Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOne of our vendors with which we have credit terms issues a refund when the monthly statement has a credit balance instead of carrying that credit balance into the next month. We returned more to this vendor this month than we purchased, so I have both bills and vendor credits to reconcile. How do I match all transactions to the refund? The "Find Match" function on the banking page returns no transactions to select, and the "Bill Pay" function won't let me apply the full amount of the vendor credits, only the amount that offsets the purchase total. How do I mark both the bills as paid and the credits as fully applied?

Let me guide you on how to mark bills and credits as paid and fully applied, @NealeyFinance.

When paying a bill in QuickBooks Online, selecting more vendor credits than the total billed amount is unavailable. This is a built-in feature to ensure accurate accounting and prevent errors. However, there is still a way to achieve your desired outcome. You can create a credit card credit to account for the refund and link it to the remaining credits.

It's essential to pay the bill with the total purchase amount first. Then, create a credit card credit affecting accounts payable to record your refund.

Here's how:

Now, you can match the transactions in your bank feeds.

Lastly, let's link the existing vendor credit to mark it as applied:

Moreover, I've added a helpful resource to guide you in reviewing your bank statement and QBO transactions: Learn the reconciliation workflow in QuickBooks.

I'm still ready to back you up if you need more help with your vendor refund. I'll keep the thread open so you can comment back.

Thanks for getting back to me. Is there a workaround for when the vendor credit is on a credit card? That is our current situation, and the credit card account is not available for selection when creating a check.

Thank you for the prompt response, @NealeyFinance.

Let me provide you with a workaround that will let you use your credit card account instead.

Link the bill and vendor credits using an expense transaction. Make sure that the vendor credits match the amount on your bill.

Here's how to do it:

After doing this, you can now match the transaction to your bank feeds.

You can now reconcile your account.

I'm adding this helpful article on how to put your online transactions to the correct accounts: Match online bank transactions in QuickBooks Online.

If you have more questions or concerns about your bank transactions, our Community team is always ready to provide you with assistance. Take care.

Thank you for the response, Janbon, but this still doesn't work. As soon as I select the first bill, it redirects to the Bill Payment page where I cannot select more credit than the total billed amount and therefore cannot achieve the total refund amount.

I appreciate you for following the steps provided by my colleague and keeping us updated, @NealeyFinance.

In QuickBooks Online, when you're paying a bill, the system does not allow you to select more vendor credits than the total billed amount. This is built-in to safeguard and ensure accurate accounting. But we can still achieve your goal by creating a credit card credit to account for a refund and link it to the remaining credits.

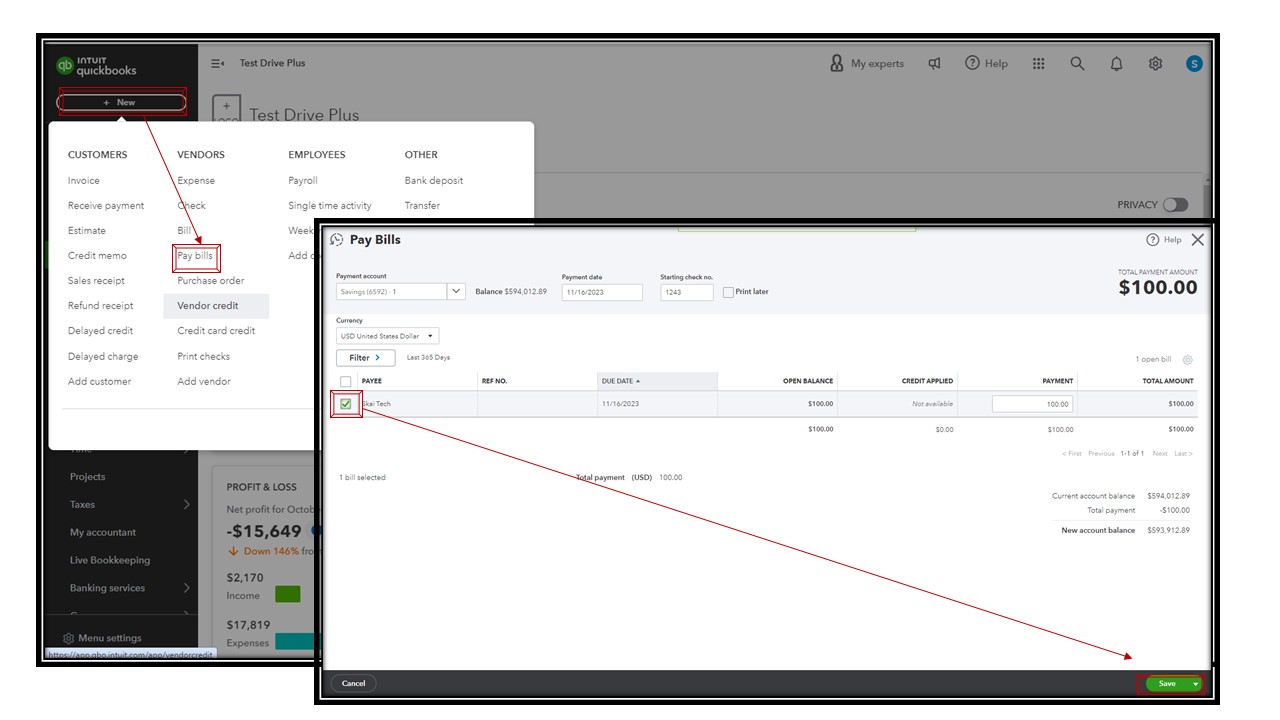

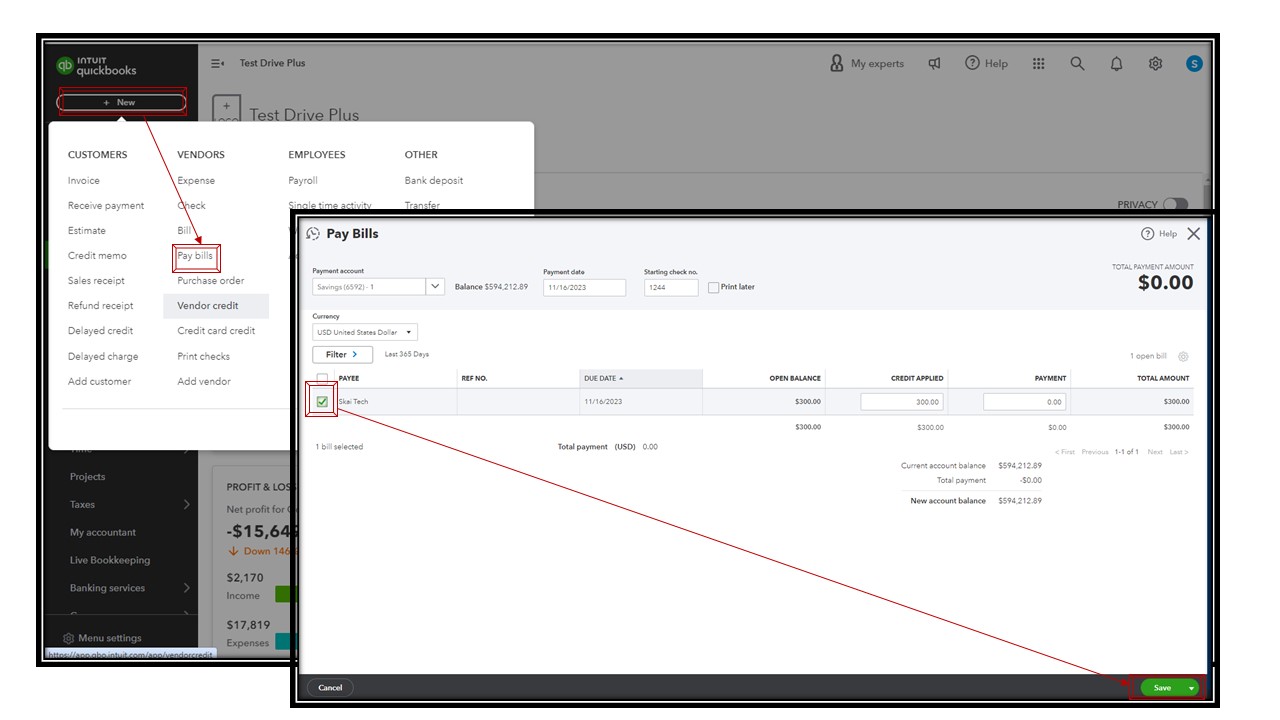

First, let's pay the bill with the total purchase amount:

Second, let's create a credit card credit in QuickBooks to record the refund you've received from your vendor:

Now, you can match the downloaded refund in bank feeds to the created

credit card credit.

Lastly, let's link the existing vendor credit to mark it as applied:

Moreover, once you're done categorizing and ensuring that all transactions are matched, you can start reconciling your QuickBooks account. This will make sure that financial records are kept accurate and discrepancies are dealt with promptly.

I'm still all ears if you need more help with your vendor refund. I'll keep the thread open so you can comment back.

Thank you for your response, @ShyMae, but as I mentioned above, this refund is on a credit card, so I cannot select it as the account for a bank deposit.

However, I remembered that this actually happened with the same vendor for the October 2022 statement, so I went back to see how I reconciled it at that time. The process at that time involved three transactions:

This method worked again today to reconcile all statement transactions and the credit card refund.

Thank you for your and @JanbonN's help, and I hope my method

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here