Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We record some "Unbilled" transactions against a customer's account.

If the customer only pays part of the "Unbilled" but "tagged" invoices based on a vendor payment, the next time the customer pays, the item does not pop up.

Is there a way to do this where the balance on an item/invoice will show again?

We do not create the traditional billing to customers as most of our customers are just reimbursement claims on expenses we have incurred and for tracking purposes only.

Example:

Customer ABC Has 2 "Unbilled" invoices showing due

Invoice 1 - $150

Invoice 2 - $200

Customer ABC provides us with $300 cash

We select Invoice 1 - $150 (apply entire amount)

We select Invoice 2 - $200 (apply only $150)

Customer ABC Later on provides the $50 balance due

There is nothing out there to apply the $50 to........

I’m glad to see you in the Community today, NNeese.

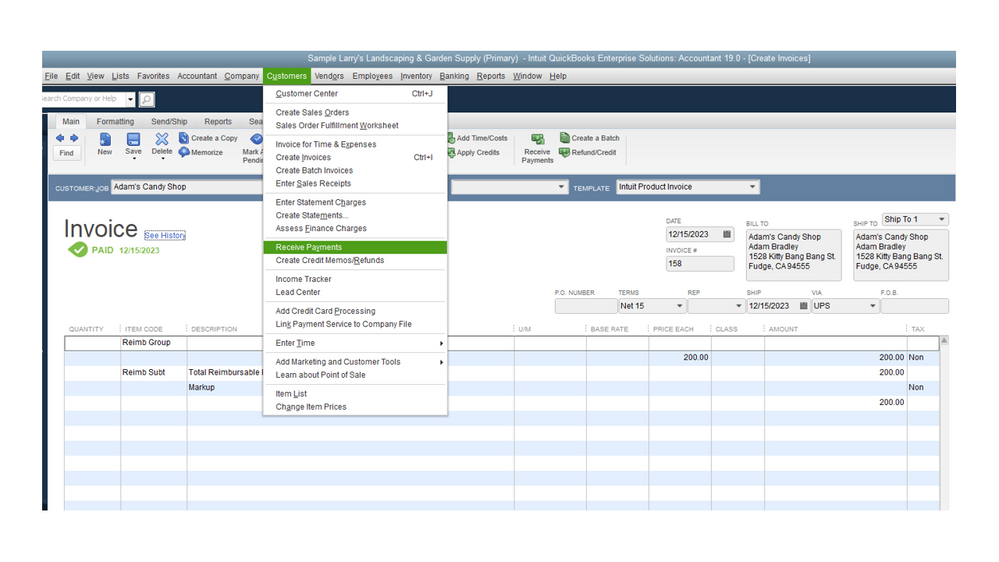

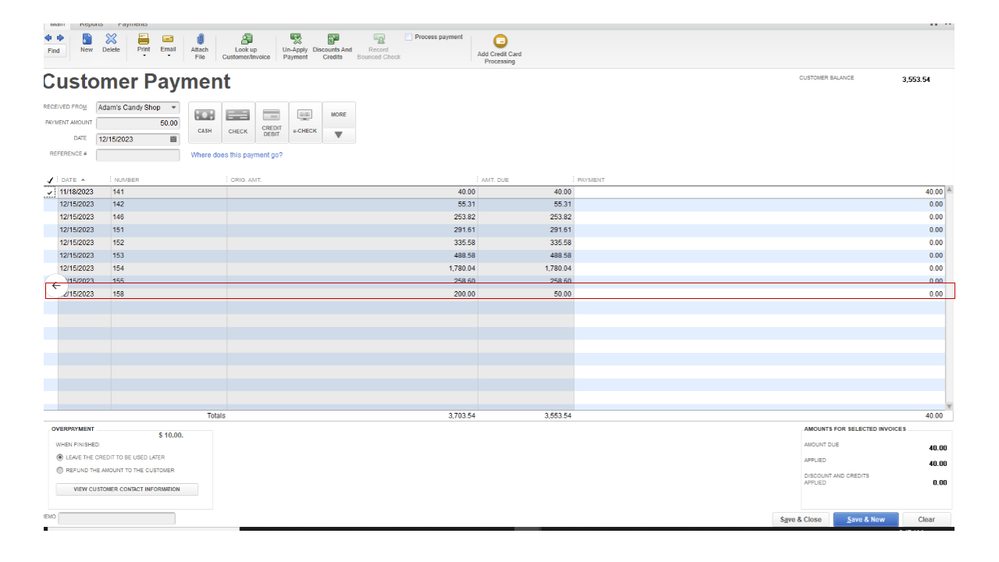

I’m here to help ensure you can apply the remaining $50 to the same invoice. We’ll have to go to the Customer Payment screen to accomplish this task.

When there’s a payment balance, the invoice will show as open in QuickBooks. The remaining amount to be paid will reflect in the AMT DUE column. Once you’re ready to pay it, go directly to the Customer Payment screen to view the invoice and pay the balance.

Here’s how:

This reference contains resources to help efficiently organize your cash flow, track sales, receivables, and profitability more accurately: Get started with customer transaction workflows in QuickBooks Desktop. It contains links on how to perform customer-related activities such as invoicing, recording payments, depositing them, etc.

Stay in touch if you have other concerns about applying payment to unbilled transactions. I’ll be around to make sure this is taken care of for you. Have a great rest of the day and stay safe.

This will not work as we didn't actually Bill the customer. It was attached to "Unbilled Costs by Customer/Job" and had balance left. It brings in entire item instead of what you type in as the amount to apply to a Sales Receipt.

Hi there, @NNeese.

Let me join in this conversation and help you record your customer/job payment in QuickBooks Desktop.

Once you link a billable expense to a sales receipt, the system will only allow you to record the payment once in the program. QuickBooks doesn't have the option to record partial sales receipts since it's recorded at the time of sale. That is why you're unable to see its remaining balance.

It would be best to record the billable expense using an invoice. That way, you can properly track the actual payments made by the customer then record them in QuickBooks. For the detailed steps, check out this article: Track job costs in QuickBooks Desktop.

After recording the partial payment, follow these steps to receive the full amount.

Here's how:

I'll also share our Year-End Guide for QuickBooks Desktop. This will provide you with some info on what you'll need to do when closing your books and preparing for the new one.

Let me know if you need further assistance with this, @NNeese. I'm always around to provide answers and clarifications to your questions. Have a great day ahead and take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here