Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowMK. I took over the bookkeeping recently and found either partial or totally unpaid customer invoices from as far back as 2014. For example in the the Open Invoices I have the following:

6/6/2014 xyz Corp. $10,000.

This invoice was originally $40,000 but ony $30,000 was paid.

The accounts receivable as of 11/19/2020 are correct.

I simply want to clear our these remnants without affecting the financials.

Any toughts.

thanks,

mike

I can provide the steps to zero out the balance in 2014, devapatir.

You can consider writing it off as a bad debt to ensure your accounts receivable and net income is balance. Let me guide you through the steps on how to correct this:

Step 1: Add an expense account to track the bad debt

Step 2: Close out the unpaid invoices

Stay on top of your customers' open balances with the Accounts Receivable Aging Detail report. And, customize it to check your daily statement.

Let me know if you need additional information by commenting below. I'm always right here to help ensure your accounts are accurate.

Thanks MarylandT,

As I mentioned in my question, the AR balance as of today is exactly correct there are no excess amounts due. I just want to eliminate the invoices without any effect on the financials.

If I do what you say wil there be any changes in the P&L and Balance Sheet.

Thanks,

Michael

I appreciate the quick response, devapatir.

Yes, deleting an invoice will affect your Accounts Receivable and Balance Sheet. Instead, you'll want to void it then create a Journal Entry to offset the amount. This way, QuickBooks will keep the invoice number and list it in reports but changes the amounts to zero.

Before doing so, I suggest consulting your accountant to guide you with the correct debit and credit accounts to use.

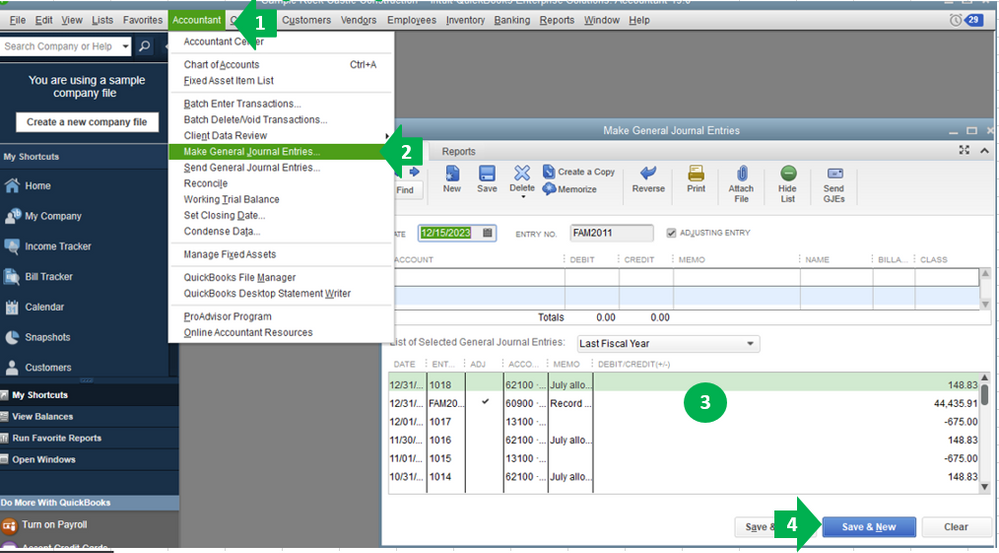

Here's how to create a journal entry:

Check out this article about Transaction Journal report in QuickBooks Desktop for additional information.

Please let me know if you have other concerns. I'm just around to help. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here