Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It's our priority to ensure everything reports correctly, @payroll17.

After applying the credits to the bill, the amount should be taken out from the report. Make sure to run the correct reporting period and accounting method. Here's how:

I've also included here an article about applying vendor credits to bills and expenses: Manage Supplier Credits.

Furthermore, there are various financial reports available in QBO that give you snapshots of different areas of your business. You can also personalize them and focus on the details that matter the most to you.

Keep in touch with me here should you need further assistance in customizing your reports. I'm always available to help.

Hi @payroll17,

Hope you’re doing great. I wanted to see how everything is going about running your report. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead.

Hi LieraMarie,

Thank but I had already accessed the trial balance in the way you suggested and that is where the erroneous amount is still showing. The supplier's account is now showing a nil balance (correctly) so I don't know why it is on the Trial balance for the last financial year-I dated the dummy bill and off set the credit as march 31st.

Thanks for following up with the Community, payroll17.

To identify why your trial balance shows an outstanding credit, I'd recommend working with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form:

You'll additionally be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply if there's any questions. Have a great day!

Hi ZackE

Thank you for your reply but it is my accountant who suggested I ask Quick Books as he cannot work out why!

Thanks for getting back to us here in the Community, @payroll17. Let me guide you on the actions you need to take care of your supplier's credit on the Trial Balance report concern in QuickBooks Online (QBO).

The Trial Balance report summarizes the debit and credit balances of each account on your chart of accounts during a period of time. Based on your description of the issue, I can tell that you've followed the appropriate process in recording the supplier's outstanding credit in QBO.

Since the credit amount still shows on the said report even though the supplier's account is now showing a nil balance, I'd recommend deleting and then recreating the transactions that cause the balance (i.e., bill and bill payment).

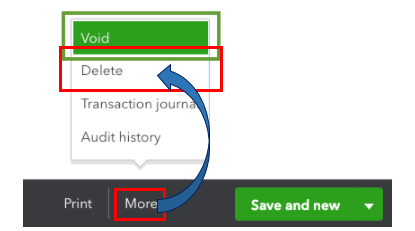

To delete a transaction in QBO, here's how:

Then, recreate the transactions accordingly. Apply the supplier credit to your bill by performing the step-by-step guide in this article: Enter a credit from a vendor.

Once you're done, pull up the Trial Balance report again from the Reports menu's Standard tab. Then, customize it to focus on the details that matter to you the most. This way, you're able to check that the transactions are recorded accordingly.

However, in case the issue persists, I encourage you to check with your accountant if the adjustments created are correct. This way, you can keep your financial data and books accurate.

Also, to further guide you in managing your business's expenses and all other supplier transactions in QBO, you can check out this article: Expenses and Suppliers in QuickBooks Online. It includes topics about vendor credits, paying bills, and managing inventories, to name a few.

Please don't hesitate to keep me posted on how it goes. Let me know in the comments if you have other reporting concerns and questions about managing supplier credits in QBO. Take care, and I wish you continued success, @payroll17.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here