Hello, @Starbuck1123. I appreciate the details! Allow me to provide some information for your guidance.

When you move from QuickBooks Desktop to QuickBooks Online (QBO), your custom templates won't transfer over.

Although QBO offers several invoice templates, you must manually assign them to a specific class and select the template when creating an invoice.

I can guide you through the process of creating an invoice template.

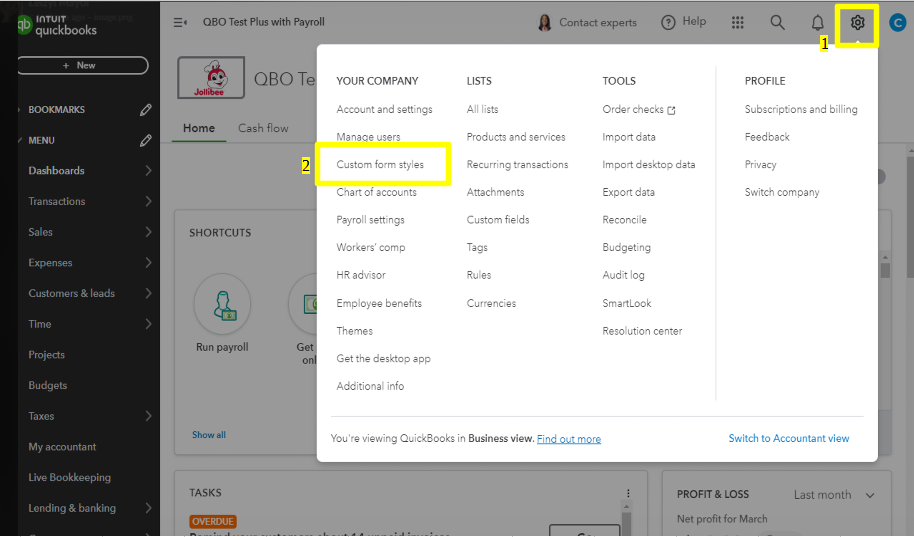

1. Go to the Gear icon and then select Custom form styles under Your Company tab.

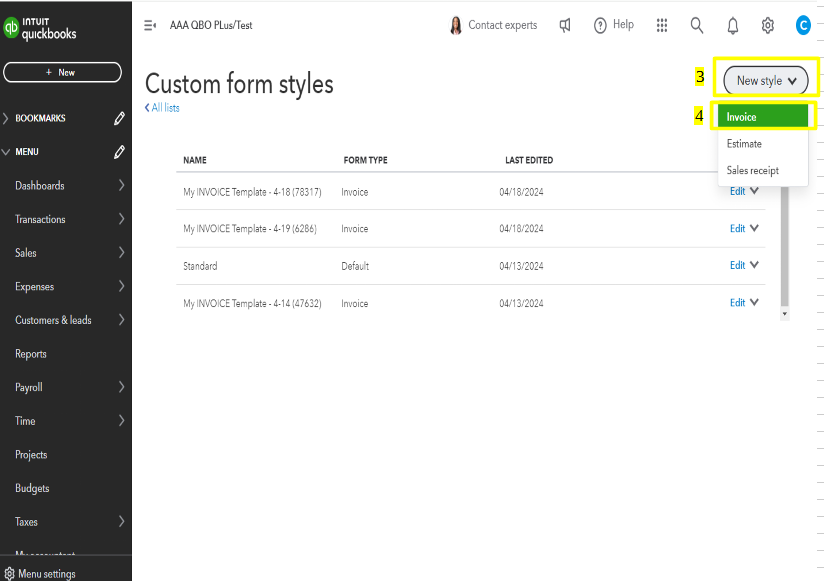

2. Click on the New Style dropdown and hit the Invoice.

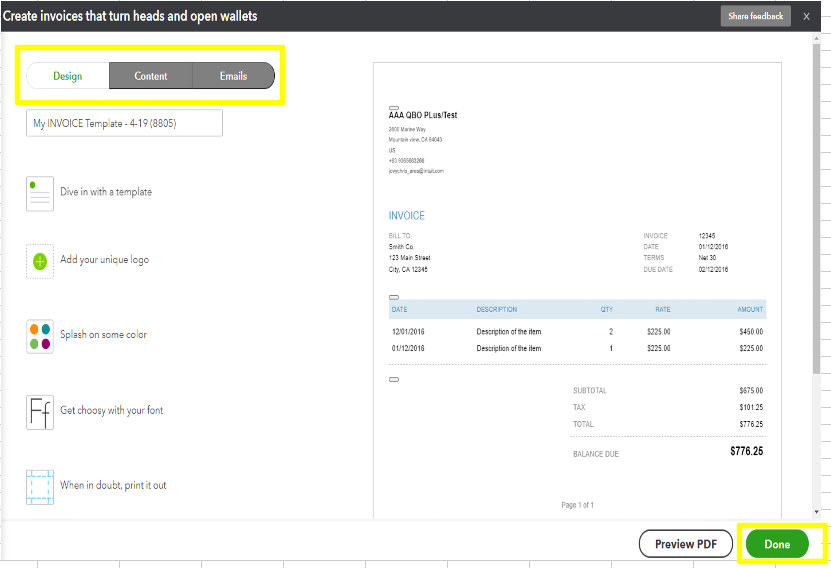

3. After you've completed the previous steps, you will be able to personalize your invoice template to match your preferred style.

- Go to the Design tab to edit the template name, logo, color, font, and margins.

- Go to the Content tab to customize the header, body, and footer of the invoice template.

- Click Done when finished.

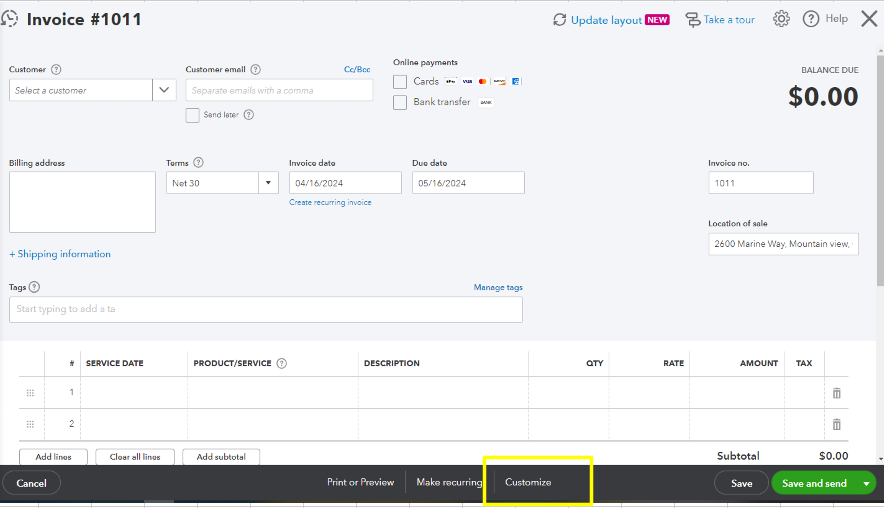

Once done, you can assign the template to the invoice with a specific class by clicking the Customize button. For visual reference, I've added a screenshot below.

For the detailed steps in creating multiple templates please see this article: Customize invoices, estimates, and sales receipts in QuickBooks Online.

If you have any questions or need clarification about managing invoices. We're here to guide you through the process and ensure accurate recording.