Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello Community:

I manually created "Expenses" in QBO. The transactions that correspond to these expenses are now showing in my downloaded Credit Card transactions. Problem is the downloaded transactions aren't matching to the Expenses, and I see no way to match them, as "Find Match" only looks for Bills. Is there a way to match these now, or do I have to Delete the manually created expenses and add from the Bank Center? Thanks for any help you can provide.

Hello, @JustineEFI.

I hope you're having a wonderful evening. You're going through the correct steps to match the expense. However, there can be many reasons as to why you don't see any of the expenses you created manually on the Find Match screen. I've listed a few ideas here:

You can find more details about matching transactions in this article: Assign, categorize, edit, and add your downloaded banking transactions.

Please don't hesitate to touch base with me here if you need any additional assistance. I look forward to hearing from you again

Hi @Anna S,

I hope you had a great weekend! Thank you for the information. Unfortunately none of the scenarios you mention are correct, see my comments in blue.

I have attached screen shots of one of the Expenses I created and the CC transaction that shows in the Banking View. I feel like at this point it would just be easier to delete the expenses I created and go through the action of adding them from the Banking View. Next time I will just create them as a Bill and then apply the Payment.

Thank you for trying to help. Wishing you well.

Thanks for adding more information and a screenshot, @JustineEFI.

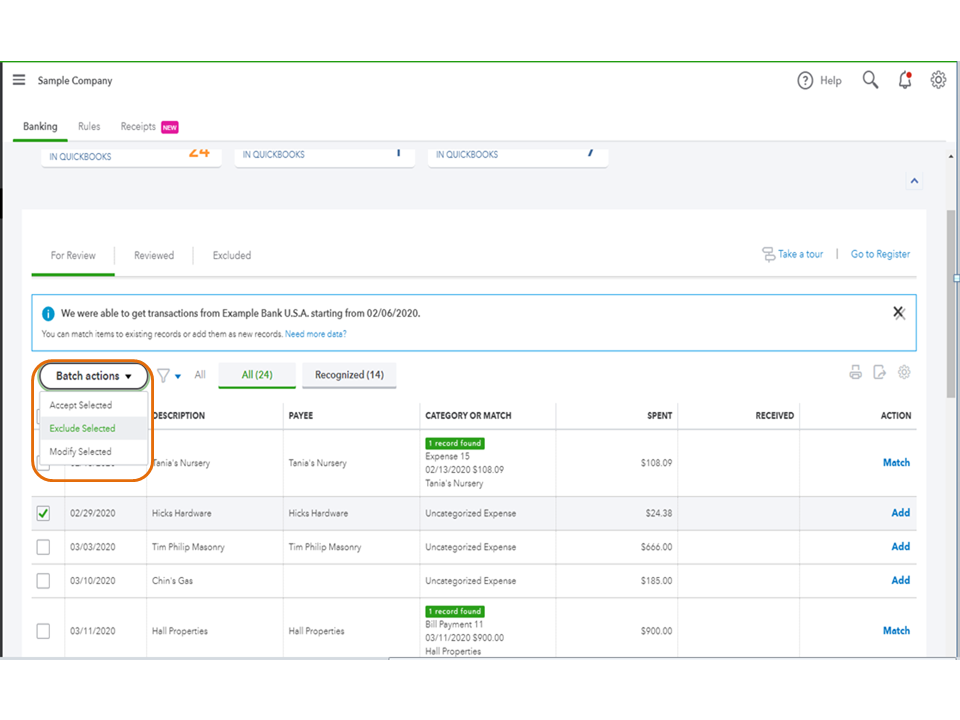

Since the issue doesn’t match to any of the reasons mentioned above, I suggest you exclude the downloaded transaction. This way, you’ll no longer have to delete the expense.

Performing this action ensures the records are in tiptop shape. Removing an entry on the bank feeds can be done in just a couple of minutes.

Here’s how:

Let me share the Exclude expenses from downloaded bank transactions guide for more information. It outlines the steps on how to add previously-excluded data.

Additionally, this article provides an overview of how to easily match transactions. It includes some tips to avoid duplication of entries: QuickBooks Online’s Bank Feeds.

Let me know in the comment section below if you have any clarifications or questions. I’ll be right here to answer them for you. Have a good one.

I am having the same issue and while your solution is a viable workaround, it is clearly not ideal. Firstly, using one transaction or the other (rather than both) loses the detail of one or the other (the coding from the statement is lost if I exclude it, the detail from my expense (item detail, memo) if I delete the expense), not to mention the extra effort that is required to fiddle with this instead of clicking "match" (you can't exclude until you have verified during reconciliation that the item is exactly correct (dates, amounts, etc., then you have to go back out of the reconciliation, back into the banking to exclude, then back to reconciliation). This is tedious and a tremendous waste of time if you have lengthy statements. I am currently faced with at least 50% of my credit card transactions not matching to properly entered expenses.

Why does this happen (if the information is exactly the same)? It appears to be a bug in the software, as sometimes, if I manually enter the expense from the statement (to provide more detail for the expense), it will pop up to match, and sometimes it doesn't.

Each time a bug like this presents, if I have to go to support, I am spending between 2 and 3 HOURS explaining, showing through screen share, etc. for no resolution. I have wasted days in the last few months on this process, and rarely get any kind of solution. Is there a list of known bugs and/or a list of fixes planned, or even just a way to send a bug by email rather than having to go the live assistant route if you don't need an immediate answer?

The entire beauty of QB online is the bank/credit card feeds. This is the one source of truth your business can count on to show what transactions have occurred in your bank accounts. With that being said, let’s make sure the info coming thru the feeds are correct. What is probably the most important setting in QB is not turned on by default. Go to the bank feed page, over on the right hand side right above the first transaction in the feed you’ll see a settings gear, click on it. In that dropdown check the box next to Include Bank Memo and UN check the box right underneath it, something about having QB suggesting categorizations.

If you have already went thru the trouble of entering this expense in QB then you’ll see Match on the right. Just click Match and that clears your transaction. Sometimes there might be more than one possibility and it will show you the options. Don’t just blindly add transactions, check the memo field and always enter the payee in the payee field if you haven’t recorded the transaction yet. I’ve only seen one or two instances when a transaction should be excluded and your situation isn’t one of them.

Hope this helps!

Jen

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here