Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowJust opened a busy restaurant and our system provides a report which shows the daily totals for food sales, meal tax payable to the state, local tax, alcohol sales and merchandise sales; however Im having a hard time recording this in quickbooks as i don’t know how much of that was credit card sales and what was cash unless i go through each receipt which would be a nightmare. How to i record the two separate deposits and also show the income from each category?

I'm here to help record the deposits in QuickBooks Desktop, sandy71383.

You can use the Make Deposits feature to record sales from your restaurant. Before proceeding, make sure to set up your daily sales accounts that will track those deposits.

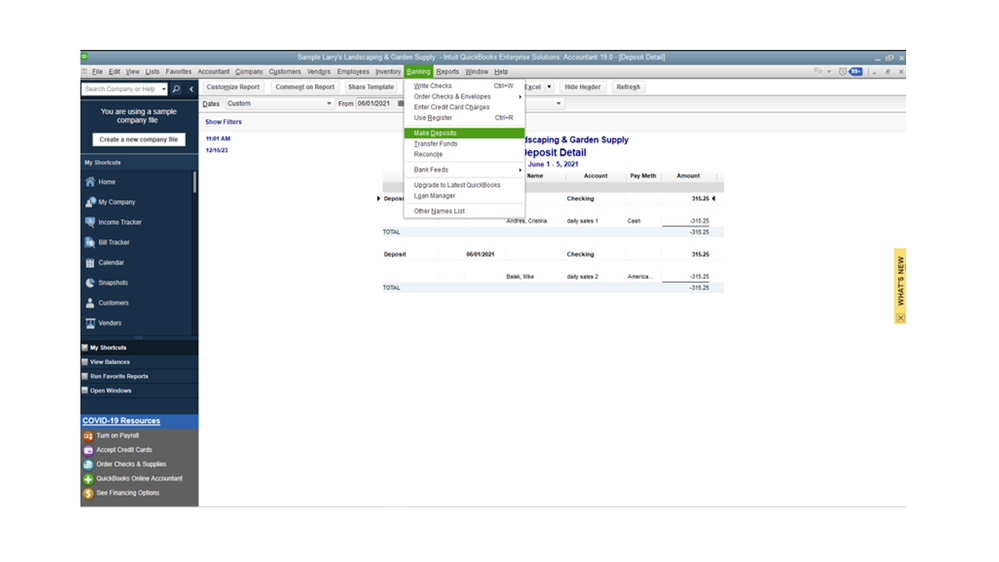

After setting up the account, you can follow these steps on how to record your deposits:

For the category of those deposits, I recommend contacting your account. They can provide specific instructions on what accounts to use for your daily sales. Doing this will help ensure your books have accurate records.

I’ve also added this article that you can use for future guidance: Reconcile an account in QuickBooks Desktop.

Let me know if there's anything else you need with entering your daily sales in QuickBooks, I'm always around to help you.

Thanks for the response; however, it doesn’t answer how i can record the two separate deposits. I don’t want to combine the two.

Thanks for the response; however, it doesn’t answer how i can record the two separate deposits. I don’t want to combine the two.

Welcome back to the Community, sandy71383.

I’ll guide you in the right direction on how to record the two separate deposits in QuickBooks.

We’ll have to enter the sales one at a time and input the payment method. This process will help you determine the credit card and cash sales.

Here’s how:

This how the transaction looks after following these steps.

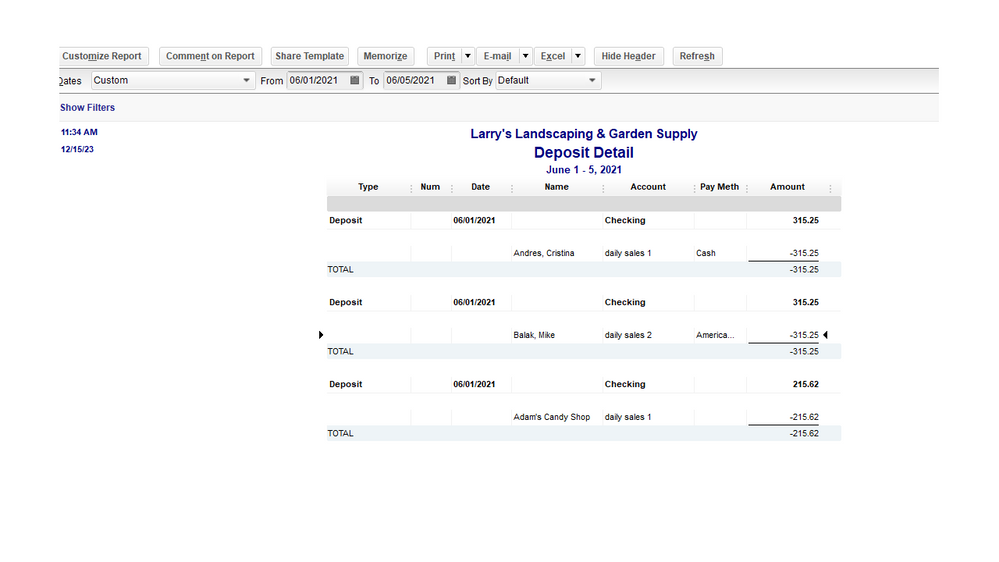

Then, run the Deposit Detail Report to show the income category for your sales transactions. You can customize it to see the accounts used and their payment methods.

To build the report:

Here’s an article that contains topics about customizing reports. From there, you’ll find the links on how to set the report preferences, modify and memorized statements, etc: Customize reports in QuickBooks Desktop.

Additionally, these resources will guide you on how to see transactions they’re linked to such as an invoice and its payment: Use Check or Deposit Detail Reports to show transaction links and mimic Cash Receipt Report.

Feel free to leave a comment below if you have additional questions or concerns. I’ll pop right back in to make sure you’re taken care of. Have a great weekend ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here