Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI recently got a bank loan through my business to purchse seveal used trucks. The bank paid the truck dealer directly . I had to give the bank a first and last as a down payment. The loan term is 60 months, so i have a remaining 58 payments that come out of my acccount automatically on the 15th of each month. How would I go about setting this up in quickbooks online? What is the easiest way as i am brand new to quickbooks.

Thanks

Tom

Solved! Go to Solution.

Start with your down payment check as you can include most information in it without using a journal entry. Numbers as an example.

Price = 30k with 3k down plus initial payments. Without knowing the actual terms of loan and simplifying it let's assume monthly payments of 500. Thus your check or checks up front total $4000 ( 3k down plus 2 payments). If one check or just a 3k check in the check detail lines will be +30k fixed asset for truck followed by -27k loan liability = 3k down payment.

The 1000 additional will include both principal and interest and you may want to wait for your first loan statement to adjust amounts and if the bank does not apply the "last" payment to the loan up front you will record it as a separate other asset type similar to a deposit held on utility accounts and only apply it to p&i at end of 5 years. But whatever the bank says it what you go by.

You can set up a recurring memorized transaction to automatically record the payment on the 25th of each month and then once you get the statement make adjustments to p & i portions.

The truck asset includes all taxes and title fees but you can direct expense the license plate charge and not have to depreciate it. Depreciation over time or accelerated write off is a question to be posed to your tax accountant

Hi there, EPS2019,

Let me provide the steps on how to set up and categorize a bank loan and record its payment.

You need to manually record the loan payable in QuickBooks Online. To do so, please follow the steps outlined below for your guidance.

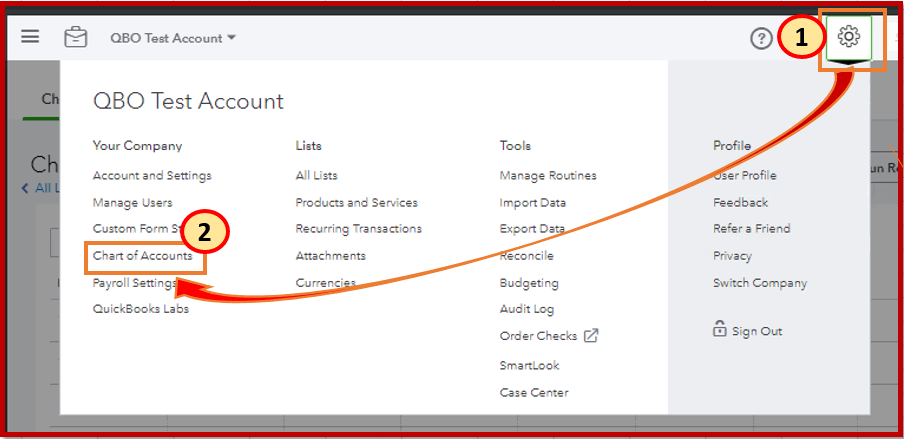

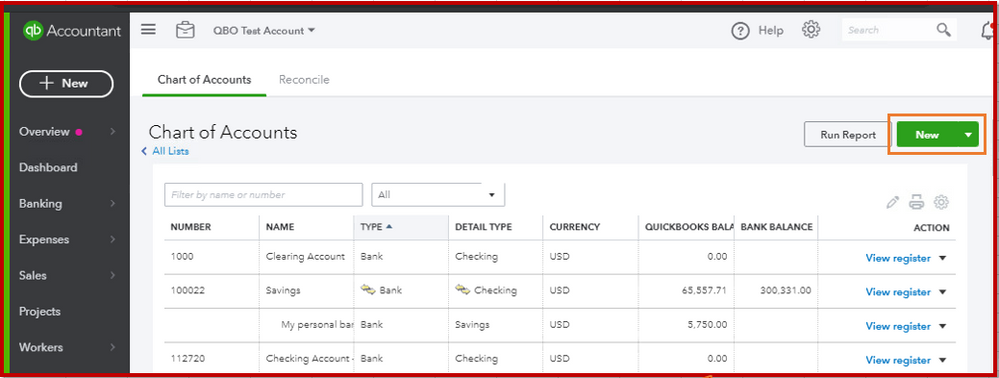

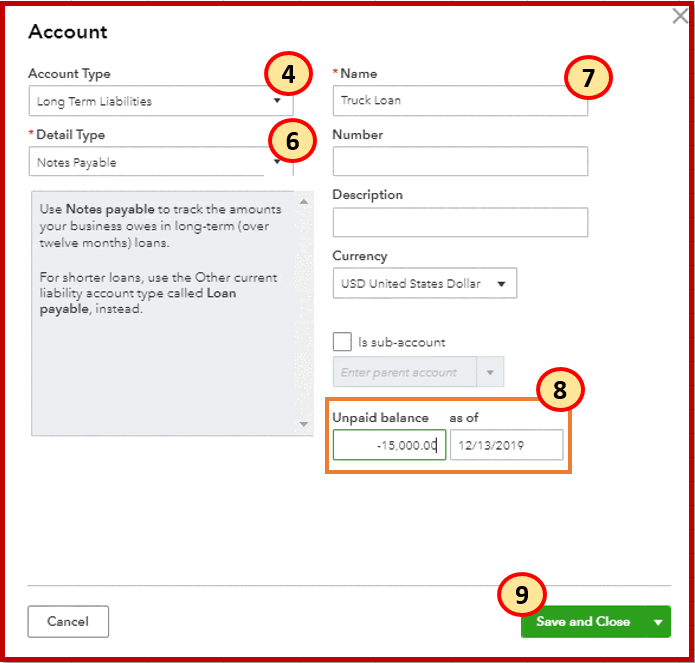

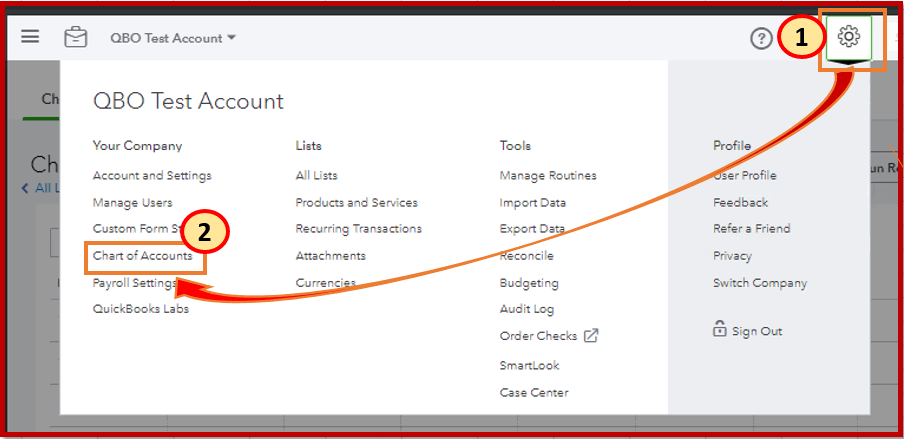

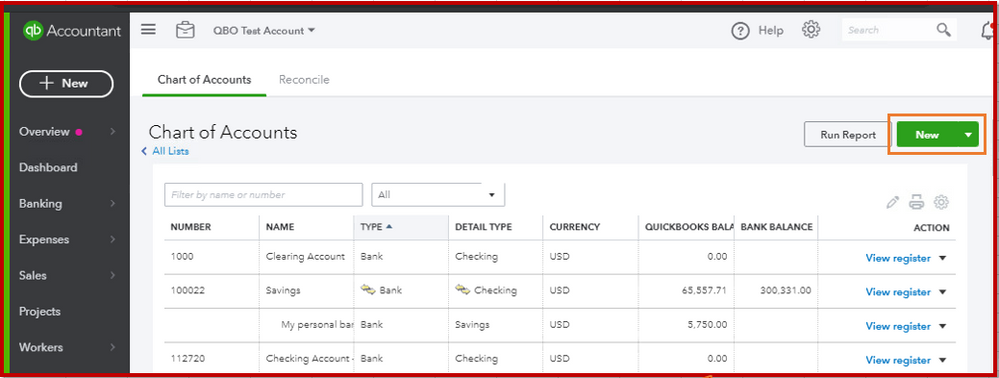

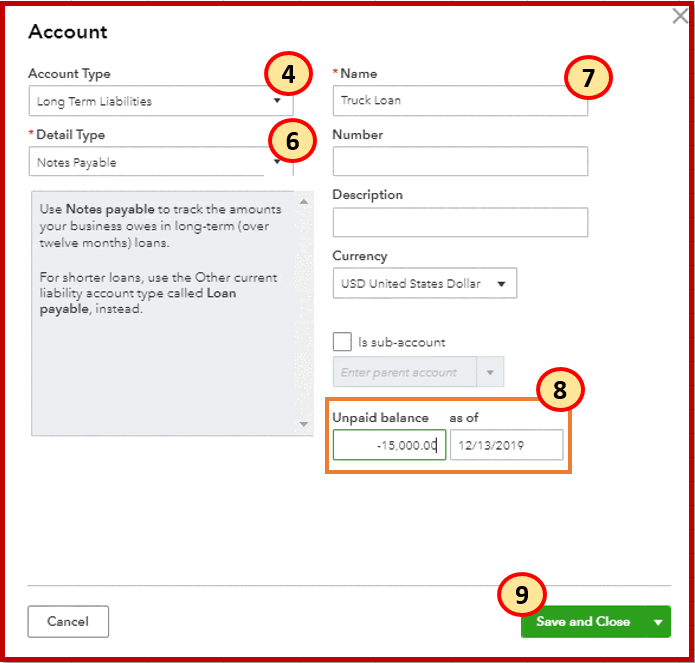

Step 1: Create a liability account for the loan payable.

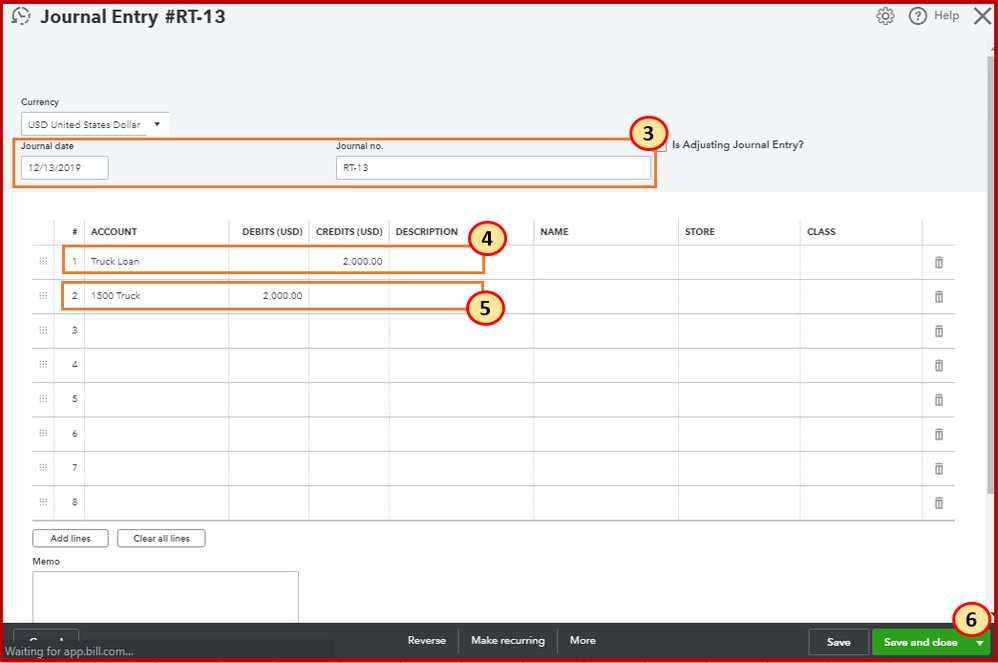

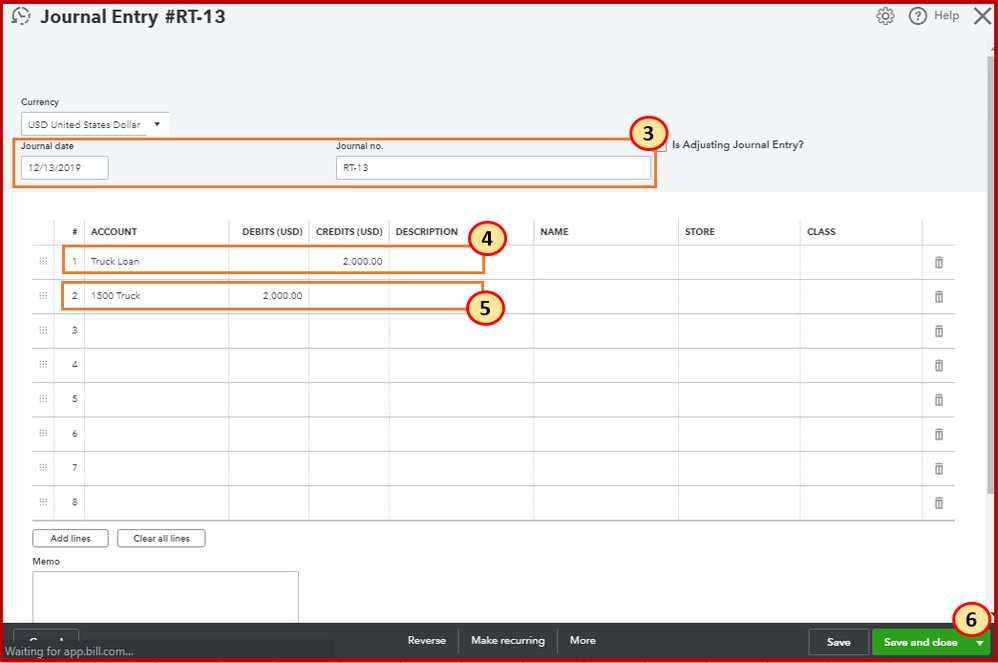

Step 2: Record the money you got from the loan.

The money is an asset to your business. To pay and amortize the debt of an asset, check this out: Amortization schedule in QuickBooks Online. It provides instructions and detailed steps for your guidance.

Step 3. Record a loan payment.

Upon sharing this solution, I still suggest consulting with your accountant. He/She might have specific instructions on how to handle a truck loan.

If there's anything else you need, please leave a comment below. I'd be happy to help you out.

1. Type of payment is immaterial as it is still a "check"

2. The step by step explained by the staffer includes all the steps but all those steps can be accomplished within the first recorded ACH. You can add new accounts at any time and from the check detail entry screen as I suggested which saves some tune and bypasses using journal entries which can be confusing and will not track by name.

Start with your down payment check as you can include most information in it without using a journal entry. Numbers as an example.

Price = 30k with 3k down plus initial payments. Without knowing the actual terms of loan and simplifying it let's assume monthly payments of 500. Thus your check or checks up front total $4000 ( 3k down plus 2 payments). If one check or just a 3k check in the check detail lines will be +30k fixed asset for truck followed by -27k loan liability = 3k down payment.

The 1000 additional will include both principal and interest and you may want to wait for your first loan statement to adjust amounts and if the bank does not apply the "last" payment to the loan up front you will record it as a separate other asset type similar to a deposit held on utility accounts and only apply it to p&i at end of 5 years. But whatever the bank says it what you go by.

You can set up a recurring memorized transaction to automatically record the payment on the 25th of each month and then once you get the statement make adjustments to p & i portions.

The truck asset includes all taxes and title fees but you can direct expense the license plate charge and not have to depreciate it. Depreciation over time or accelerated write off is a question to be posed to your tax accountant

great thanks,,, please forgive me ... as i mentioned i am brand new...

1. So all downpayments and future payments are ACH electronic payments that pull funds directly from my checking account. does that make a difference will eveything you mention still apply?

2. how do i categorize and record this loan? do i intially setup anything in charts of accounts ? Is there a step by step tutorial or sometning i could follow?

Hi there, EPS2019,

Let me provide the steps on how to set up and categorize a bank loan and record its payment.

You need to manually record the loan payable in QuickBooks Online. To do so, please follow the steps outlined below for your guidance.

Step 1: Create a liability account for the loan payable.

Step 2: Record the money you got from the loan.

The money is an asset to your business. To pay and amortize the debt of an asset, check this out: Amortization schedule in QuickBooks Online. It provides instructions and detailed steps for your guidance.

Step 3. Record a loan payment.

Upon sharing this solution, I still suggest consulting with your accountant. He/She might have specific instructions on how to handle a truck loan.

If there's anything else you need, please leave a comment below. I'd be happy to help you out.

Thanks for the reply...

regarding "Step 2" - i never received the loan amount in my account. The loan bank paid the vendor directly and we then received the truck. so, do i still follow step 2?

1. Type of payment is immaterial as it is still a "check"

2. The step by step explained by the staffer includes all the steps but all those steps can be accomplished within the first recorded ACH. You can add new accounts at any time and from the check detail entry screen as I suggested which saves some tune and bypasses using journal entries which can be confusing and will not track by name.

if we follow these directions - the actual amount used to pay down the loan principal is not recorded as an expense...how can you accomplish that?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here