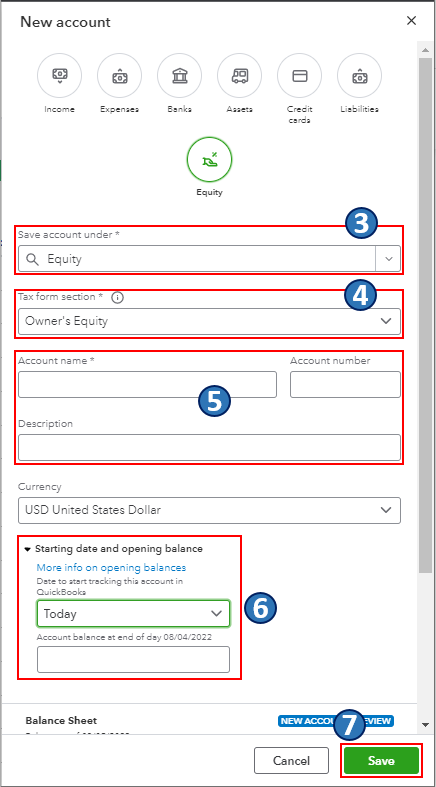

Whenever you're ready, you can start by creating an Owner’s Equity account. It is an equity account used to track withdrawals of the company's assets to pay an owner. To do this, here's how:

Once you're done, write a check from an owner's equity account. For the complete guide, please refer to this article: Set up and pay an owner's draw.

Then, you can read one of our blogs and this IRS article to further guide you in paying yourself as a business owner in QBO:

Also, you may want to check out one of our Help pages as your reference in case you need a guide in managing your QuickBooks account and everyday business transactions using QBO: QuickBooks Learn and Support. It includes QuickBooks help articles, Community discussions with other users, and video tutorials, to name a few.

Please keep me posted on how it goes in the comments below. If there's anything else you need, or you have other concerns about the Owner's Equity account and paying yourself in QBO, I'm always ready to help. Take care, and have a great day, @emdec.

Thanks for the help.

Would I record a transfer to my personal bank account as a transaction, expense or cheque?

What would go on starting balance when creating this type of account?

Let me help you record a transfer to your personal bank account, emdec.

If you're trying to record the transaction from your Business Account to your Personal Account, we can create it as a Transfer. Then, record the transfer and the check number using the Check window if you used a physical check to transfer funds. Here's how:

Once the transaction is recorded in the personal account, you can categorize it as Owner's Equity. You can read through this article for more detailed information: Set up and pay an owner's draw. Also, I'd recommend consulting with your accountant so that your books are reflecting the owners' payments in a way that works best for you and your business accounting structure. They can also provide you with detailed information if the transfer should be recorded as a transaction, expense, or check.

On the other hand, QuickBooks tracks all of your opening balances for all of your accounts in an Opening Balance Equity account. This helps us to go back and look at what you entered later on. If you connect your bank and credit card accounts, the program automatically downloads your historical transactions up to a certain date. Then, it totals them up and enters the opening balance and date for you. If you don't connect your account, just manually enter the opening balance. Here’s how:

You can now start tracking new transactions in QuickBooks that come after the opening balance date. If you skipped opening an opening balance and have already been tracking transactions, here’s an article you can refer to for more details about entering an opening balance later on.

Lastly, I've added these articles to learn more about managing your bank transactions:

Get back to us here if you have other questions about managing your Transfer transactions. I'm always here to help. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here