Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHoping someone can help.

I pay per diems in cash to non-employees. For example, when I have a job with a client and a number of people travel, I pay per diems to clients and independent contractors which are all expensed back to the client.

How do I record these since the per diems are not being paid to employees?

Thank you

Solved! Go to Solution.

Hi, @cjd1111. I'll give you insights on how to record per diems in cash for non-employees in QuickBooks Online (QBO).

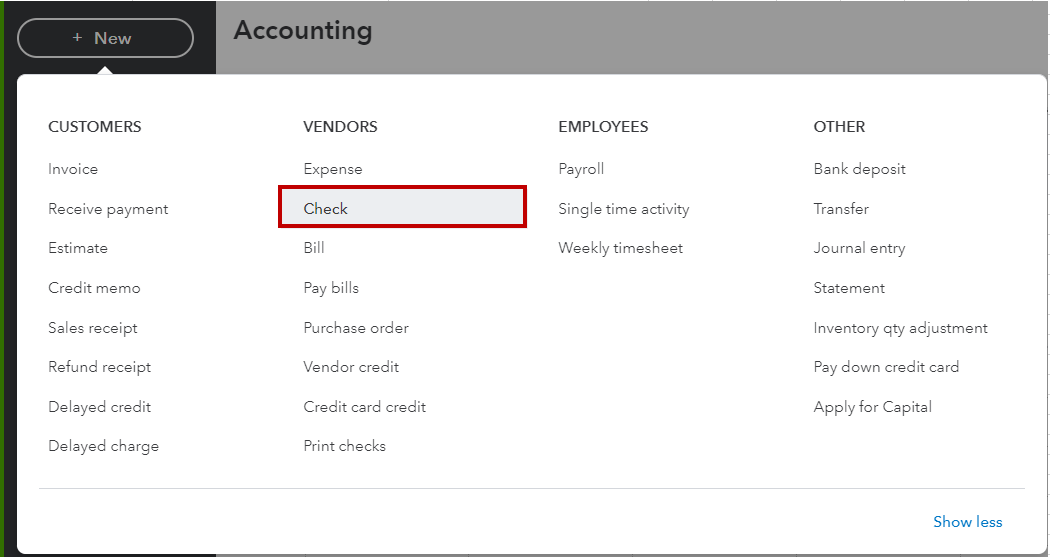

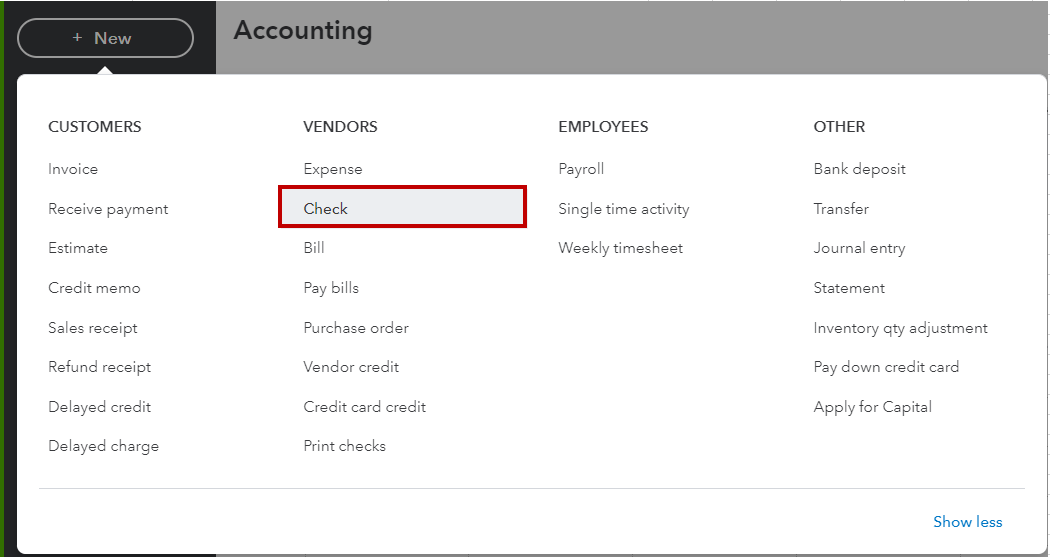

You can use a check or an expense transaction to issue per diem for clients and independent contractors. If you haven't yet, make sure to set your accounts from the Chart of Accounts to track your per diem entries accordingly.

Here's how:

After that, enter the check following these steps:

I'm also adding this article for more hints about the process: Create and record checks in QuickBooks Online.

On the other hand, here's how you can record, edit, and delete expenses in our system: Enter and manage expenses in QuickBooks Online.

Please know that you're always welcome to post again if you need anything else. I'm always here to help. Have a good one!

Hi, @cjd1111. I'll give you insights on how to record per diems in cash for non-employees in QuickBooks Online (QBO).

You can use a check or an expense transaction to issue per diem for clients and independent contractors. If you haven't yet, make sure to set your accounts from the Chart of Accounts to track your per diem entries accordingly.

Here's how:

After that, enter the check following these steps:

I'm also adding this article for more hints about the process: Create and record checks in QuickBooks Online.

On the other hand, here's how you can record, edit, and delete expenses in our system: Enter and manage expenses in QuickBooks Online.

Please know that you're always welcome to post again if you need anything else. I'm always here to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here