I'll ensure you'll be able to log all of these transactions, LaG1121.

Generally speaking, keeping business and personal expenditures separate is good practice. While it is not advisable to combine them, there are times that you'll encounter situations that will require you to do so.

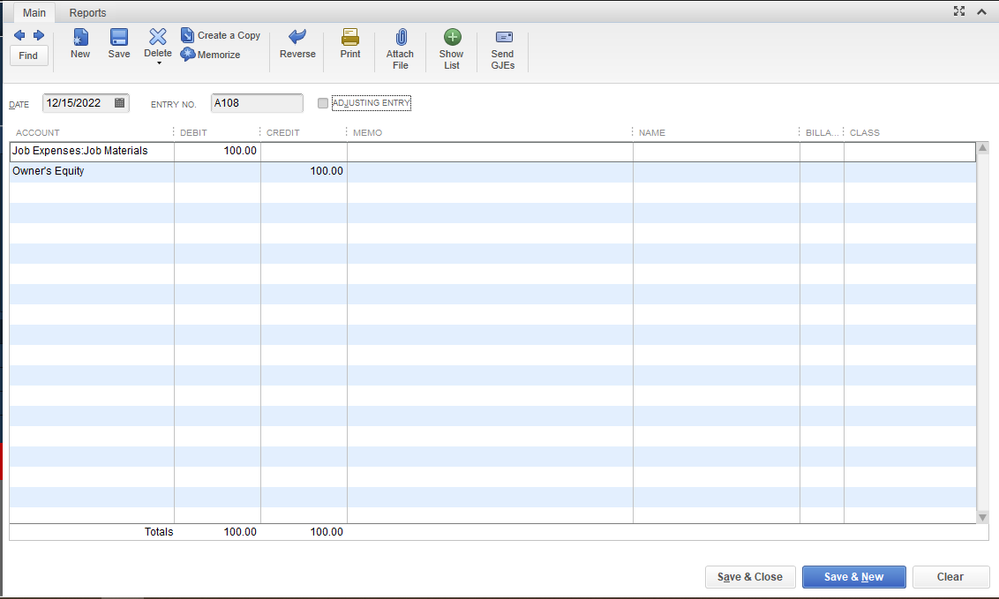

To record the purchase for the company you made with personal funds, you'll have to create a journal entry affecting Owner's/Partner's equity. This category represents the credit card you use for the expense. Here's how:

- Go to the Company menu.

- Choose Make General Journal Entries.

- Set the transaction date and select the expense account for the purchase on the first line.

- Enter the purchase amount in the Debits column.

- On the second line, choose Partner's equity or Owner's equity.

- Enter the same purchase amount in the Credits column.

- Add a memo as needed, then click Save and close.

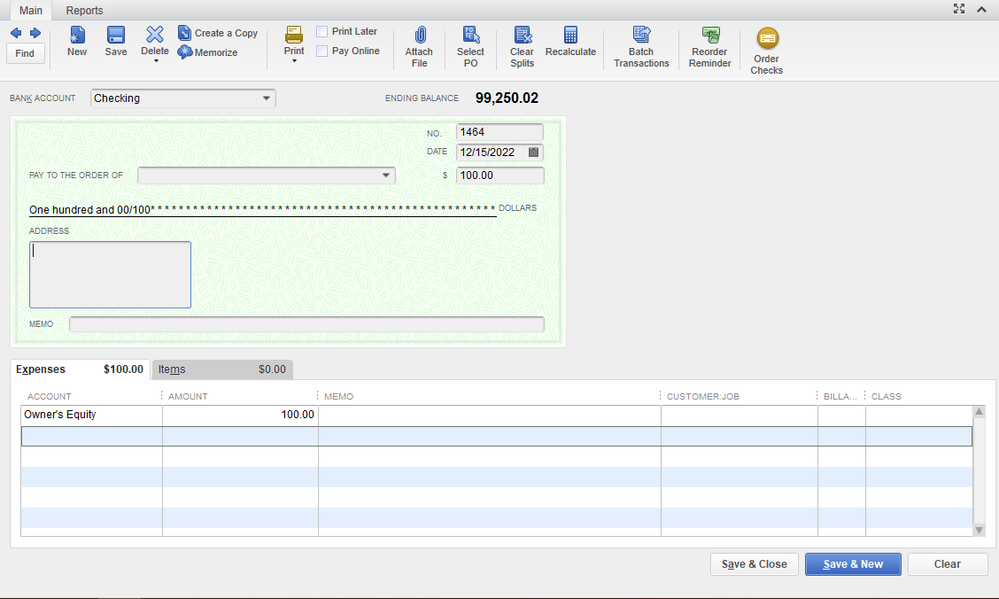

After that, you're now ready to enter the reimbursements from the business as checks:

- Head to the Banking menu.

- Choose Write Checks.

- Select the business bank account to use to refund.

- In the Category or Account column, choose Partner's equity or Owner's equity.

- Enter the amount, then tap Save and close.

I'm also adding this article to learn how to keep track of the charges and payments you made to maintain accurate financial reports: Set up, use, and pay credit card accounts.

Please feel free to get back to me here if you require further clarification regarding this topic. It's always my pleasure to assist you in managing your books. Thanks for dropping in, and cheers for more success!