Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a small business. I pay many of my accounts payable using my airline credit card. There are times that the business does not have the cash flow to pay off the credit card. To avert interest charges, I pay off the credit card with personal funds. I didn't process this correctly and need to know how to fix it. Many of these accounts payables are from 2022.

My problem is that these bills are still hanging in accounts payable even though they have been paid, and I have not been paid back. So I need to move them to the loan to officer account. But, I need to close the account payable entry and have it added to the loan account. I have researched you tube and their solutions to put it into account discrepancies doesn't work because then I can't add it to loan to officer. When I add to loan to officer acct it leaves the account payable open because it is saying the vendor has not been paid, when they in reality have.

Does anyone know how to close the accounts payable, have the money in loan to officer account, and get rid of the journal entries? I hope this makes sense.

Your small business is important and we want to help you how to handle your bills effectively, NW5.

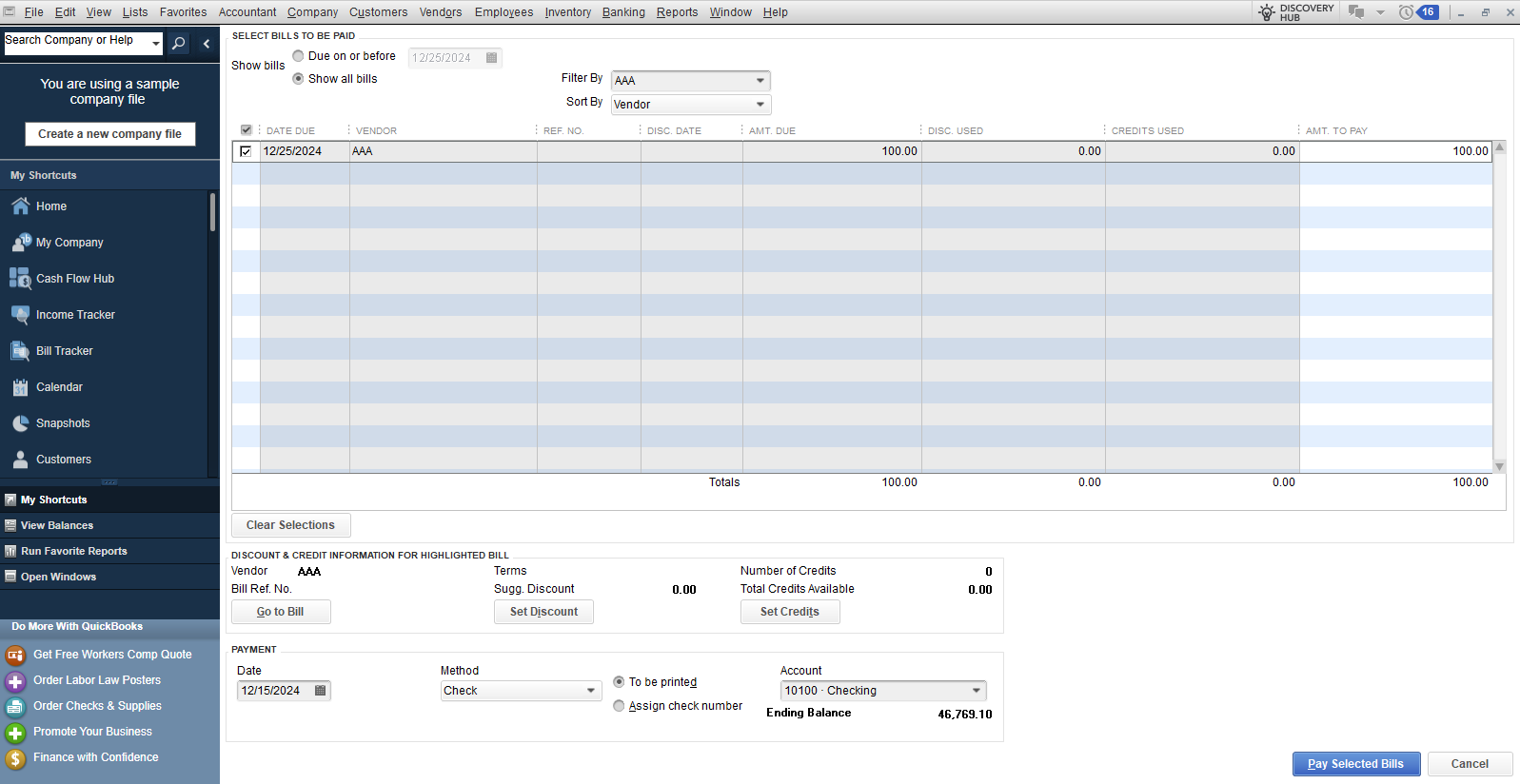

Before doing so, can I ask where you record the payment? I'd be grateful if you send some screenshots for me to be able to guide you with an accurate response.

If you're paying a bill using a personal credit card, you can enter a journal entry debiting Accounts Payable and credit the liability account you used to track the amounts owed by the company.

Once the company reimbursed you, simply write a check affecting the liability accounts you used to track for the personal credit card.

On the other hand, it's best to seek guidance from an accountant who can provide you with advice to have the money in a loan to an officer account and help you to get rid of the journal entries. If you don't have an accountant, I can help you find a QuickBooks ProAdvisor.

For your future reference, we prepared this helpful guide for you to learn how to customize your vendor reports and adjust them to your desired preferences: Personalize vendor reports in QuickBooks Desktop.

Every business counts whether big or small and we ensure we're providing accurate assistance in any way we can. Comment down below if you require further help, and I'll lend a hand right away.

"Does anyone know how to close the accounts payable, have the money in loan to officer account, and get rid of the journal entries? I hope this makes sense."

My answer assumes you're on accrual basis and you didn't make any entries in QB that reflect the payments made on the credit card from your personal bank account. If either of those are not true, let me know.

There's no need to use journal entries for this and you should avoid them. The best way to do this is to create vendor credits (Vendors > Enter Bills > click 'Credit' radio button) for all of the outstanding bills. Date the credits in 2024 (you don't want to affect closed periods) and select the Loan to Officer liability account on the Expense tab (set one up if you don't have one). Then, pay the bills with those credits. That will close the bills and you will have a corresponding amount in your Loan to Officer liability account. When you reimburse yourself, assign the Loan to Officer liability account to the payment/check entry.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here