Hello there, @calicoellie.

I'm here to help ensure you're able to pay your vendor with the fee deducted from their commission.

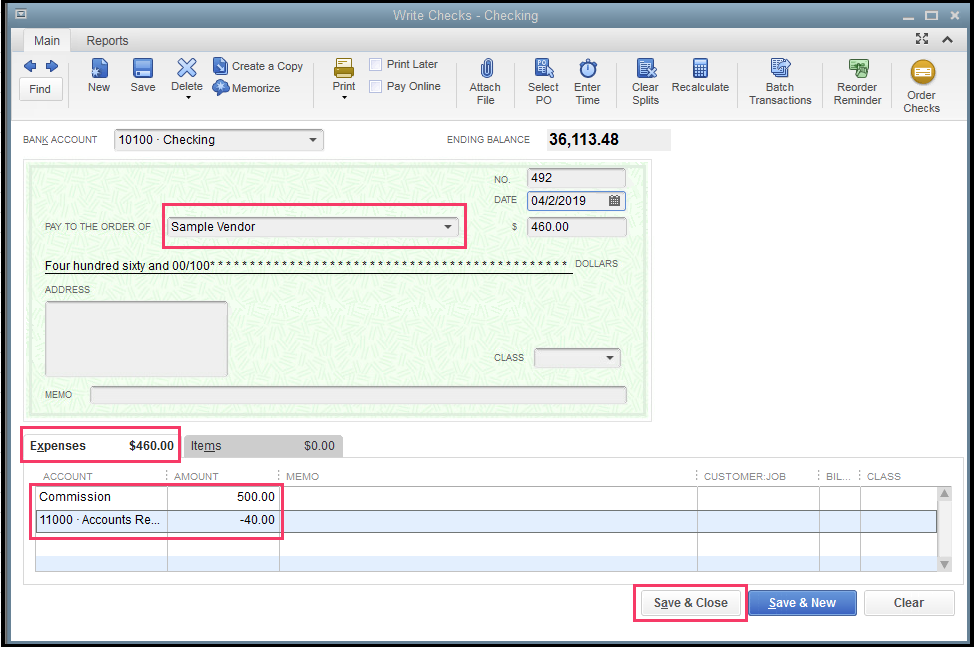

You can write a check for the commission expense, then create another line for the fee with a negative amount. QuickBooks automatically provides you with the net amount in the transaction.

Let me guide you through on how to accomplish this:

- Click the Banking menu, then select Write checks.

- Select the vendor and complete other details.

- Click the Expenses tab.

- Select the expense account for the commission, then enter the gross amount.

- Select the receivable account for the fee, then enter the negative amount.

- Click Save & Close.

To be accurate with your 1099, you only need to map the commission expense.

You can also read through this article for additional information about writing a check: Create, modify, and print checks.

That will answer your concern for today about handling commissions and fees in QuickBooks Desktop.

Let me know if there's anything else I can help with your QuickBooks. Just drop me line and I'll get back to you.