Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe invoice all our customers monthly. When I generate a profit & loss report, it shows all the invoices as income. How can I get a report showing actual income? Thanks

Solved! Go to Solution.

The invoices are income. Actual income.

If you don't want to see your AP expenses or your AR income until each are paid, switch the basis to cash basis in the P&L.

The invoices are income. Actual income.

If you don't want to see your AP expenses or your AR income until each are paid, switch the basis to cash basis in the P&L.

And don't overlook your Sales reports. Example: Reports menu > Sales, Sales by Customer Summary, Columns by Item Type, set for Cash Basis.

Actual income is usually the same amount you bill to customers, just timing differences usually.

Is "Sale by Customer Summary" a more accurate way of looking up income for the year? Because the total income on the "Profit & Loss" report is different then "Sale by Customer Summary"

Ultimately Sales/Revenue/Income = Amounts Billed/Paid by Customers, agree?

The difference between reports is usually a matter of timing and how you run reports.

For example,

P&L run on a cash-basis will only include revenue where you have already received cash.

Accrual-basis would include revenue that you have billed to customers who have not paid yet.

Sales by Customer Summary should match one of those P&L's, so you can see the differences.

RE: Ultimately Sales/Revenue/Income = Amounts Billed/Paid by Customers, agree?

No. Sales and income are not the same thing. Similarly Bills and expenses are not the same thing.

Income includes things like Interest income, deposits for things other than sales, and so on - where many of these things are either not sales or not usually tracked as sales in QB.

Expenses include things like depreciation, petty cash, credit card charges and so on - none of which are usually tracked using Bills.

Is there a report in Quickbooks for total money received? (I don't want this report to minus discounts or sales tax) I just want a report for all checks received with no deductions.

Total money received is the Cash that you received so would be after discount since that is what you received (if you offered discounts). Sales tax would be added to amount if you bill for sales tax.

Good day, @Vitan.

I can help you run a report that shows the total money receive including the discounts and sales tax.

That should do it. Keep me posted if there's anything else you need about reports. Just mention my name or add a message below. Have a good one.

This is wonderful and exactly what I need, except for the fact that I switched to Online Quickbooks at the beginning of last year. Having a bit of a hard time with it. Seems completely different than the Desktop Version. Is this sort of report available in the Online Version? Can't seem to find it.

Thanks for the prompt response, @Vitan.

Allow me to join the conversation and help you pull up a report that would show the total money received in QuickBooks Online.

From the All Sales tab, you have the option to filter the data by Money received and print the list or export it to Excel. Here’s how:

1. Go to Sales from the left navigation and select All Sales.

2. Click the Filter drop-down and choose Money received as the Type.

3. Select Status, Date, and Customer, then click Apply.

4. Once done, click the Export icon to export it to Excel or the Print icon to print the list.

These steps should get you the data you need. Please update me on how it goes. If you have additional questions, leave a reply below. I’ll be more than happy to help. Have a great day!

RE: Allow me to join the conversation and help you pull up a report that would show the total money received in QuickBooks Online.

Except your report doesn't do that. It does not include money received in deposits, Journals that act like deposits, and any number of other transactions that are excluded from Sales reports.

BRC - It is considered not best practice to not use proper accounting journals to get best results on any system. Meaning not using JE's for Deposits when there is a function for Deposits that ties to other proper Journals like Revenue, AR and Cash Receipts where one would expect cash entries. Deposits are not Revenue until they are connected to a customer invoice for a legitimate "sale." Sales Reports show Sales, not journal entries or random bank deposits with no customer invoice.

In my P&L I also see invoices that have been paid when I run it on a cash basis. We don't have sales so I usually just psudo invoice, pay the invoice and most of the time when I run a P&L it's showing the income on my bank statements (that's how I check the income). However, when I run last years P&L several invoices are showing in there with a duplicate amount as the deposit. I deleted those without any problem or un-reconciling my months but there are invoices showing in there that are actually mistakes but no way to delete these without screwing up my reconciliation for the year. This is crazy, how do I get them out of my P&L because they are showing income and they were never received....running cash basis only.

The answer is NO and it's a problem for me also. We do not have "sales of items" but are a consulting firm so we are paid when we invoice customers but the P&L always shows other income that you have to go in and delete. it's never correct and it's very frustrating to my boss who doesn't understand that every refund and every wird income is put into that category. Ultimately in the Chart of Accounts I set up an account for payments to the invoices only that way it comes out in the report as an "income account" and I know that's correct but it still gets watered down by the screwy way QB records invoices. Always go over every line of the income on your reports to correct.

Thanks for sharing the details with us, @Carolexx.

The Profit and Loss reports are the distributions of all income and expense accounts. It'll show the income account associated with the product used in the invoice.

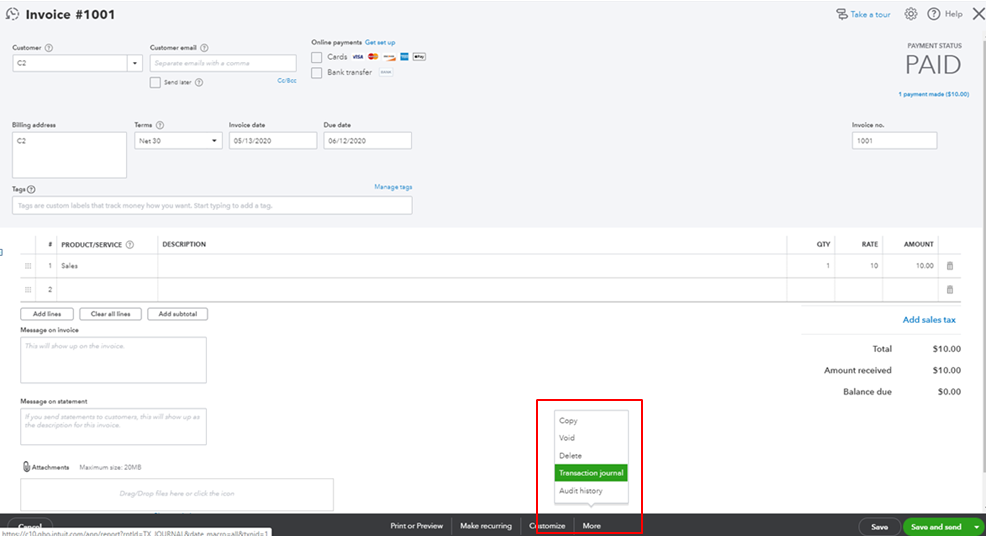

Running the report in a cash basis shows invoices that are paid. You'll want to open the Transaction Journal report of the transaction to review it. Here's how.

I also recommend getting in touch with your accountant to further assist you with this. This way, we'll ensure the accuracy of your books after making some changes.

I'm also adding this article that can guide you in customizing your reports and shows the data you need: Customize reports in QuickBooks Online.

Let me know if there's anything else you need help with. I'm always here to assist you. Keep safe!

@Carolexx

Every business has "sales." Most call this "revenue." QB calls this "income." All is money from customers.

Some companies sell products and many only sell services. Services are hours worked = labor dollars.

You are right that the sum of money coming IN on bank statement is the total amount of Cash you received.

This should match the total Debits (increases) to your Cash account (account is oddly called "Bank" in QB).

This is made up of one or more of the following:

1) Revenue from customers (QB calls it "Income"). This is normally first account or accounts on P&L.

2) Other Income (Usually a separate account or accounts at the bottom of P&L) that may include:

2a) Interest Income (Such as earned on investments or bank account).

2b) Refunds from vendors (Such as for returned items or overpayments).

2c) Refunds from tax agencies (Such as for overpayments made in error).

2d) Proceeds from Sale of Fixed Assets (May be a gain or loss).

It is important to split these amounts between category 1 and 2.

#1 - Should have customer invoices on AR Aging pending customer payment receipt

#2 - Would not have customer invoices and may need to be moved to another account

If you see duplicate amounts for customer invoices, you may have posted duplicate invoice or payment.

If you are creating fake invoices, you could be doubling invoice amounts and/or posting duplicate payments.

@Carolexx wrote:In my P&L I also see invoices that have been paid when I run it on a cash basis. We don't have sales so I usually just psudo invoice, pay the invoice and most of the time when I run a P&L it's showing the income on my bank statements (that's how I check the income). However, when I run last years P&L several invoices are showing in there with a duplicate amount as the deposit. I deleted those without any problem or un-reconciling my months but there are invoices showing in there that are actually mistakes but no way to delete these without screwing up my reconciliation for the year. This is crazy, how do I get them out of my P&L because they are showing income and they were never received....running cash basis only.

@Anonymous -

Agree, was trying to keep simple for user to clarify the terminology differences, just splitting between money coming in vs. going out. Expanded reply below since it is categories and terminology causing confusion.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here