Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello Community,

I'm helping a client clean up their books and have run into an issue I haven't experienced before and can use some help. I am working in QBO.

#1 - I have a vendor that has a credit on file for an over payment on a bill. This is in 2018, so I know I shouldn't make any changes to 2018. I wonder how I should handle in 2019? Should I just add a bill on 1/1/19 and apply the payment to it? What do you think?

# 2 - I have a vendor with a bill that was entered with the Account as Accounts Payable, and the payment is showing up as a credit on their account. I'm not sure how to clear this. It was in 2018 as well. How would I handle in 2019?

I appreciate any advice you can offer.

JL

Thanks for coming here, JL Harris.

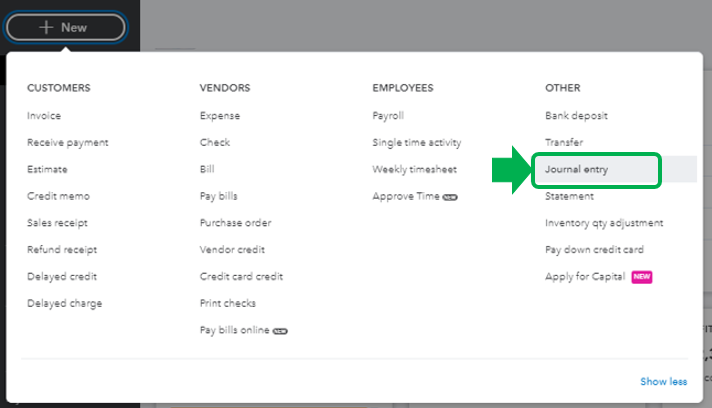

You're right. We can't make changes from previous years especially when the books are already closed. For those transaction dated in 2018, you can write up a journal entry to clear the account balances.

Before doing so, I recommend consulting an account to make sure the accounts used for debit and credit are accurate.

Here's how:

You can use this guide as your reference on how to create Journal Entries in QuickBooks Online.

Be sure to get back to me if you have additional questions, Take care and have a wonderful day ahead!

Hi Charies_M,

Thanks for taking the time to respond to me. I really appreciate it.

I know how to enter a journal entry, but choosing the account to credit on the vendors with over payments and open balances is now the challenge. What's the best way to determine which account to use to clear the overpayment and open balances?

For one of the vendors with a credit balance I entered the attached JE for $855 and saved and refreshed. The vendor still has a credit balance of $855. Why isn't the overpayment being zeroed out? I confirmed I am using the correct vendor name.

The same is true for a journal entry I entered for a vendor with an open balance of $599. I entered the JE, but the vendor still has a balance due.

I hope you can help. :)

Thanks for the clarification and the screenshot, @JL Harris.

You'll want to use Accounts Payable in creating a journal entry then apply it to the existing debit or credit. Doing so will clear the overpayment and open balances of your vendor. Let me guide you how.

In your QuickBooks Online (QBO):

Then, apply the journal entry to the existing debit or credit:

I'd also recommend getting in touch with your accountant for further guidance in recording this. This way, we'll ensure the accuracy of your books after recording this.

I'm also adding this article that can guide in reconciling your accounts accurately: Reconcile an account in QuickBooks Online.

Do get back to me if there's anything else you need help with your QBO account. I'm more than happy to work with you. Have a great day!

Hello @JasroV .

Thanks for jumping in. I entered a JE as you suggested, but I don't see it showing up as a credit. What are your thought on this?

By the way, the way I entered the journal entry doubled the open invoice on the vendor profile, so i reversed it and it zeroed it out, but now I don't see it in the Pay Bills window. The vendor profile shows $0 for open invoices and $2,075.72 in open invoices. Before the journal entry it was $2,075.72 in both Open and Overdue invoices.

Thanks for actively responding, @JL Harris. I've read the entire conversation to make sure I'm getting what you want to achieve with your QuickBooks Online (QBO) account.

I also appreciate you for trying the steps provided by my peer @JasroV. That's right, the correct process is to reverse the journal entry to zero out the open invoices.

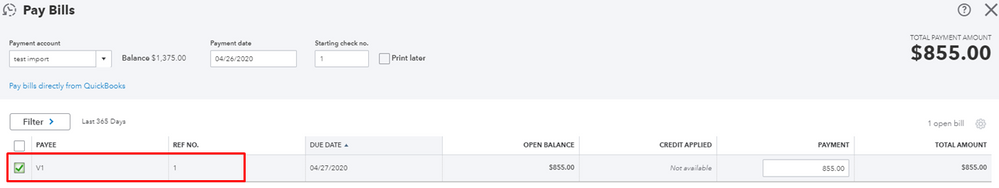

To resolve the issue, let's now proceed to the next step which is to apply payment in accounts payable so it will be linked to the bill. Here's how:

For more information and future reference, check out this article: Resolve A/R or A/P balances on a cash basis Balance Sheet. It also includes steps to review Transaction Reports to help you identify the cause of the balance and decide what step is required to take to resolve the issue.

Feel free to message again if you have other questions. We're always here to help you some more.

Hello @Charies_M @JasroV @katherinejoyceO ,

Thank you all for your assistance! I was able to resolve it before @katherinejoyceO responded. What I did was add a journal entry then go to the Vendor profile, open the bill, and apply the payment (journal entry).

I cannot wait to take the Intuit QB Online training in June!

Thanks again!!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here