Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Good day @lindsay6,

Let me share a few information about your sales tax period.

In QuickBooks, the sales tax period is set to default from January to December every start of the calendar year.

In addition, your sales tax period won't show your actual fiscal year since we aren't on the said month yet.

With this, you can check and verify your sales tax period if it's showing your actual fiscal year. Just pull up your Sales Tax Liability report and choose a Report period to Last Fiscal Year.

Here's a screenshot for your visual reference.

I've attached an article might be handy for your future reference: Sales tax in QuickBooks Online.

I'll be always around to help you here in the Community if you have any other questions.

This does not answer the question as to how to record the payment. Please advise.

Thanks for getting back to us, Tawni.

With the Automated Sales Tax in QuickBooks Online, the Sales Tax Center is default to calendar year. We don't have the option to change the default yet.

What we can do is to change the month manually before paying the tax due. You can use this link for reference: File your sales tax return and record tax payment in QuickBooks Online.

Also, we'd appreciate your feedback by sending it through any of the articles mentioned above:

Our development team might be able to put it into consideration for product updates.

Feel fee to get back to us if you need anything else.

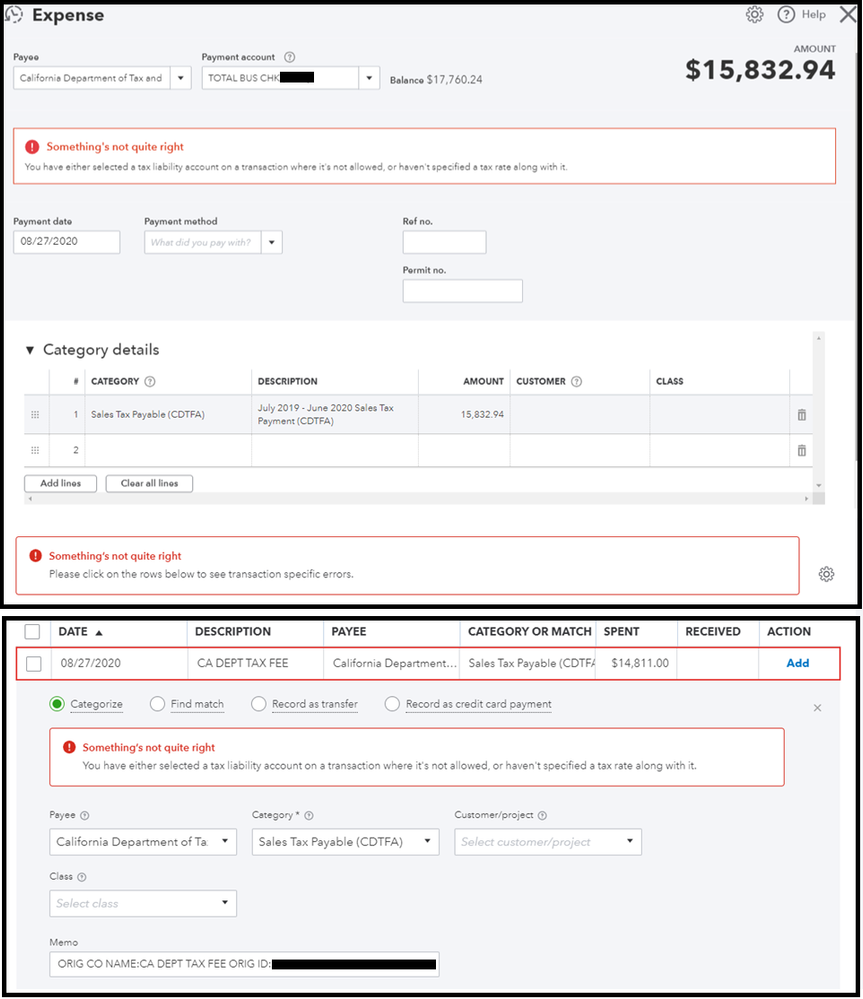

Hi James, thanks for your response. However the article provides incorrect instructions for a work-around. It states that you can simply change the month manually, but this is not correct, it does not let you change the month. In the example screenshots below, you can see it only allows me to go back as far as October 2019 even though my start date is 7/1/2018. The taxes for the annual period July 2018 - June 2019 have already been filed and paid, and I need to record the payment (manually made) for the period July 2019 - June 2020. But it does not allow me to.

This is an issue for many of our clients and it is extremely frustrating to say the least.

Thank you for the screenshots added, @Tawni.

As mentioned above, we can't edit the sales tax due date for automated sales tax. That said, you won't be able to select July 2018 as a starting date under the Sales Tax Due window. The good news is, you can record the payment as an expense type or transaction or as a check. I'll show you how.

To learn more about managing sales taxes in QuickBooks Online, feel free to read the details from these links:

In case you need related resources while working with QuickBooks in the future, you can also open the topics from our help articles.

You can always visit us here if you have any other concerns. I'm a post away to help. Take care!

Hi Angelyn,

Thanks for the response. The instructions you provided partially correct. There is only one way this type of payment can be recorded outside of using the Sales Tax tab, which is recording it as a Check. Even if it was paid via ACH, it can only be recorded as a check. As you can see in my screenshots below, payments cannot be added as Expense (via the +Plus icon), nor can they be categorized directly from the Bank Feed. I have updated your instructions below in the hopes of helping others who encounter this very frustrating issue, and hope that you pass on this feedback for the Instruction Articles to be updated.

To record a Sales Tax Deposit Payment manually:

The Sales Taxe system is still not working, and it's now July 2022.

For the price of QB online, you would think they could fix this in a couple of Years. Wow!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here