Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI entered items in a purchase order.Vendor requires payment when they ship. Now that I am receiving the items, it defaults to creating a bill, but the items were paid for already????? I'm not sure how to handle this. Thanks for any help.

I got you covered, @shining sea.

Here are the steps you can perform to record the payment for the prepaid inventory. You can write a check to the vendor and record it in your Accounts Payable (A/P) account, reducing the balance until you're ready to enter the final bill.

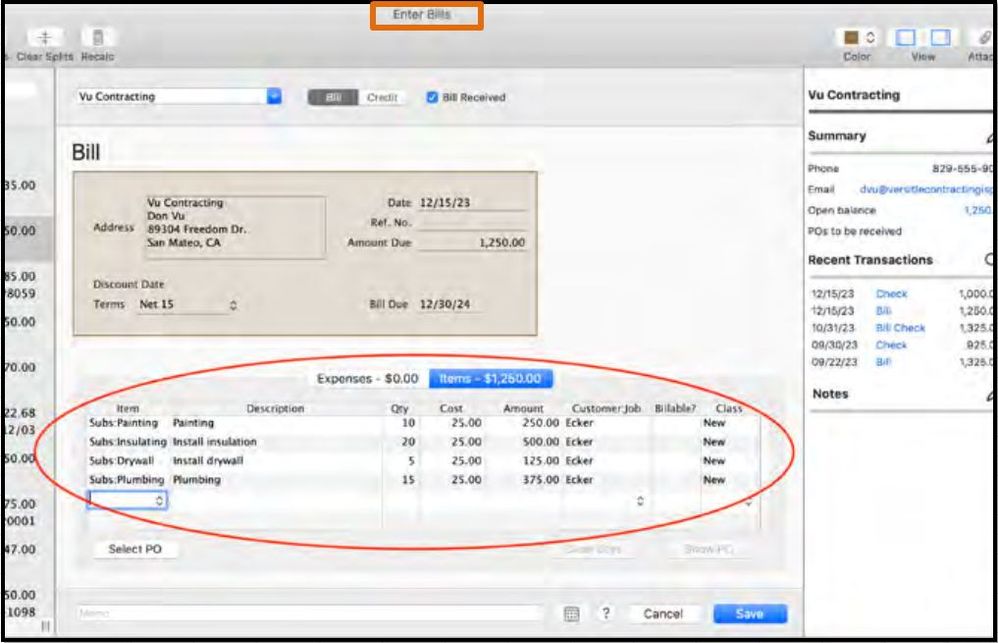

Next, is to enter the bill:

Then, apply the prepayment to the bill. Here's how:

For more details, please refer to this article: Record vendor prepayments or deposits for prepaid parts or services.

I've also added this helpful source, so you can browse topics that can help you with your QuickBooks tasks. To get started head to the QuickBooks for Mac user's guide.

Let me know if you have further questions in recording your prepaid inventories in QuickBooks. I'm always here to help. Have a good one.

Thanks Divina for the quick and detailed reply. I will try it today, but I don't see any reason why it shouldn't work. I'll reply again when I get finished. Thanks much!

It's great to see you were able to get the assistance you needed here in the Community, shining sea. That's what this space is all about!

If you ever get stuck again in the future, I recommend checking out the Desktop for Mac page for some helpful info.

You're always welcome here of course as well. Myself and the rest of the Community have your back.

Having trouble...I go to receive inventory (only some items from a PO, not the entire PO was received). When I choose the PO to apply the receipt to, when I go to save I get an error that the transaction is not in balance and it does not receive the inventory. HELP!!! Thank you!

Let's try running some steps to isolate the issue, shining sea.

We can fix this by running the verify and rebuild tools to find the most common data issues in a company file. Let me guide you how:

If you see, Your data has failed the integrity check, you'll have to rebuild the file. You can do that by clicking Rebuild Data under Utilities on the File menu. Then, continue with the prompts to successfully rebuild the program.

I've also added this reference as your guide in creating purchase order: Create a purchase order in QuickBooks Desktop for Mac.

Let me know how these steps work on your end. Keep safe!

Per your recommendation I: Went through the Verify Data process.. It found errors. Then I did the Rebuild Data process, no problem. Rechecked Verify Data and no errors. Went back to Receive Inventory, entered the quantity received, verified the prices were accurate, chose the PO to receive against, verified that the total $ of the items in the detail area matched the total at the top, and STILL get the error. I'm stumped. Thanks for any help.

Thanks for keeping us updated what happened after verifying and rebuilding your data, shining sea.

I've read the responses in the thread and it looks like all possible troubleshooting steps have been shared with you. In this case, I'd recommend reaching out o our Chat Support Team. They can take a closer look at this to check why you're getting the error and sort this out as well.

Here's how:

Please take note that the chat support line is open every Monday to Friday, from 6 AM to 6 PM (PDT).

I'd also like to share these articles about tracking inventories for additional reference and guidance:

Don't hesitate to reach out to us again if you need more help while working in QuickBooks.

I am trying to do this in QuickBooks Online and there is no "Set Credit" button. Any idea how to tackle this in QBO?

You can count on me to help you accomplish this task in QuickBooks, @mking716.

The steps that were shared above are only intended for QuickBooks Desktop (QBDT). That's why the 'Set Credits' radio button isn't visible in QuickBooks Online (QBO). However, we can still use a similar process to record vendor prepayments in QBO. I'll show you how:

First, create a check for the vendor.

Then, create a bill. Simply, select +New and click Bill. Fill in the necessary information and select Save & Close. For the final steps, apply the prepayment to a bill.

Here's how:

Unlike QuickBooks Desktop, the credits automatically applied to the bill in QBO. You'll have the option to edit its amount if necessary. Simply click the CREDIT APPLIED box and enter the amount.

If you require further assistance with vendor-related topics, please feel free to visit our Expenses and vendors page for additional guidance.

Please feel free to reach out to me anytime if you require further assistance with QuickBooks Online. My goal is to ensure that you always achieve your desired outcomes in your bookkeeping. Take care and stay safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here