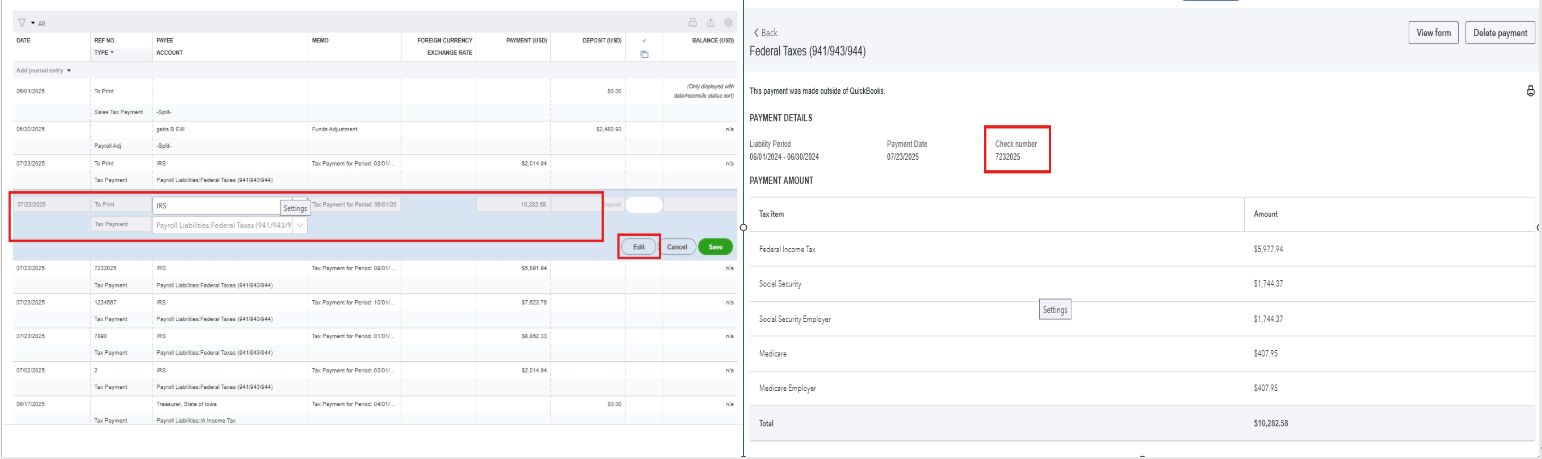

You'll need to manually open the tax payment in the register to view the check number, as the unique check number will not automatically display in the check register, Finsec.

Here's a sample screenshot:

However, if you have already opened the tax payment in the register and find that the check number wasn't entered, you can delete the tax payment and re-enter it to re-enter the check number.

Here's how:

- From the Payroll taxes.

- In the Payment tab, scroll down to the button and click All Payment History.

- Select Tax Payment History, then tap the taxes you want to edit.

- Hit Delete Payment button.

- Once done, go back to the Payment tab, locate the deleted payment, pay it, and re-enter the check number.

Please let me know if you have other questions or concerns.