My main goal is to ensure you can track the transaction accurately with QuickBooks Online (QBO), support.

When you mention "pay one of my clients," are you referring to a purchase of a product or service from them that needs to be recorded as an expenditure in QBO? If that's the case, we can create a bill and then process a partial payment.

Beforehand, we'll still need to add your customer as a vendor first. For visual guidance, I recommend following the video tutorial shared in this article: Add a Vendor in QuickBooks Online.

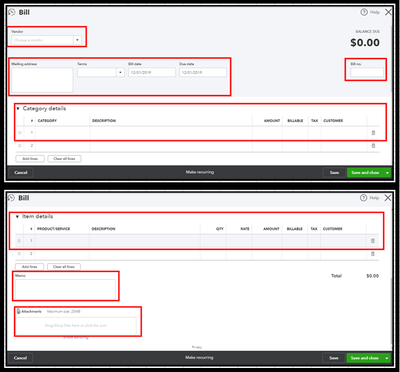

Once done, I suggest following these steps to record a bill:

- Go to + New and then select Bill.

- From the Vendor drop-down menu, select the vendor you've added.

- Enter the Bill date, Due date, and Bill no. as they're recorded on the bill.

- Enter the bill details in the Category details or Item details section, then add the Amount and tax.

- Once done, hit Save and close.

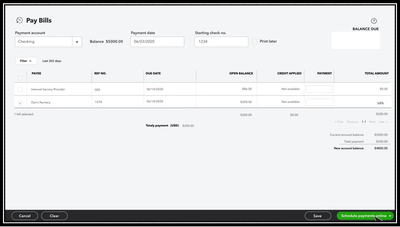

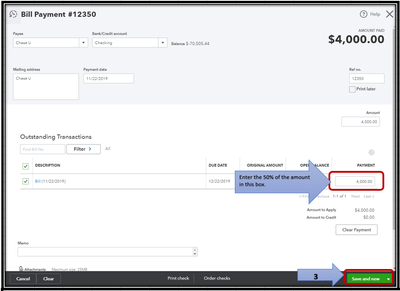

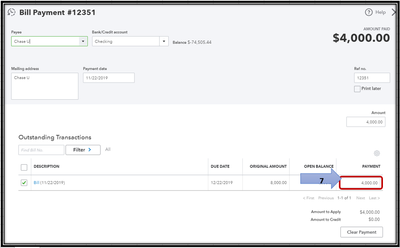

After that, we can log the partial payment in QBO. It will allow us to track the 50% payment while marking the remaining 50% as a balance to be paid at a later date. To accomplish this, please follow these steps:

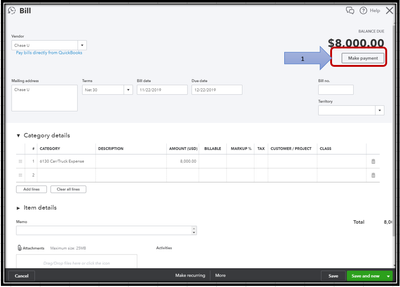

- Open the bill that needs to be paid and hit on Make payment at the top.

- Enter the 50% of the payment in the amount section.

- Hit on Save.

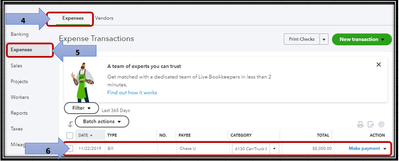

If you're ready to pay the remaining 50%, reopen the bill by going to the Expense tab and making a payment again. For visual reference, I've added a screenshot below.

On the other hand, if you've incurred expenses on your client's behalf and need to invoice them for reimbursement, the steps are a bit different. You can follow the steps outlined in this article to guide you through the recording process: Enter billable expenses in QuickBooks Online.

Please know that you can always drop me a comment below if you need more guidance on the process or need clarification. I'll be happy to help you some more.