Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

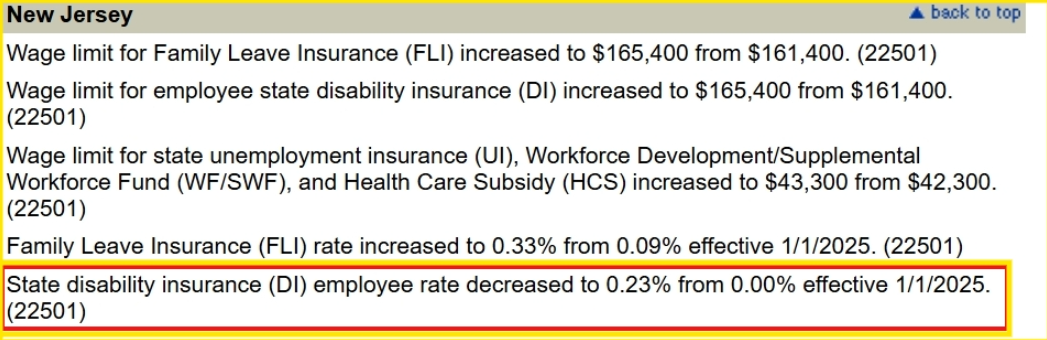

Buy nowI use qb's enterprise desktop professional services. I received an email from inutit to update the NJ employee disability insurance rate from 0.00% to 0.023%. However, when I went to update the rate in the payroll setup, qb's doesn't let me manually adjust the rate. It gives two pull down options - 0.00% or 0.23%. It will not allow to me to type 0.023%. The employee rate of 0.23% is too much. It is missing a 0.

Good day, Melinda. I'll provide some information of your concern.

The New Jersey State Disability Insurance (SDI) rates are automatically included in the QuickBooks tax tables. If you have received an email about this and have updated the tax table to the latest release (Payroll Update 22508), please ensure you select the correct SDI rate for New Jersey: either 0.00% or 0.23%.

Since there are no changes to the tax table for payroll update 22508, you can refer to the tax table changes outlined in payroll update 22506: QuickBooks - Tax Table Changes.

Additionally, you can visit New Jersey's state agency website to find the latest SDI tax rate: Access state agency websites for payroll.

Please let us know if you have any further question about State Disability Insurance in New Jersey.

Thank you for your reply but that is not correct. The QB's updates do not update tax rates (at least not for NJ). Qb's has 0.23% but the email states the amount should be 0.023%. Which is correct? Is the wrong rate listed in the email I received? See below a portion of the email received from Intuit Qb's.

We want to send out a reminder that for 2025 the New Jersey employee disability insurance rate increased from 0.00% to 0.023%. This rate isn't updated with tax table updates and you need apply it in QuickBooks, just like other unemployment insurance tax rates.

If you haven’t already done so, update the NJ employee disability insurance rate in QuickBooks for 2025.

Hi Melinda - I'm in NJ. The correct rate is 0.23%. Whatever you are looking at isn't right for some reason.

Kathy

Thank you for your reply Kathy. I am looking at an email I received from QuickBooks. I copied & pasted the email I received directly from them in my last reply. I appreciate your response. QuickBbooks should send a corrected email reflecting 0.23%.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here