Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI know all about the steps to enter a vendor refund (enter a deposit, create a credit memo, link the two in the Pay Bills window). But how do I PHYSICALLY get the check to the bank?

Following the above steps -- which are the procedures I've ever found online - only zeroes out the two transactions. It doesn't physically put that refund check on a deposit slip for me to take to the bank.

How do I print a deposit with the check included so I can cash the refund check?

I appreciate you sharing your concerns regarding the refund vendor check, AmericanRV.

I'm here to provide insights into how QuickBooks handles this.

QuickBooks is a powerful tool for accurately recording and tracking business transactions purposes only, ensuring the integrity of your accounting data.

Concerning printing a deposit, QuickBooks doesn't provide the specific functionality to print deposit slips. You can handle the deposit process by manually submitting it to your bank.

I'm sharing this article that will guide you in recording refunds you received from a vendor: Record a vendor refund in QuickBooks Desktop.

Furthermore, I'm also adding this link to monitor the payments made to your vendors within a specific period: Customize vendor reports.

If you have any further questions or require assistance with any other QuickBooks task aside from vendor refunds, please don't hesitate to add them below. I'll be here to lend a hand.

@AmericanRV RE: But how do I PHYSICALLY get the check to the bank?

Same as any other deposit: Take the check to the bank and deposit it, either using the ATM or with a teller.

Not funny.

I don't think @BigRedConsulting was trying to be funny and I had the same thought when I read your post.

Your questions were:

"how do I PHYSICALLY get the check to the bank?" and "How do I print a deposit with the check included so I can cash the refund check?"

With all due respect, QB doesn't have any way to print a deposit slip and you need to make a bank deposit at your bank. Not sure what else you could be asking.

I wasn't trying to be funny.

The solution tells me how to receive the refund and zero it out in QuickBooks. But I'm standing here with a physical paper check in my hand. I guess what I need is to get it into undeposited funds so I can print a physical deposit slip to take the physical check to my bank and deposit it. The above method simply enters a $0 transaction. It doesn't give me an option to actually have it entered as a bank deposit.

With customers who pay by check I enter the payment against the invoice and put it into undeposited funds, then print a physical deposit slip, walk over to the bank and deposit it. Then I have the correct deposit (not a zero dollar deposit).

QuickBooks doesn't give me the option to put a vendor refund check into undeposited funds the way a customer payment does. I have a physical paper check, not a virtual one. So how do I accomplish that?

- Since you recorded a deposit in your bank account, I'd think you can print a deposit slip from the deposit. It doesn't matter if the thing you're depositing is from a vendor or a customer. What happens when you edit the deposit and click the Print | Deposit Slip from the top of the window?

- No matter what happens, there is no reason to print a deposit slip from QuickBooks. You can fill one out by hand at the bank, if they require it, or the teller will do it for you. Or, deposit the check into the bank's ATM.

"With customers who pay by check I enter the payment against the invoice and put it into undeposited funds, then print a physical deposit slip,"

I didn't know that you could print a deposit slip from QB. I was obviously wrong about that in my previous post. My apologies.

Really? Do you do manual deposit slips then? Well, now you know.

Let me see if I can state the issue more clearly.

But at this point I'm left with:

Thus my question: How do I get that physical check into my bank account so QB is accurate? Even if I have to hand-write the deposit slip, it still doesn't fix QB.

I can't find any method at all that lets me show my vendor gave me a credit and sent me a check that I then will deposit in my bank. To my it seems that instead of using the credit to pay a bill (resulting in a $0.00 payment auto-created by QB), there should be a step somewhere that I can put it in Undeposited Funds, and then deposit a PHYSICAL CHECK.

Am I taking crazy pills here?

“No matter what happens, there is no reason to print a deposit slip from QuickBooks. You can fill one out by hand at the bank, if they require it, or the teller will do it for you. Or, deposit the check into the bank's ATM.”

I don’t care whether I print it or fill it out by hand, that’s irrelevant. And I know how to make a deposit with a teller or an ATM (and fill out my own deposit slip). That’s not the point. The point is making QB match my credit to the paper check I’m holding in my hand right now. Just that. How do I get QB to create a link between the credit memo and the actual refund (paper) check? (As in, how to prevent the "QuickBooks generated zero amount transaction for bill payment stub" that it automatically does when you use a credit to pay a bill.)

“Since you recorded a deposit in your bank account, I'd think you can print a deposit slip from the deposit. It doesn't matter if the thing you're depositing is from a vendor or a customer. What happens when you edit the deposit and click the Print | Deposit Slip from the top of the window?”

A couple of things here:

Through all of this discussion I (think) I can narrow it down at least a little bit.

You can’t enter a check FROM a vendor, only checks TO a vendor, so I can’t bring in the Undeposited Funds account, which is where every other incoming funds are entered if it’s a paper check.

The purpose of a credit memo is to remove the returned item from my inventory and show that it’s been credited to me – so at that point my inventory is correct.

It’s how QB handles the remaining process that’s all twisted up.

If I enter a deposit for, let’s say, a $25.00 refund, and a corresponding credit memo for the $25.00 inventory item I returned, I have to link them in QB for my vendor and inventory numbers to be correct. But as soon as you link them through Pay Bills, you get a check for $0.00 and the message: “QuickBooks generated zero amount transaction for bill payment stub”.

That doesn't work. I need to show a REAL deposit for $25.00 from that vendor for that item. And obviously my checking account won’t balance if that $25.00 refund check comes up as $0.00.

In my mind there’s steps missing or too many steps taken in this process to make this happen correctly. Do away with the credit memo? It doesn’t get my inventory item out. Just throw the check in with my other deposits when I run them? It doesn’t show under my vendor. There’s no history to link the refund from my vendor to a deposit of a paper check.

I can’t believe it’s this difficult. Am I asking the wrong questions? Wrong terminology? QB is supposed to be able to handle the basic functions. I’m using QB 2024 Premier, not just the basic QB. I’d think this kind of thing would be built in. But if it’s not, I need a workaround.

Would using a pass-through account work in this situation? And if it would, what are the steps?

I'm at a loss as to what the problem is. You wrote that you recorded a deposit in your bank account in QuickBooks, listing the vendor name and amount and the AP account. If so, then you're done, as far as keeping records in QuickBooks to match your bank account.

Then you wrote how you applied the credit the deposit created to a bill. Then you're done as far as your AP account. You can ignore the 0.00 check some versions of QuickBooks create when you do this. I don't know why they do that.

Then deposit the check you're holding in your bank, which mirrors the deposit you created to start the process.

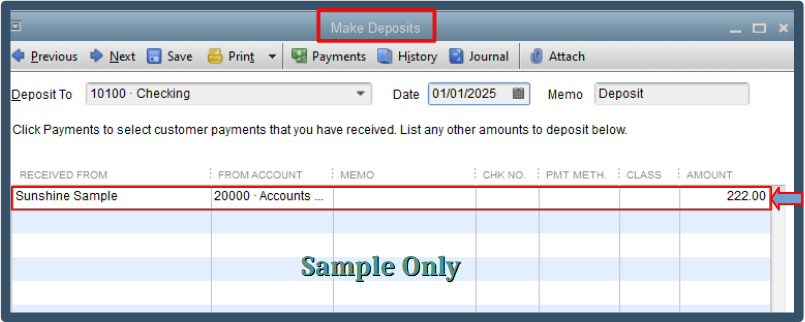

"2. I create a deposit, and leave the "Deposit To" as my default checking account. Rec'd from: Vendor name. From acct: Accts payable. Memo: A note on what it's for, Pmt Method: Check, amount, and save."

Stop right there. After this step, you're done as far as the deposit is concerned. Finished. Finito. Done like dinner. Moving on. Look at your bank register, you will see the deposit listed. You're getting tripped up by the credit memo and $0.00 check. The credit memo and the $0.00 check have nothing at all to do with the deposit. That is just how QB records the offsetting account (reason) for the deposit and gets it listed under the vendor' account.

You must not be the only one taking crazy pills, I must be also. I am so confused by this, because when I enter a deposit, it does not show up anywhere in my Pay Bills screen or my vendor transactions, it only shows up in reports.

This seems like such an antiquated and arduous process that it is surprising QB is still the most popular accounting software.

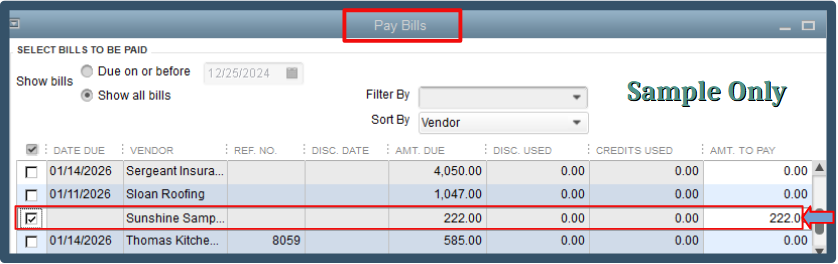

I know you want to keep your financial transactions well-organized. PWendt. The deposit will show in the Pay Bills screen if you've chosen Accounts Payable in the From Account column.

When you create the deposit for the vendor check, select Accounts Payable. This process ensures the refund is accounted for against the original bill or expense.

Once you've chosen the appropriate account, the deposit will be visible in the Pay Bills window. Please see the attached screenshot for visual reference.

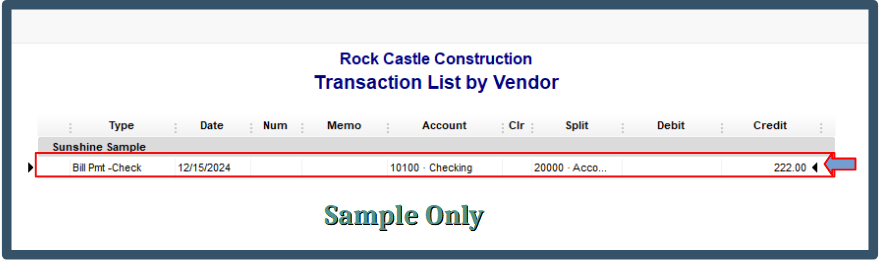

The deposit will also appear in vendor transactions and reports, such as the Transactions List by Vendor report. However, it will be displayed as a Bill Pmt-Check.

If you need further guidance in recording vendor refunds, here's an article you can visit: Record a vendor refund in QuickBooks Desktop.

For future reference, here are some articles for more insights about handling vendor credits in QuickBooks:

The information above should help clear up any confusion about the process of recording refunds and the visibility of deposits in QuickBooks. If you have any further questions or require additional support, we're still here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here