Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen an inventory item shows a negative asset value, it means you have not ordered it or not done that properly, or you have sold what you do not have in stock.

You order inventory using the expense form, click item details, select the item, enter the qty ordered and the cost (or use a bill). That is what stocks the item with qty and cost. The cost block you see on the item screen is just for your info, usually the last purchase price, it should not be used by the system but intuit has never fixed this bug.

You do have to turn on purchase orders and item details in company settings first.

Thanks very much for coming back to me -

We don't actually use every single feature of Quickbooks so some parts don't apply. I imagine this might be causing some of the problems?

What I don't understand is that comparing two items that both have the same fields populated (Sales price/ cost price/ stock levels) yet one is showing as a positive Asset Value and the other negative (even when both have a positive figure for stock). I also can't seem to figure out what calculation is being used to calculate Asset Value, as it doesn't seem to be any logical result of multiplying either the Cost or Sales price by the number in stock.

We really just want a simple way of seeing the total value of what we currently have in stock for any given product or brand - is there no way to do this without other things being factored in and skewing the results?

Hello, @sales193.

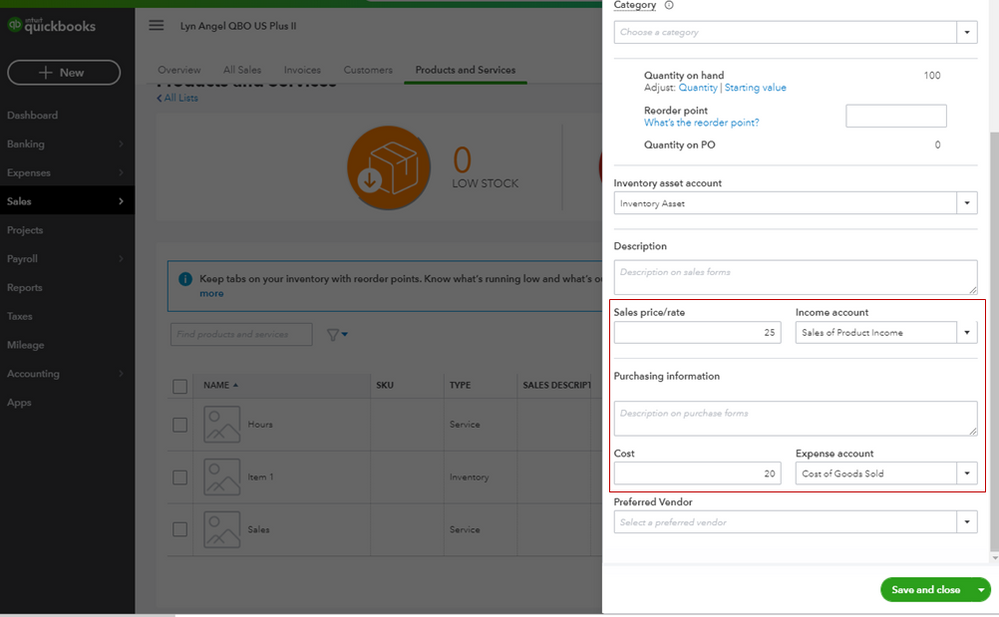

For now, I recommend reviewing your inventory or items that are added to your QuickBooks Online (QBO). Please check if the starting value is set up on your inventory. If only a starting quantity is added on an item without the sales price or cost price, this will cost a negative in an asset once you use them on the invoices.

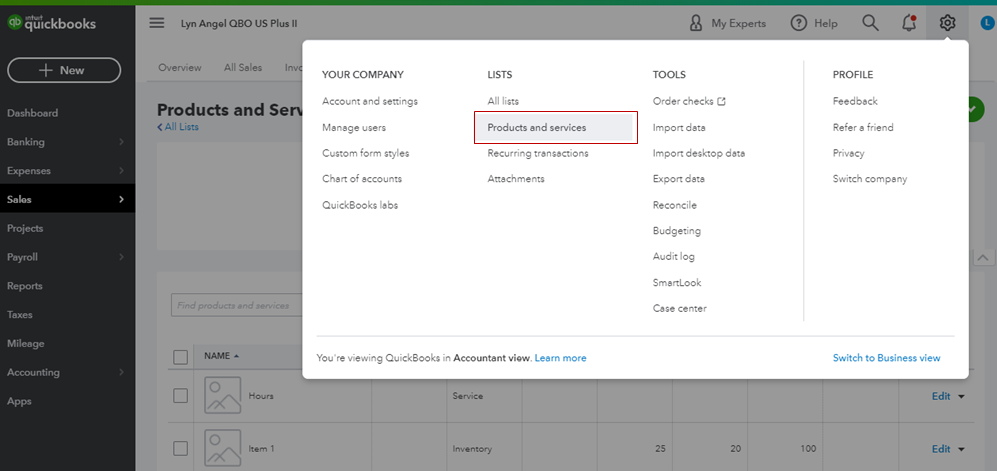

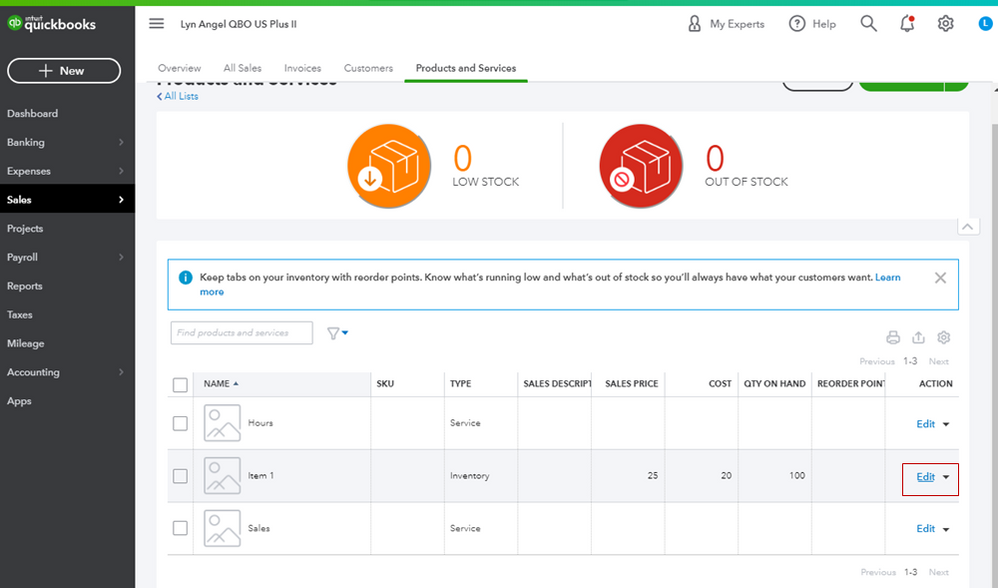

Here's how to review your products and services:

For additional references about managing inventory in QBO, check out these articles:

Feel free to leave a comment below if you have any other questions. I'm always here to help. Have a good day!

Hi,

Please see an example attached. We have stock of the item and the cost and sale prices have been set, however when we run the Stock Valuation Summary it shows up as a value of -2,457.

Do you know what is causing this? We generally haven't been setting starting values - is this something we can adjust after the fact without distorting other figures elsewhere?

All that pic shows is the item set up, that has nothing to do with asset value after it is created.

As I said, asset value comes from purchases. NOT from you entering the cost on the item screen.

Show us a pic of how you order the item?

We don't actually use Quickbooks for ordering at all - we primarily use it for stock management and invoice generation. Is this likely to be the cause of the problem? It feels as though this is being influenced by aspects of Quickbooks that we don't actually use.

What I'm finding odd is that some products seem to show a positive figure despite everything having been added in much the same manner. Is there no way we can run the report whilst omitting extra factors? We literally just want a simple report showing us each product and then cost or sale prices multiplied by inventory value.

@sales193 wrote:

We don't actually use Quickbooks for ordering at all - we primarily use it for stock management and invoice generation. Is this likely to be the cause of the problem? It feels as though this is being influenced by aspects of Quickbooks that we don't actually use.

What I'm finding odd is that some products seem to show a positive figure despite everything having been added in much the same manner. Is there no way we can run the report whilst omitting extra factors? We literally just want a simple report showing us each product and then cost or sale prices multiplied by inventory value.

Run the "Inventory Valuation Detail" report. Check the Inventory Starting Value transaction. And look for Start rate/cost. It should show what's causing this.

If needed, you can click the transaction and adjust the initial cost field.

Is the Inventory Valuation Detail the same as Stock Valuation Detail? I can't actually seem to find the former anywhere.

Looking at this I'm not sure what's determining the FIFO cost and asset value fields?

@sales193 wrote:

We don't actually use Quickbooks for ordering at all - we primarily use it for stock management and invoice generation. Is this likely to be the cause of the problem? It feels as though this is being influenced by aspects of Quickbooks that we don't actually use.

What I'm finding odd is that some products seem to show a positive figure despite everything having been added in much the same manner. Is there no way we can run the report whilst omitting extra factors? We literally just want a simple report showing us each product and then cost or sale prices multiplied by inventory value.

Yes that is the issue.

From what you say, some of the items were created with a cost, so QB uses that cost and cost * qty is asset value

when you do not set a cost at the creation of the item, then later enter a cost, qb uses that cost. BUT since there was zero value at the start, when you sell something it subtracts the item cost, that drives the asset value negative. This is a bug present in QB since 2006, maybe earlier.

For QB to work properly you have to enter a purchase of the item(s). That establishes the asset value, and when you sell the item QB then subtracts the item cost from the total item asset value as it should

Yes, as we were using QB in a very basic capacity to begin with most items weren't added with a cost initially and this was then added after the fact. Is there any way to retroactively enter a cost earlier on and would this get around the bug?

Do item purchases need to be added on a regular basis in order for it to work? Similarly would this solve the problem?

Given the circumstances I'm beginning to wonder if it might be simpler to just run/download a more basic report and then modify it in Excel to show what we need!

In desktop, and I assume in QBO, if you enter a purchase of the item, in the qty needed, then the erroneous cost posting will be recalculated.

Yes a purchase must be entered to establish item cost and for that cost to post to COGS when sold

Where can we add the purchases? Also, will this affect the quantities as well? Thus far we've just been manually entering stock as it arrives.

How can we add quantities to offset any negative stock values?

Negative inventory is caused when sales transactions are entered before the corresponding purchase transactions, sales193.

Following @Rustler's recommendation which is "if you enter a purchase of the item, in the qty needed, then the erroneous cost posting will be recalculated" helps offset any negative stock values.

You can create bills and expenses to add purchases and track your items. This will increase the item's quantity on hand if you'll make a purchase for the items. Then, decreases them if you'll sell some items.

Overall, make sure to record the sale of inventory of items after you have purchased them and entered the purchases in QuickBooks to prevent negative inventory

Other ways to fix negative inventory issues can also be found in this article: Fix Negative Inventory Issue In QuickBooks Online.

You can run inventory reports to track your inventory status: Use Reports To See Your Sales And Inventory Status.

Reach out to us if there's anything else that you want us to help with. We're here to assist you.

This is an interesting thread.

I have a Q;

So once you have identified Negative Asset Values on an item, how can you amend this?

There was a lot of discussion about why it is happening and how to avoid it, but how can you rectify an historic Negative Asset Value once it has occured?

In my case the negative asset value happened because I did a 'stock adjust' to add existing stock as we transitioned to a computerised system.

My START value was ZERO as was the COST. This was amended as the count was entered.

Thanks for checking in with us, yasbas.

I appreciate you for providing us with information about the cause of the negative asset value on your account. Here are also the possible reasons for negative inventory:

We can review your inventory or items that are added to your QuickBooks Online (QBO). Then, check if the starting value is set up on your inventory. It will cost a negative in an asset once you use them on the invoices if the starting quantity is added to an item without the sales price or cost price. Here's how to review your products and services:

For additional references about managing inventory in QBO, check out these articles:

You can always update us after performing the steps as I want to make sure this is resolved for you. Just reply to this post and I'll get back to you. Have a great day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here