Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are the US distributor of a product produced overseas. For some legacy customers, we must buy goods from supplier and resell to customer, at same price. Then we invoice the supplier for our sales commission. Quickbooks desktop doesn't allow us to invoice a supplier/vendor, so we set up both vendor and customer entities for this supplier.

However, now the supplier is asking us to subtract the sales commission from their bill payment, and also send them an invoice for that sales commission.

How can I create this invoice, and use the eventually "received" payment to reduce the vendor bill?

For example. Customer orders $1000 product. We purchase and deliver $1000 product, invoice the customer $1000, then create a 10% commission $100 invoice to supplier's customer account, mark it paid and use that to reduce payment on the $1000 vendor bill, to $900.

Solved! Go to Solution.

Hey there, sevans.

Let me help you with pay an invoice to reduce the vendor bill in QuickBooks Desktop.

A barter bank account is used to post both sides of a traded transaction. For instance, you might trade or exchange something you sell for something a client sells. Recording a barter transaction in QuickBooks is a process that requires a few one-time setup steps that can then be used to record any barter or trade transaction you may have with your customers or vendors.

Make sure that the barter's partner name is both listed as a vendor and a customer. For example, you can either use Intuit Smith as the customer name and then Intuit L. Smith as the vendor name.

To set up a barter bank account:

To create an invoice for the barter transaction:

To enter a bill for a barter transaction:

By following these steps, you'll be able to pay the invoice and reduce the vendor bill.

Let me know if you have additional questions about reducing vendor bills. I'm always here to help.

Hey there, sevans.

Let me help you with pay an invoice to reduce the vendor bill in QuickBooks Desktop.

A barter bank account is used to post both sides of a traded transaction. For instance, you might trade or exchange something you sell for something a client sells. Recording a barter transaction in QuickBooks is a process that requires a few one-time setup steps that can then be used to record any barter or trade transaction you may have with your customers or vendors.

Make sure that the barter's partner name is both listed as a vendor and a customer. For example, you can either use Intuit Smith as the customer name and then Intuit L. Smith as the vendor name.

To set up a barter bank account:

To create an invoice for the barter transaction:

To enter a bill for a barter transaction:

By following these steps, you'll be able to pay the invoice and reduce the vendor bill.

Let me know if you have additional questions about reducing vendor bills. I'm always here to help.

@Rose-A - thanks, seems like a good solution. However when setting up a Bank account, I do not have a Detail Type dropdown to select Cash on Hand. See attached. Using QB 2016.

Also, you mention making names match, but I'm dealing with companies not individuals. What field must be matching or similar? Here's our current structure:

Thanks!

Thanks for getting back to me, sevans.

I appreciate the screenshot you've provided. Let me help you get this straightened out.

I've updated the steps above. You can click Continue after choosing Bank. Regarding the names, it doesn't matter on how you name the customer or vendor as long as you know who to pay and who to bill.

You may find this article helpful: https://quickbooks.intuit.com/community/Income-and-expenses/Create-an-invoice-in-QuickBooks-Desktop/....

For additional help with QuickBooks, feel free to reach out to our Customer Care Team. You can get our most-up-to-date number here:

I'm still here if you have additional questions. Have a good one.

Rose-A, great recommendation, and I have a similar question but somewhat different

I sell a product to retailer A, that is manufactured by Producer B, and Distributed by Distributor C.

1. Retailer A is Invoiced by and pays Distributor C

2. Distributor C is invoiced by and pays Producer B

I received a commission from both Distributor C and Producer B

My question is how in QB can I keep track of the sale to Retailer A, by creating an invoice to Distributor C and Producer B that reflects the correct expected receivables (commission) from the producer and distributor, while tracking the volume (quantity and dollars) to Retailer A?

It is important to note that each product has a different commission rate

Thank you for any insight and guidance you can provide.

Thanks for joining us here in the Community, @NOG_T.

Let me provide some information about tracking commissions in QuickBooks Desktop.

You have the option to add yourself as a sales representative. This way, you'll be able to track the allocated commission for each invoice that you're going to process from both Distributor C and Producer B.

To do that:

After that, you can now enter your name by the time you create invoice. Make sure to enable the rep section on the template so it will be visible.

Here's how:

Once done, you can now create an invoice and select your name as the sales representative. This way, you can run a report that contains all the transactions where you can get commission and manually compute the commission amount to be paid.

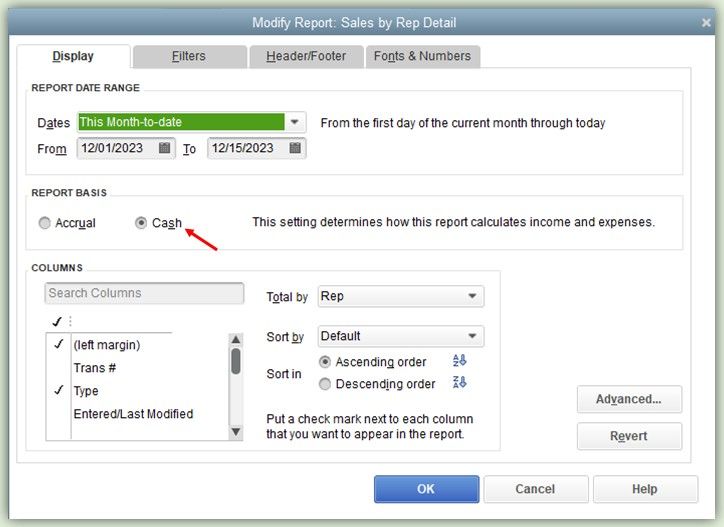

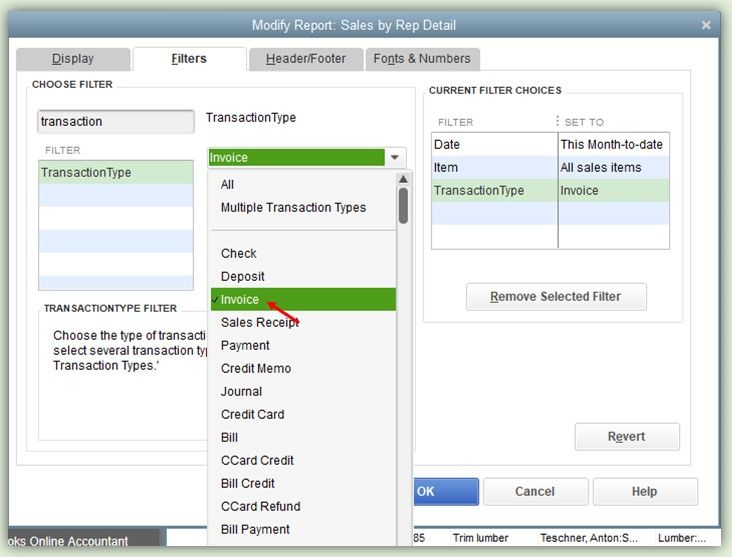

To run the Sales by Rep Detail report:

I also, added this article that might come in handy to personalize your report: Customize reports in QuickBooks Desktop.

For future reference, you can also memorize the report so that you'll not go to the same process again, here's an article to help you through the process: Create, access and modify memorized reports.

Let me know if you need more help about this matter. I'll make sure you're all set. Have a lovely day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here