Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI can share some insights about your W-2 corrections, @,

The General Instructions for Forms W-2 and W-3 (2021) under Specific Instructions for Form W-2c states the following:

Boxes 15 through 20—State/Local taxes: If your only changes to the original Form W-2 are to state or local data, do not send Copy A of Form W-2c to the SSA. Instead, send Form W-2c to the appropriate state or local agency and furnish copies to your employees.

Correcting state information. Contact your state or locality for specific reporting information.

To send W-2C copies to your employees in QuickBooks, the process may differ for every QuickBooks Online Payroll versions.

If you're using QuickBooks Online Payroll Enhanced, you must create and file a W-2C form with the Social Security Administration manually. This form is currently unavailable for this payroll service which is why you need to do it outside the program. See the General Instructions for Forms W-2c and W-3c section in General Instructions for Forms W-2 and W-3.

For QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite and QuickBooks Online Payroll Full Service subscribers, we will be the one to fix it. Our experts will file a W-2C form with the SSA, and mail the W-2c to your employee. You’ll also receive a copy of the amended form.

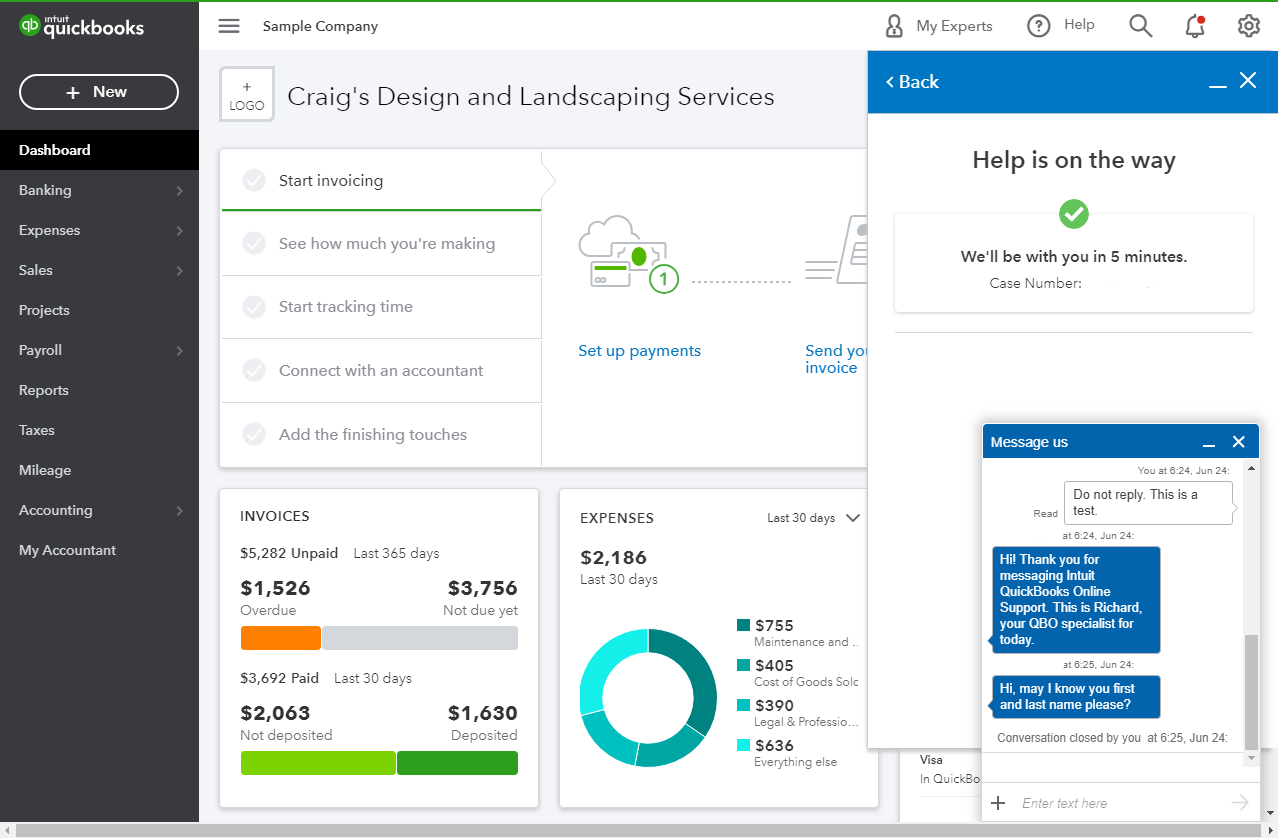

To request a correction, please contact our Support Team. Here are the steps to do that:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

The expert you talk to will let you know approximately when you and your employee should expect to receive the W-2C.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

Post here again if there's anything else you need help with. I'll be right here to assist you with your payroll form corrections and other concerns in QuickBooks. Have a nice day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.