Sales tax is calculated based on the buyer's location in QuickBooks Online, zeroaccountingisbetter.

For now, there's no option to split a single invoice to apply different tax rates for two separate locations.

Because of that, the best option is to delete the current invoice. Then, create two separate invoices, making sure the correct tax is calculated for each location.

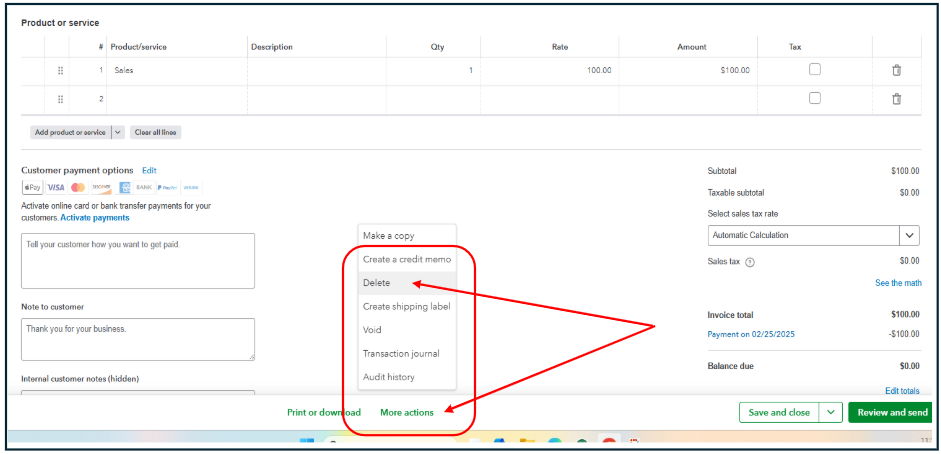

After that, reapply the payment that is already deposited in your bank account. Here's how to delete the invoice:

- Open the transaction.

- Click More actions at the bottom, then choose Delete.

Next, recreate the invoices and follow these steps on how to reapply the payment:

- Click the + Create button and choose Receive payment.

- Choose the name of the customer in the Customer field.

- Select all invoices that you just recreated.

- Scroll down to the Credits section and check the box before the unapplied payment.

- Click Save and close.

Feel free to reply or post more questions if you need anything else.