Hi there, brooklyn. I understand the importance of preparing and filing your 1099s on QuickBooks Online (QBO).

I'm here to share insight about using Social Security Number (SSN) instead of Employer ID Number (EIN) when creating the form.

In QBO, the EIN is required to be entered in the Company profile and needed for 1099 filing, even if you have a sole proprietorship business. SSN is necessary for employees and contractors only. It's the reason why you can't continue with the process.

Please check out these guides for more details about SSN and EIN in QuickBooks:

With this, you may consider updating your EIN information in your account. To do this:

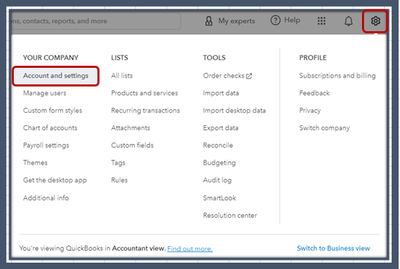

- Go to Settings, then Account and Settings.

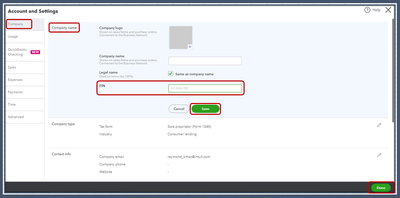

- Select Company, then Edit icon in the Company name section.

- From the EIN section, select and enter the EIN.

- Once done, click Save and Done.

You may also contact our QuickBooks Support Team regarding this matter. They have tools to provide alternatives or solutions to ensure you can file on time.

In addition to that, if you want to apply for an EIN and learn more about the requirements, you can visit the IRS website.

Moreover, you may utilize this guide to learn more about 1099s: Get answers to your 1099 questions.

I'll always be available in this forum if there's anything else you need further assistance with when managing 1099s. Let me know in the comments below, and I'll make sure to provide additional help.