Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am the volunteer bookkeeper for a small non-profit. Out chart of accounts (less than 50 accounts) has become a bit messy. The account numbers are not in an order that works for our needs. We also would prefer 4 digits, rather than 5. We have developed a new chart in Excel that works well for our needs - management reporting and government grant reporting.

We are also changing our FY. that appears to be an easy change in an existing company, resulting in a short year.

my question is how do I handle these changes in QB Desktop?

1. Create a new company and build a COS from scratch? (We know that we have to look to the “old” accounts for history)

2. Edit each of our existing accounts to change the account number as well as the account name? Then make all of the old accounts “inactive”.? If I add each BS account with a beginning balance, how does that impact reporting since there are now two accounts for the same purpose - especially retained earnings?

Because we are all volunteers and role changes happen, I want to try to ensure that a future bookkeeper is not posting posting anything to one of the old account numbers.

I'd be glad to join you here and help with your questions about managing your list of accounts, MHA11205.

The Chart of Accounts in QuickBooks is highly customizable. You can either edit the existing ones or import a new list into a new company file. I'll share the steps for both options so you can test them and see what works best for you.

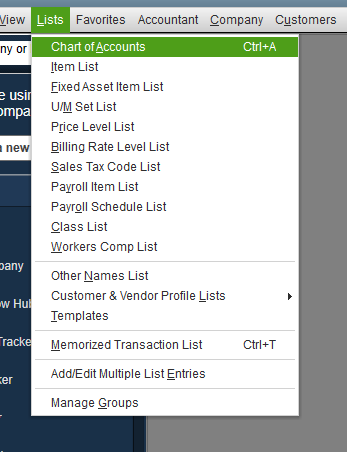

If you want to create a new file, follow these steps if you want to create a new file and start from scratch:

After that, import the Excel file for the list of accounts that you've created. Here's how:

Here's an article about this option for more details: Import or Export MS Excel Files.

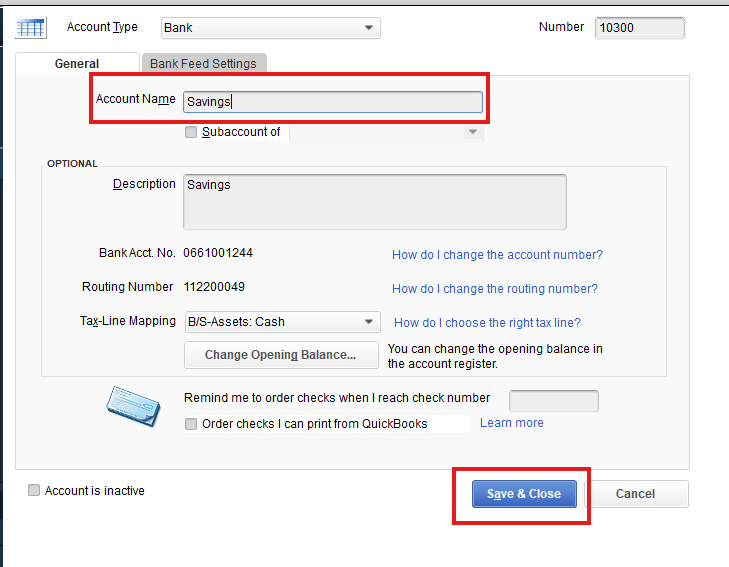

You can also follow these steps if you want to edit or make existing accounts inactive if you want to keep the same company file.

Please know that inactive accounts will still show up in your reports. You can create journal entries to zero them out or move amounts from one account to another to make sure they're not duplicated in you financial reports.

Let me share these articles for additional details:

You can try both steps to see what works best for you. Please don't hesitate to reply to this thread if you have follow-up questions.

Hi, I am an accountant with client using QB Desktop, and I need to make changes to his Chart of Accounts (change accounts and account types) - my question is what is the best way for him to send me his QB data file, I make those changes, and send the file back to him? Should we use a backup copy, or portable copy of the data file?

My pleasure to have you in this thread today, CPA. Let me share some information on how to get your client's QuickBooks Desktop (QBDT) file to modify his Chart of Accounts (COA).

Great news! Your client can either create a file to put on a USB/online hosting service or use the Accountant's Copy File Transfer Service to send a file through the web. Before that, disable any advanced inventory features for QBDT Enterprise only.

To create a file to place it on a USB:

After that, your client will now have an Accountant's Copy of his file with the .qbx extension. He can put the file on a USB, attach it to an email, or share it through a cloud service like Box.

On the other hand, here's how to send a file through the Accountant's Copy File Service:

I'm also adding this article for more reference: Create an Accountant's Copy of your company file in QuickBooks Desktop.

When you receive your client's accountant’s copy (.QBX), you have to convert it to an accountant’s copy working file (.QBA) so you can make changes to their books. You can run through the resources from this link as your reference: Use an Accountant's Copy working file in QuickBooks Desktop.

Please let me know if you have follow-up questions while working with your client's file. I'm always here to help. Have a good one!

We have 4 restaurants that we would like to have duplicate COA's. Currently they are all set up different, and that's the issue. Is there a way to duplicate and replace them all?

Hi there, @Alexis77.

To uniform the Chart of Accounts (COA) across your four restaurants, the process will depend on whether the accounts are default or manually created.

Since you have set up those four companies differently, it's important to note that each company has default accounts based on its setup, which can't be changed or replaced.

If you have manually added an account to your company, you can import and export accounts. For example, if you created an account for your first company, you can export it and then import it into your other companies to have your companies the same account.

For default accounts, you'll have to modify the name so that it matches your preferred COA account setup with your other company files. Here's how to edit:

If you have any further questions, please don't hesitate to use the Reply button below.

We know how to edit the accounts, that's not the issue. We are needing to send monthly financial reports to the bank for all 4 restaurants. When we create that report in QB, because the COA's are different there is a ton of duplication on the report. We are wanting to clean that up and have them match up as much as possible.

Does that make more sense?

Thank you for the clarification, Alexis77. I'll explain the further details and the workaround to achieve this.

The COA in QuickBooks represents the entire company file, and matching the four restaurants is not possible unless you manually edit the accounts provided by our previous agents above.

As a workaround, you can utilize Class or location tracking to monitor transactions, activities, and accounts for each restaurant. It will also allow you to generate financial reports separately for each restaurant without duplicating or combining data.

On the other hand, we recommend consulting with your bookkeeper or accountant to ensure your records are accurate and for further guidance on this matter.

Please let me know in the comments below if you have further questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here