Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAn employee gave me the wrong banking information on one of her accounts. It was rejected but the other direct deposit went through. We issued her a check and for the rejected bank and used the DD offset to get the correct amount. I spoke with QB support and he deleted the entire direct deposit, so we created another check for the $700 that went through as a direct deposit. The employee's summary page is correct with the right numbers. Her 2024 W2 is not correct due to the $700.00. How do I fix this?

Hello there, vas4. I understand the challenges you're experiencing with the incorrect info on the W2. We can work together to resolve this.

Could you please let me know which specific box in the W2 needs to be updated? If any changes are necessary, we might need to make an adjustment.

I found this helpful article that explains what steps to take if you or your employee discovers an error on their W-2. Feel free to check it out for guidance: Fix an incorrect W-2 and W-3

Additionally, I’ve gathered some detailed articles specific to handling the W-2 form within QuickBooks that might be useful for you. These resources will provide step-by-step instructions and further insights to help you navigate and manage any related issues effectively.

If you have any more questions or need further assistance with the W-2 issue, please don't hesitate to reach out, vas4. We're here to help ensure your W-2 forms are accurate and up-to-date.

The entire w2 is wrong

Thanks for the clarification, vas4.

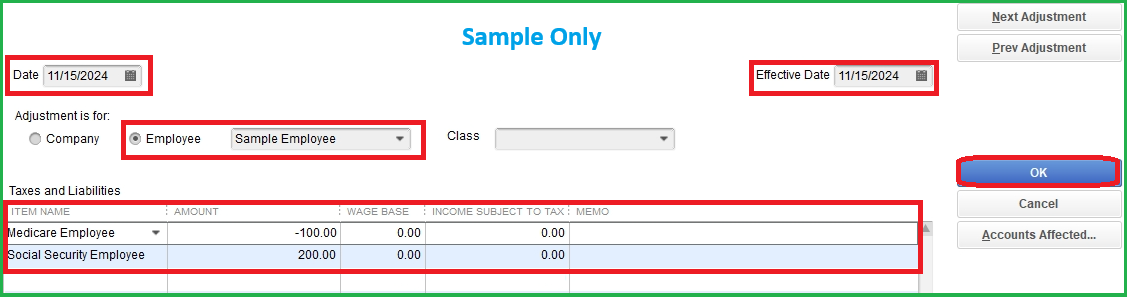

We can create a payroll liability adjustment to correct the amount(s) of incorrect taxes. I'll share the steps below.

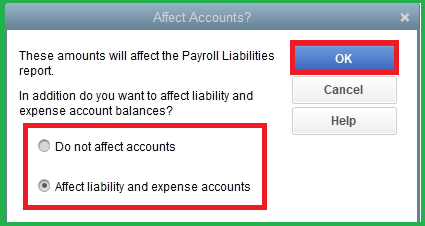

Here's how:

Since the procedure above is complex, it's still advisable to seek guidance from a tax or accounting professional to ensure this entry is recorded accordingly. This way, you'll retain accurate tax data in the platform.

You may also utilize this resource once you need to resolve denied or unsuccessful tax filing and payment: Handle payroll e-file and e-pay rejections.

Don't hesitate to reply to this thread if you have more concerns with your taxes in QuickBooks. We're just a response away.

Hello,

Thank you for the information. This fix worked for all but box 1 on the W2. It still shows the higher gross income. How do I fix this?

I appreciate the effort you've done to correct the inaccuracies from your W2, Vas4. To make sure everything is accurately corrected, I'll guide you through some additional steps to resolve any remaining issues in your payroll forms.

Let's start by conducting a comprehensive payroll checkup in your QuickBooks Desktop account. This tool is designed to verify your current setup by scanning for any missing information, discrepancies, or errors in your payroll. Here’s how to access the payroll checkup:

Here's a screenshot for your reference:

After you initiate the check, QuickBooks will display a detailed view of your payroll data. This overview will allow you to easily identify and verify any discrepancies, ensuring that your records are clear and accurate. Once we have reviewed this, we can make the necessary adjustments and updates to address these issues.

Next, we'll generate the Payroll Summary Report to help us in identifying any inaccuracies or miscalculations in your taxes. Here are the steps to run this report:

Review the report to determine which taxes are inaccurate, and make the necessary adjustments accordingly. If you require additional assistance or if the issue persists, I recommend contacting our live support team. Our experts are well-equipped to provide the guidance needed to correct your payroll form.

Additionally, I'm including this article if you want to learn more about the differences on the box amounts on your payroll form: Understand why W-2 box amounts are different.

Also, I suggest reviewing this article that offers guidance on the essential steps and preparations needed as you get ready for the new year: Year-end guide for QuickBooks Desktop.

Should you need more help, feel free to post in this forum, Vas4. We're always here and ready to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here