Hello there, bsh202112. I'm here to guide you on how to correct the payee's name on a filed 1099 in QuickBooks Online.

If the 1099 forms you filed are rejected or revoked, it means that the IRS received them but couldn't accept them because the information on the forms doesn't match their records. To fix this, you need to void the batch of rejected forms first. You can follow the steps below:

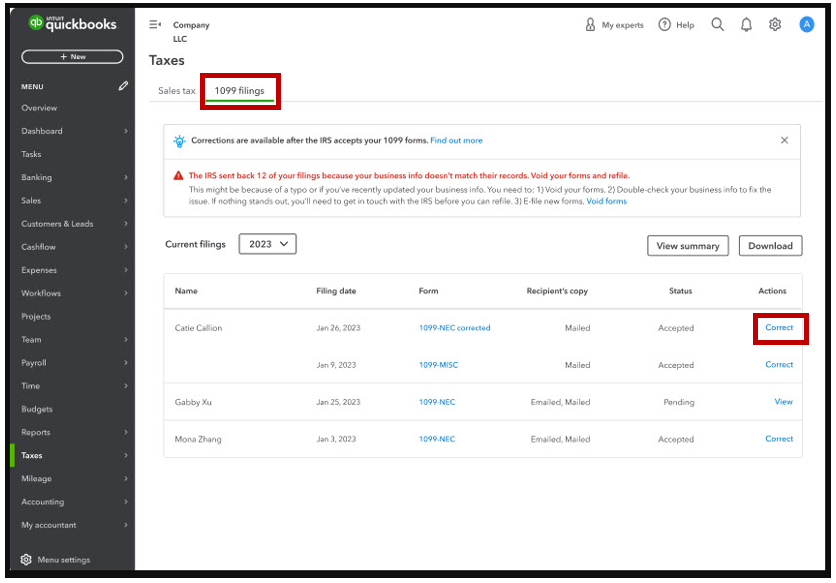

- Go to Taxes, then select the 1099 filings tab.

- To remove all the rejected forms, click Void Forms.

Once done, you can update the contractor's information in their profile. Here's how:

- Go to Payroll, then select the Contractors tab.

- Select the contractor that you want to edit or correct the payee's name.

- In the contractor's profile, click the Pencil icon to edit their information.

- Click Save.

After updating their profile, you can prepare the 1099 forms and resubmit them through QuickBooks. If you already paid for your 1099 e-filings, you won't be charged again when you resubmit.

On the other hand, you can correct the 1099 forms by clicking the Correct option in the Tax Center if they are accepted by the IRS. You may refer to the image below:

Furthermore, if you want to print your 1099 forms in the program, you may refer to this article for future reference: Print your 1099 and 1096 forms.

I'm all ears if you have any concerns about correcting 1099s or other QuickBooks-related queries that need to be addressed. Have a great day!