Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I recently merged 2 sales tax payable vendor names together so they would be in one place. ( btw I use desktop QB Enterprise Manufacturing and Wholesale 24.0 Platinum version.)

When I go to pay my sales tax for the month, I now have a credit and debit in the same amount that is all of the past transactions for 13 years. I can't click and "pay them", they just give me a message they have been paid with credits and a check won't be written to this vendor. Nothing happens they just stay there in the sales tax payable as a debit and credit line. The credit one has the correct vendor name next to it, the debit one will not allow me to add the vendor name. I did a journal entry, and it doesn't get rid of it. It just messes up my reports. If I look at the "open balance" on the vendor I merged them with, all the past transaction show up, equaling the total that is in the "pay sales tax". Is there an easy fix to this? Short of redoing every transaction over again for the past 13 years. The problem I now have, is that I can't seem to fix the problem, nor can Intuit support. (I have run data rebuilds, made sure I have the latest version etc.. )Intuit seems to think it's a program error. I can't reverse the merge to my knowledge, any help would be appreciated. Thank you!

Thank you for explaining exactly what happened to get you to this point, I do books. I can see the challenges you're facing while paying your sales taxes this month after merging your vendor. It's vital to maintain accurate financial data to ensure your business operations run smoothly, so I recommend utilizing your backup company file to restore your data and help you complete your tasks with ease.

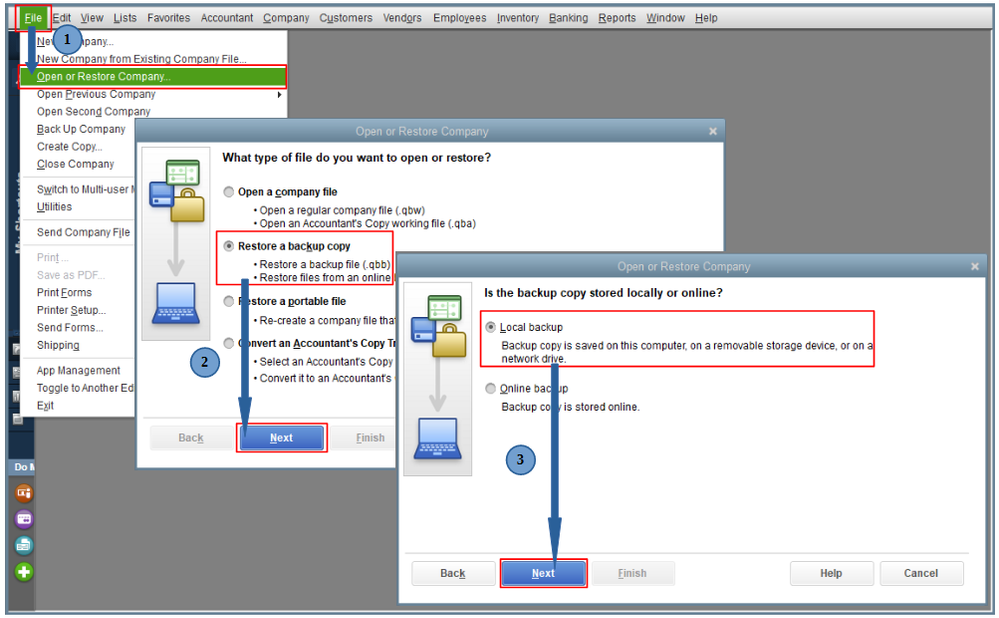

Based on your description, it seems there’s a problem with the merging of your vendor. To get this sorted out, you’ll need to restore the backup of your company file. Before you do that, please remember to transfer the file to your local hard drive if it’s currently stored on an external device like a USB or a hosting service. When you’re set to move forward, here are the steps you should follow:

You can find more insight about the procedure above in this article: Restore a backup of your company file.

Next, you can merge your vendor. Just make sure the one you're merging isn't a tax authority, tax-exempt, or one that is paid through online banking or direct deposit. For assistance with the process, please refer to this article: Merge list entries in QuickBooks Desktop.

Additionally, when you’re ready to pay your sales tax, I recommend checking out this helpful article: Remit Sales Tax to the Appropriate Collecting Agency. It provides guidance to make the process smoother for you.

Ensuring the smooth processing of your sales taxes is our top priority, I do books. If you have any additional questions about merging vendors or managing their transactions, please feel free to leave a reply below. I’m always here to assist you in any way I can. Take care, and I wish you all the best in your continued success!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here