Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe have a product that we purchase from a vendor that we use inhouse. We donate some of that product to a nonprofit.

I know I need to make an invoice then record a credit memo to the nonprofit, but it shows as a negative on the vendor report.

So the total paid to that vendor is less than the actual payments made to the vendor therefore my expense to that vendor will be less when I do my taxes.

What am I missing?

Thank you for reaching out to us here on the Community page, @BJA2.

Yes, you're correct in recording the donation to a nonprofit organization. For now, I'm here to help you check why the vendor payment on your report is lesser than the actual amount.

One possible reason why this happens is when the purchase transaction is marked as billable to a customer. To start, you can open the bill then see if there's a checkmark under the Billable column. From there, remove the checkmark, then save the transaction.

After that, you may delete the previous vendor payment recorded and enter a new one.

Above all, you can as well reach out to a professional accountant to find out other ways on how to record the donation in your books.

For additional guide when running or customizing reports in QuickBooks Desktop, you can also read the details from this article: Customize reports in QuickBooks Desktop.

Once done, you can also read the topics from our help articles in case you need related resources while working with QuickBooks in the future.

Please let me know if you have any other questions by adding a comment below. I'm always here to help. Have a good day!

The billable column was not checked.

Thanks for the clarification and prompt reply, @BJA2.

This could be a data issue within your company file. Thus, the vendor report shows incorrect information. Let’s perform some troubleshooting steps to resolve this.

I’d recommend running the Verify and Rebuild utility tool. This tool identifies issues in your company file and quickly fixes it. Let me show you how in your QuickBooks Desktop (QBDT) software:

To verify:

To rebuild, repeat steps 2 and 3 and select Rebuild Data.

You can also refer to this article for more details about the process: Verify and Rebuild Data in QuickBooks Desktop.

You might also want to check this article for reference on how to save the current settings of your customized reports. This way, you can access your personalized reports quick and easily: Create, access and modify memorized reports.

I’ll be around if you have other concerns or questions about reports in QBDT. I’d be more than happy to assist you. Have a great day ahead.

That wasn't it either. I must be posting something to the wrong account

Even though it is an item I already have, should I be creating a "new item" just to use for the donated item?

Thanks for coming back to the Community, BJA2.

Based on the details shared, yes, you have to create an item specifically for the donation. Then, create a credit memo and apply it to the invoice. These steps will remove the negative balance on the vendor report.

To start, add the account for the donation. We’ll use this one to record the charitable contribution.

Next, set up the product/service item for the donation. Here’s how:

Now that everything is all set up, issue a credit memo for the value of the product you're donating. Then, link it to the invoice you created for the donated item. For the complete steps, check out the following guide: Give your customer a credit or refund in QuickBooks Desktop for Windows.

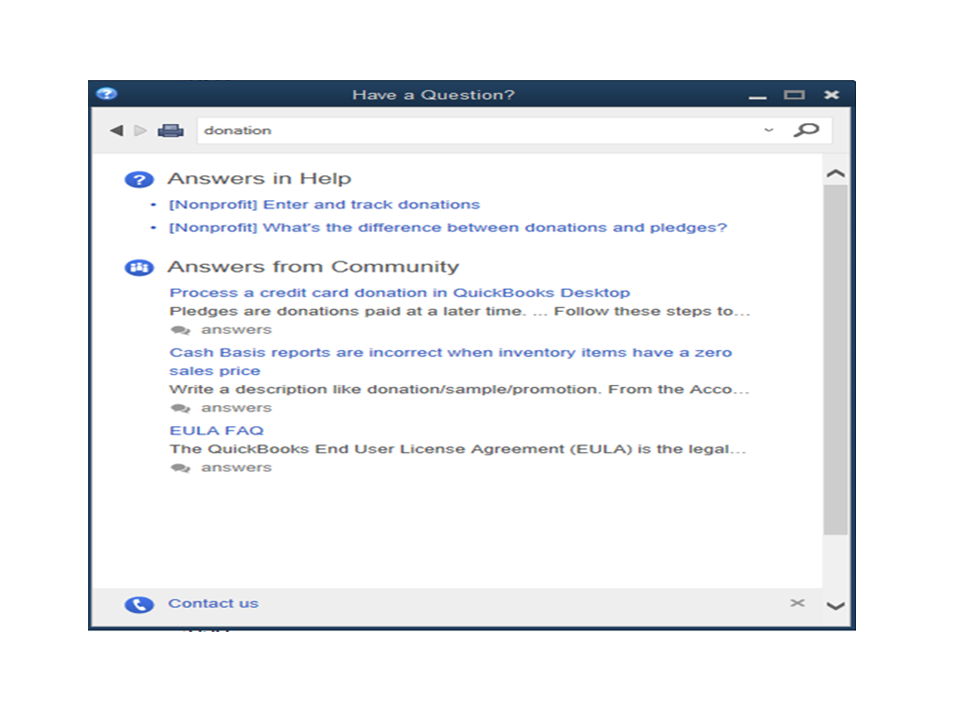

For additional resources on how to track donations in QBDT, I invite you to check out the Help feature inside your company file. Let me show you how to get there.

If you need help with QuickBooks, don’t hesitate to visit the Community again. I’ll pop right back in to assist further and make sure this is taken care of. Have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here