Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We do in-house repairs, when we do this the sales rep gets a commission off the item. In order for the appropriate commission to calculate we need to remove the labor expense as the employee who repairs the items receives a bonus for doing repairs. When we receive these items they come in on a PO listed under the account "In House Repair" with a separate line item of the cost of the bonus to the employee who is repairing the item. The reason this is done is that the repair expense needs to be deducted from the invoiced cost so the commission is paid correctly to the sales rep. However, these bills for "in house repairs" are never paid out, which means they are just sitting open. This means to me that the whole process the company has in place is wrong and I am looking to fix it.

We are currently using QB Enterprise - Manufacturing & Wholesale - desktop.

Example:

$1000 repair cost to be invoiced to the customer

$400 bonus to be paid to the employee

$600 commissionable at 65% to sales rep ($390 commission, if the $400 is not removed the commission would show as $650)

Profit to the company $210.

Thanks for visiting the Community today, meliwinks1.

I appreciate you for being detailed about your concern. The information will guide us on how to properly track the labor (repair) in QuickBooks Desktop (QBDT).

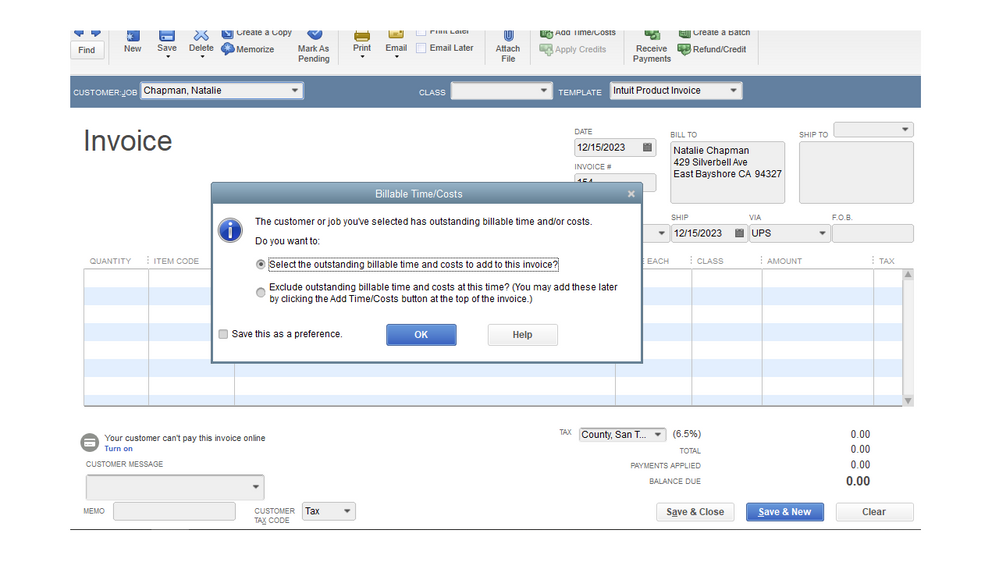

We’ll utilize the billable expense feature to input the entry mentioned above. This transaction type is an expense incurred on your customer’s behalf when you perform a work for them.

Let’s go to the Invoicing Options screen to activate the option. I’m here to assist and make sure you can do this easily.

Here’s how:

Next, enter the labor as billable expenses. Let’s create a bill for your labor cost and make sure to tick the Billable box to account for the expense. Then make an invoice for your customer.

In regard to your bonus and financial records, I suggest consulting with an accountant for further assistance. They help and guide you on how to handle the transactions to make sure your books are in order.

This reference contains topics that will help you efficiently handle all your expenses, bills, and other vendor-related activities: QBDT self-help articles.

I’m adding some links below for additional resources. These articles will guide you on how to track payroll expenses by job. You’ll also learn about the money spent and made for each work.

That should take care of it. Drop me a comment below if you have any other questions about tracking your labor cost. I’ll be happy to answer them for you. Have a good one.

Thank you very much for getting back to me.

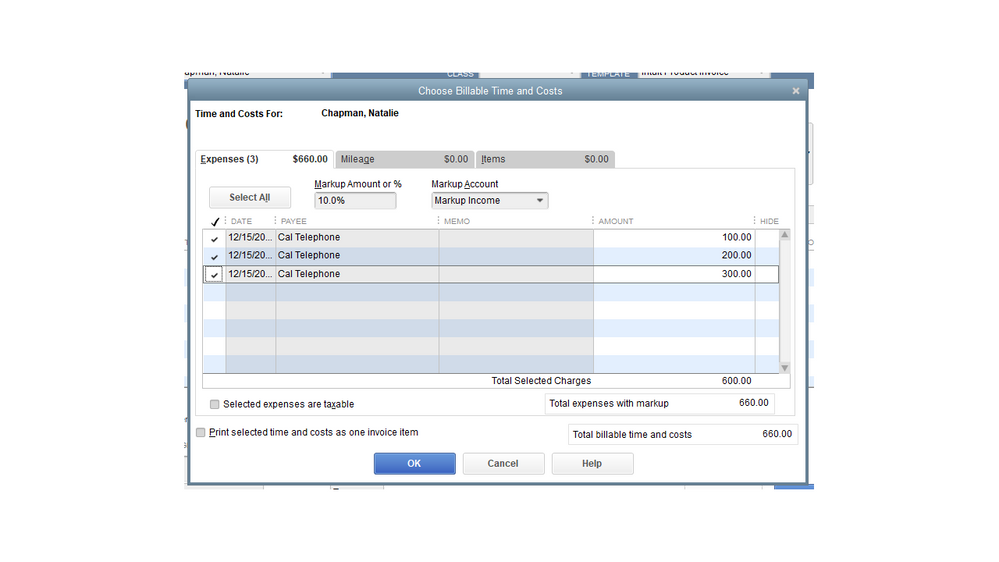

I followed the steps to make the item billable, my only question is that we use the same part number for this employee's bonus costs. Repair-CR is the part number but if there are multiple repairs for the same vendor and the cost may be different. For example I have 3 repairs to ABC company, the repair expense on A is $100 per unit, B is $200 per unit, and C $300 per unit. If I enter it in as customer job to ABC company and all come in and invoice at the same time how does this correctly apply to the invoice?

Hello again, @meliwinks1.

I appreciate you for following the solution I shared and letting me know the result. This information will guide me on how to track the part number and transaction in QuickBooks.

We’ll have to set up the repairs as a product or service in your company file and add each one as a line item on the bill. Performing this process lets you track all the items on the invoice under one customer. Check this reference to learn more on how to add an item or services: Add, edit, and delete items.

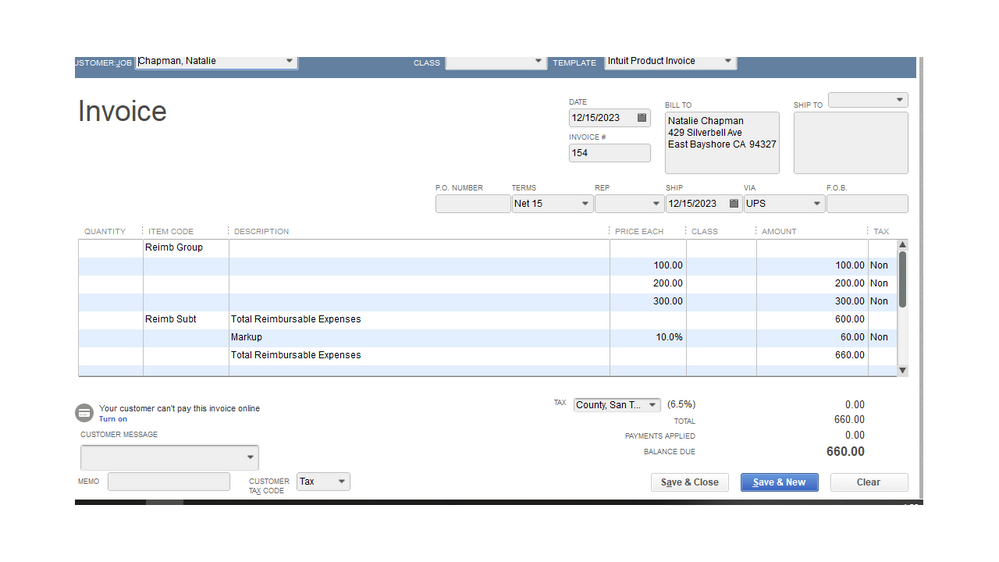

After setting up everything, create a bill and input the newly created products or services. Then go to the Customers menu to enter the invoice.

Here’s how:

For future reference, let me share the link to our self-help articles: Sales and customers. These resources contain topics that will guide you on how to efficiently handle your customers’ transactions. From there, you’ll learn about managing payments, processing refunds or credits, etc.

Keep in touch if you have any clarifications on how to track repairs and other job related-concerns. I’ll get back to assist further. Have a good one.

The only issue with this is that we don't want the customer to see this cost, as it is built into the repair cost to them. In this example, they should only see $100, not the broken-out expenses.

Good evening. @meliwinks1.

Thanks for taking the time to follow up with us.

When using the billable time feature in QuickBooks Desktop, anything included with the billed time will show on the invoice. I understand how not having this show to your customers would be beneficial for you and your business, so I've gone ahead and submitted this suggestion to our Product Development Team. This way, the feature request can be considered in a future update.

Please let me know if you have any additional questions or concerns. I'm always around to lend a hand. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here