Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

I am using an outside payroll service and I have my gratuity in the other current liabilities, but am I suppose to have a place to put it to when it gets paid?

Hello, susanhd.

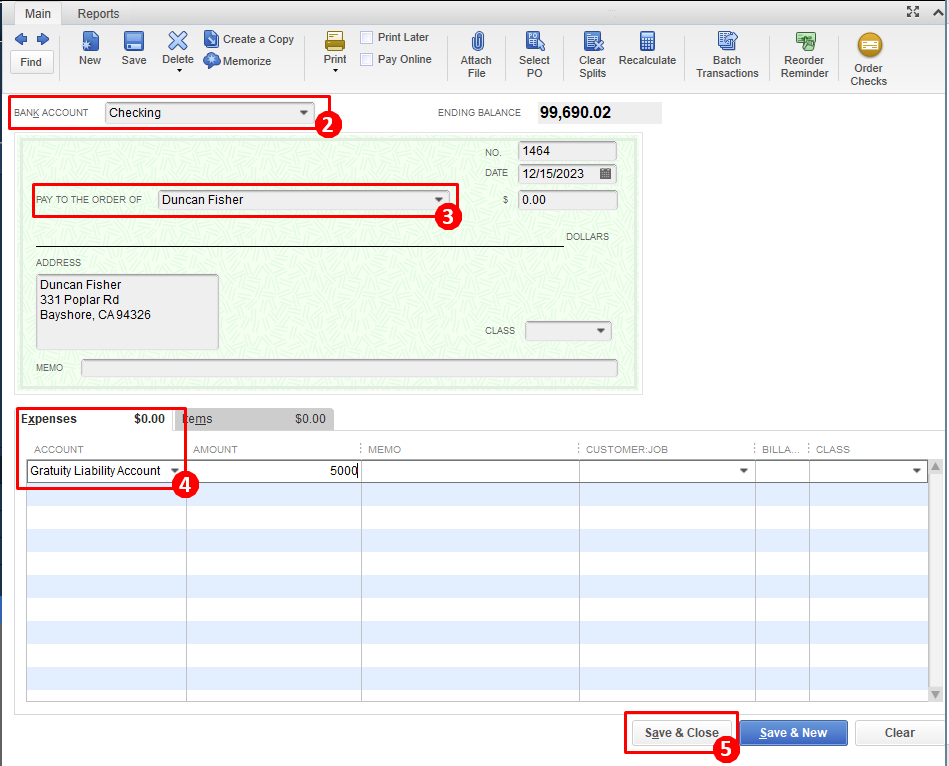

Liabilities are the company's payable. You can create a check to record this transaction in QuickBooks Desktop and choose the Liability account when paying it.

Here's how:

Since you're using a non-intuit payroll service, you'll need to include these liabilities when entering payroll data in QuickBooks Desktop to make your books accurate. If you need more details in handling gratuity paid outside QuickBooks, I'd suggest to consult and work with your accountant.

For the detailed steps in entering historical payroll data in QuickBooks Desktop, check out this article: Enter historical payroll data.

If I can be of assistance while working in QuickBooks Desktop, please let me know. I'll be around to help.

Hello,

So when I input the credit card charges from the day into my deposit I should put the tips in the other liability account, then when it gets paid I take it out of the same account?

Welcome back, susanhd.

Yes, you'll want to input tips in the gratuity account you created solely for tips and you can use the same account when it gets pad. Nevertheless, I'd still suggest consulting your accountant for more expert advice in handling tips and gratuity.

This should help get you back on track. If you need other helpful articles in the future, you can always visit our site: Help articles for QuickBooks Desktop.

Keep in touch if there's anything I can help you with QuickBooks. I'm always around whenever you need help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here