Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm new to QB and could use all the help I can get!

We're a church and I'm trying to figure out the most efficient way to input donations as sales so that I can give each donor a year end receipt.

When I download our transactions from our bank account, Quickbooks records our donations as deposits. Do I need to input the donations manually, rather than from the downloaded bank statements? And if so, how do I do that?

Welcome to the QuickBooks Community, calledup2019.

There are different ways on how you can record the donations. Since you want to print the receipt and give them to your donors, you can use the Sales Receipt to record the donation as a cash memo.

Here are the steps:

Then, follow the same process for the other donors. Once done, you can follow these steps to print the receipt:

Please see these sample screenshots below:

After recording and printing the receipt in QuickBooks, you can match them with the downloaded transaction when it shows up in the Banking section.

Here's how:

When you're ready to reconcile your bank account, I've got this article for the instructions: Reconcile an account in QuickBooks Desktop.

If there's anything else you need, just leave a comment on this thread, and I'll get back to you as soon as I can. Thank you!

Probably the best way is using the Sales Receipts feature.

However, it depends on how you'll create your year end donor statements, which can be a hurdle as QB does not have a feature to do it properly.

If you use our BRC Donor Statements - Desktop app to create proper statements, then you can record the donations as Invoices and payment transactions, Sales Receipts, Deposits, and even as Journal entries.

Hi calledup2019,

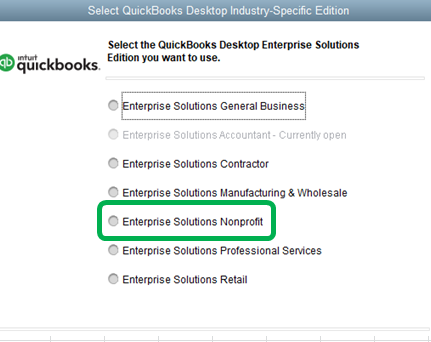

You can toggle to Nonprofit to change your QuickBooks Edition.

Here's how:

Please check this article for additional information: Toggle to Another QuickBooks edition.

Once done, you can record the transaction as a sales receipt and change the default title to Donation.

Then, follow the steps mentioned by @RenjolynC to record and print the transaction later. Then, run a year-end report for the customer.

I have also added this link for your reference: Income And Expenses.

We're always right here if you have any other concerns.

How would I do this with QB online? And also, I have imported donations transferred from Zelle and Paypal into Quickbooks and it seems like there should be any easy way to associate AND receipt the donors who gave these gifts but I haven't figured out how and would appreciate your help.

I'd love to hear the answer to the below reply from the OP. Is this possible in the online editions. The online edition is the most detailed that non-profit owners are able to access, and yet there is very little support from QB or TechSoup (which is QB partner for non-profit discounts). Very discouraging and cost consuming.

How can these actions be mirrored for the online editions?

Thank you

Thanks for joining the Community, ENascimento.

In QuickBooks Online, you can record cash and products/services donations by following the process(es) detailed in our How to record donations or charitable contributions article.

I can certainly understand how an ability to associate donations with transactions and produce receipts for them could be useful and have submitted a suggestion about it as of today.

You can also submit your own feature requests while signed in.

Here's how:

Your feedback's definitely valuable to Intuit. It will be reviewed by our Product Development team and considered in future updates. You can stay up-to-date with the latest news about your product by reviewing Intuit's Product Updates webpage.

You can also check our QuickBooks App Store for apps which may be able to help you achieve what you're looking to do.

Please don't hesitate to send a reply if there's any questions. Have a lovely day!

Hi, will making a sales receipt get a donation counted twice as income, if the bank deposit is already recorded into QB Online? thanks!

Anything I’ve looked at either gives you a report with multiple receipts or total only with no customer address. If there was a way to open sales summary and show address, then a year end donation receipt could be generated.

I appreciate you for joining this thread, @TreasurerGJC and @TFGKen.

@TreasurerGJC, yes, you're correct. Creating a sales receipt while having a deposit recorded in your QuickBooks will double your income. Since the income is already deposited in your book, let's make sure to record them in the appropriate bank account.

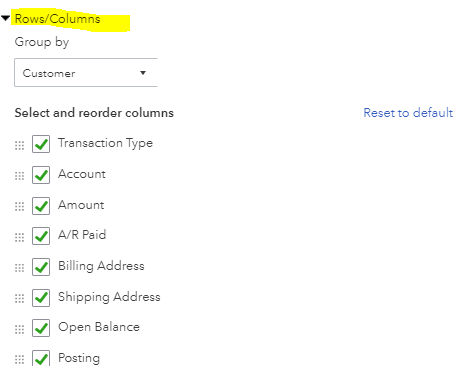

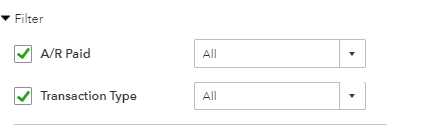

@TFGKen , I want to make sure we're on the same page. Can you share the report's name you've tried to generate? Also, are you using QuickBooks Online? If yes, we can run the Transaction List by Customer report and customize it to get the data you need.

For additional reference, feel free to visit this article: Customize reports in QuickBooks Online.

I've gathered a few articles for you. Each of them provides information about sales and customers in QBO:

Don't hesitate to add another post if you have other concerns about generating reports for your customer transactions and information. Take care and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here