Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

is there a way to find out what payment receiving transaction is opened and consequently not leaving a 0 ending balance?

Yes, there is a way to view these payment receiving transactions, kaka8.

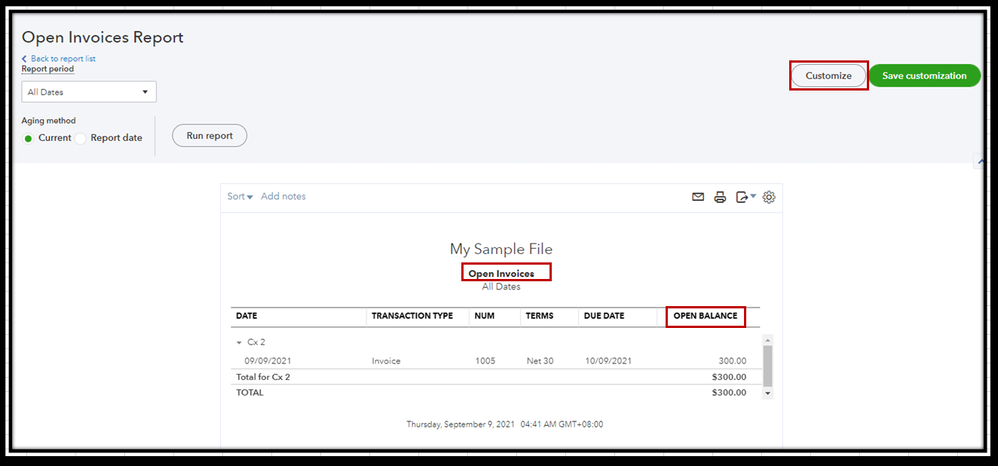

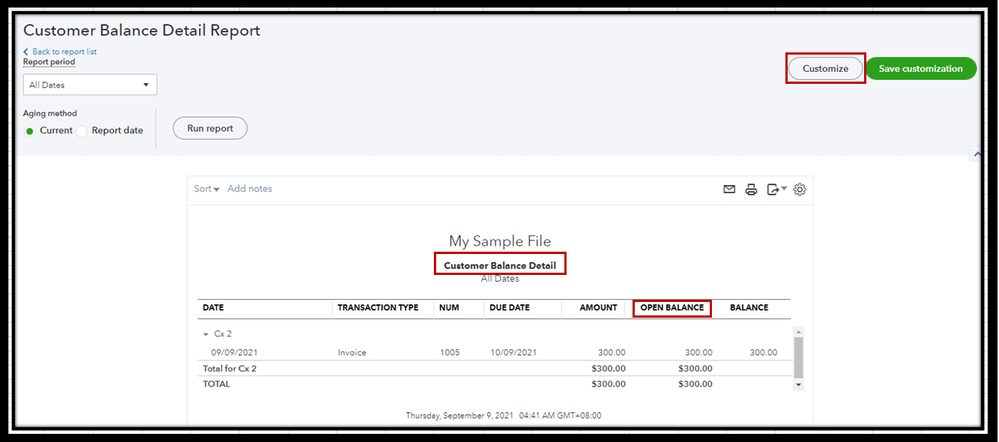

Let's run the Open Invoice or Customer Balance Detail report. This helps us view the unpaid or open sales transactions in QuickBooks Online. I'll show you how.

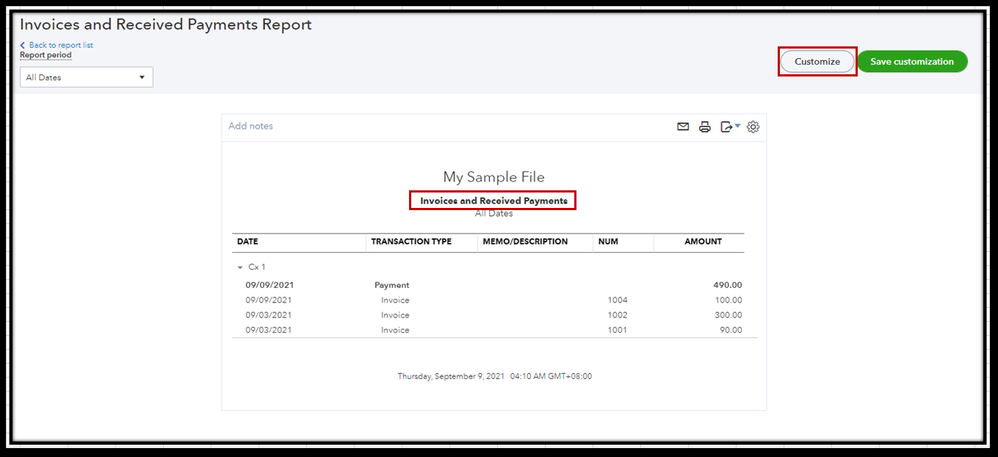

I'd also suggest running the Invoices & Received Payments report. This way, we'll be able to see the payments received transactions.

Here's how:

For more details about personalizing reports, please this article: Customize reports in QuickBooks Online.

If the invoices show unpaid, you can record the payments. Then, deposit the fund to the correct account to ensure your books are accurate.

I'm only a few clicks away if you need assistance managing and recording your customer transactions, kaka8. It's always my pleasure to help you out again.

Hi kaka8,

Hope you’re doing great. I wanted to see how everything about viewing the payment receiving transactions in QuickBooks Online. Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here