Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have Quickbooks Enterprise 2022. Trying to figure out best way to record inventory for following:

1- Our customer owns the inventory, which is stored at our facility. We have it setup with zero cost in our system.

2- we assemble their inventory and keep as final product in inventory for shipping when needed.

3- i need to bill them and show recorded income for services rendered in the assembly process, but need the inventory qty to not be affected until we actually ship the product?

4- My problem right now is that when we bill them it deducts the inventory, so qty showing is always at zero.

Solved! Go to Solution.

I'm here to guide you on the best way to record your inventories in QuickBooks Desktop (QBDT) Enterprise, @Rj2000.

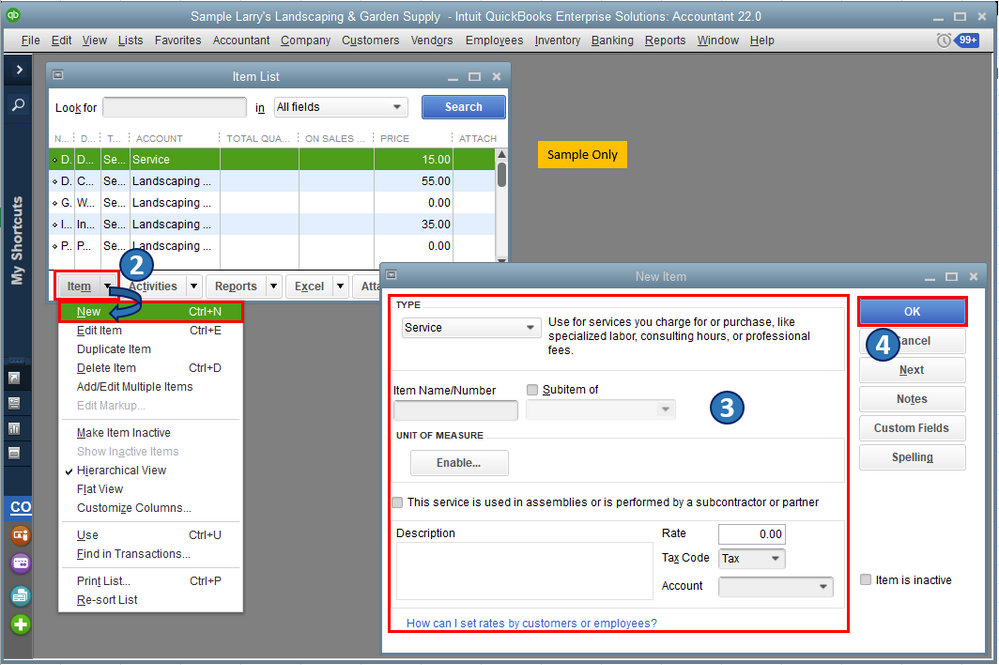

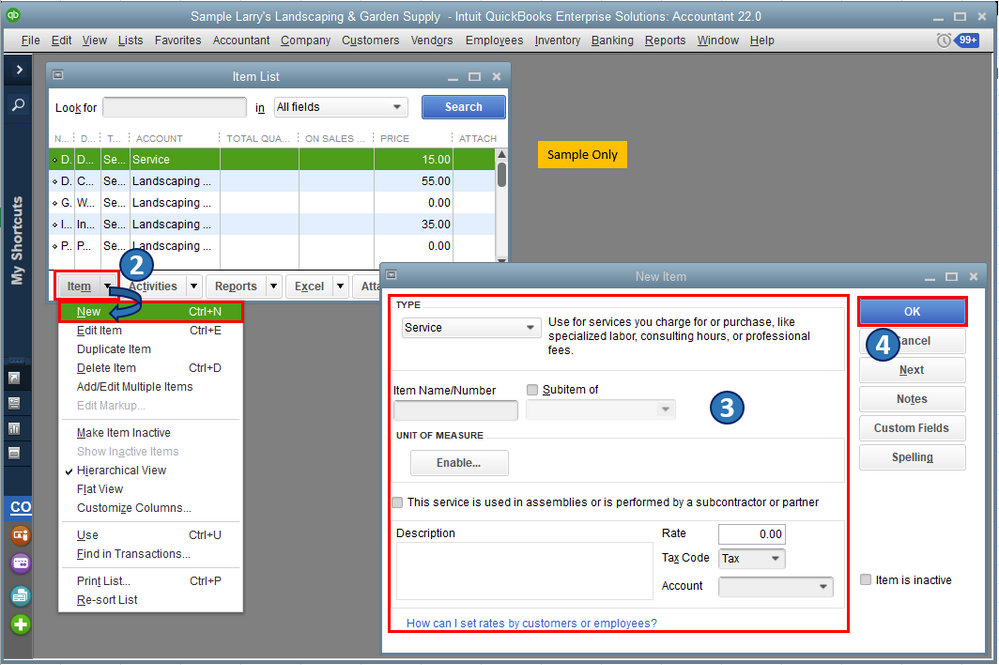

Based on your scenario, you'll have to provide an invoice to your customer to bill them and show recorded income for services rendered in the assembly process. Since you need the inventory quantity not to be affected until you actually ship the product, you'll have to use a service item when invoicing/billing your customer.

To do this, here's how:

Once you're done, go ahead and bill your customer. You can refer to this article for the detailed steps: Create an invoice in QuickBooks Desktop.

Then, pull up an inventory report (i.e., Inventory Valuation Detail) to effectively monitor the quantity of the items stored in your facility. To do this, go to the Reports menu, then select the Inventory option.

Also, you can combine inventory parts to build and track finished goods in QBDT. Then, the system automatically updates your stock of components using inventory parts. To learn more about this, I'd recommend checking out this article: Track the products you manufacture.

Please keep me posted on how it goes. Let me know in the comments if you have other concerns about managing inventories in QBDT. I'm always around to help. Take care, and I wish you continued success, @Rj2000.

I'm here to guide you on the best way to record your inventories in QuickBooks Desktop (QBDT) Enterprise, @Rj2000.

Based on your scenario, you'll have to provide an invoice to your customer to bill them and show recorded income for services rendered in the assembly process. Since you need the inventory quantity not to be affected until you actually ship the product, you'll have to use a service item when invoicing/billing your customer.

To do this, here's how:

Once you're done, go ahead and bill your customer. You can refer to this article for the detailed steps: Create an invoice in QuickBooks Desktop.

Then, pull up an inventory report (i.e., Inventory Valuation Detail) to effectively monitor the quantity of the items stored in your facility. To do this, go to the Reports menu, then select the Inventory option.

Also, you can combine inventory parts to build and track finished goods in QBDT. Then, the system automatically updates your stock of components using inventory parts. To learn more about this, I'd recommend checking out this article: Track the products you manufacture.

Please keep me posted on how it goes. Let me know in the comments if you have other concerns about managing inventories in QBDT. I'm always around to help. Take care, and I wish you continued success, @Rj2000.

Thank you for your response. I believe that is what we were looking for. Going to get our team to implement this week. Thank You

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here