Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I recently had to use my personal credit card to buy equipment for my business, and would like the business to reimburse me, but cannot afford to pay it all back at once so I will incur interest charges on my personal credit card. would like to know how to record the purchase with adding the equipment as an asset. and how to repay myself over time with the interest. Here is a breakdown. Found lots of information for QuickBooks online, but not QuickBooks desktop

1. I Purchased a piece of business equipment for $6100.00 with personal credit card at 16.99 APR

2. How to repay myself with the interest for purchase. will probably take me 2 years.

Glad to see you here in the Community, @james4223. I'm happy to address your concern about managing your business transactions in QuickBooks Desktop.

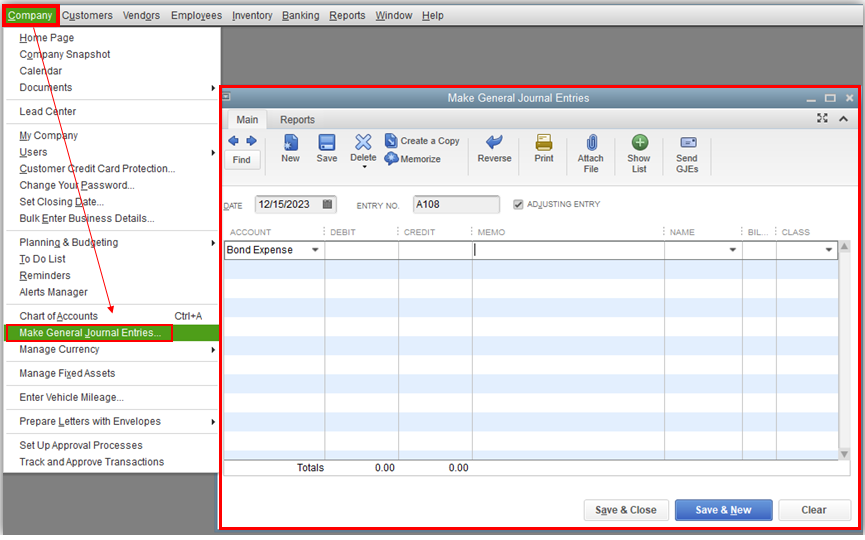

First, you’ll want create a Journal Entry that will debit the expense account and credit the equity account. Let me guide you on how:

Then, you can reimburse it as a check if you’ve decided to compensate the money. Here’s how:

Also. I'd recommend reaching out to your accountant. They can give you the best advice about this process.

Here’s an article you can refer to for more details about this process: Create a journal entry in QuickBooks Desktop.

Additionally, here are some helpful resources that you may find in handy along the way in managing your business needs:

I’m always ready to assist you if you have any other questions or concerns about managing accounts and transactions in managing your business. Tag me in your reply and I’ll sprint back into action. Have a good one and keep safe.

Thank you so much for your time and information Carneil_C that does help, but 2 points I am still unclear of.

1. The piece of equipment I am purchasing how do I attach the purchase of it and enter it as an fixed asset that I am paying for in QuickBooks. That way the transaction is connected to the purchase.

2. Since my company does not make a lot of profit and it will take me 2 years to pay myself back for the machine. How do I account for the additional interest that I will be paying for in the meantime. Probably paying myself back at about 150 a month. Do I just journal each payment in and calcualte interest on each payment time and split the transaction?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here